In a report examining the first nine months of 2015, The Canadian Venture Capital & Private Equity Association (CVCA) announced that VC deals completed in Canada totalled $1.6 billion — a 31 percent increase in deal volume over the same period last year.

This figure already surpasses the total for the entire 2014 year, which ended at $1.2 billion. “We’re seeing a sustained uptick in venture capital that shows this is now a $2 billion plus and growing business in Canada, which is a significant milestone for this industry,” said Mike Woollatt, CEO of CVCA. “While we didn’t expect a repeat of 2014 in private equity given last year’s record-setting pace, 2015 is still going to be a banner year in terms of private equity investments.”

The industry that took most of these investments was the information and communications technology with $947 million invested. Montreal-based Lightspeed POS was number one in the top 10 Canadian VC deals with $79 million.

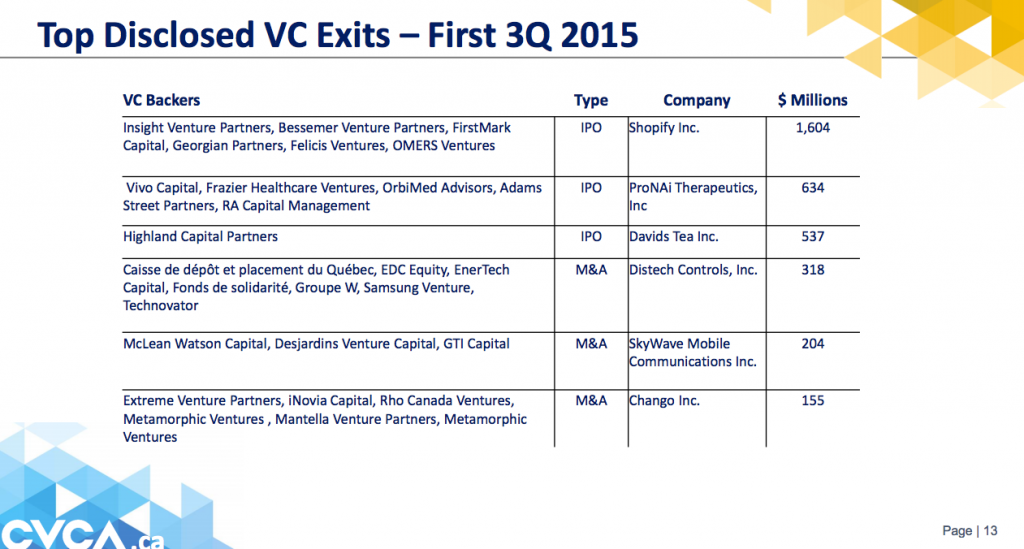

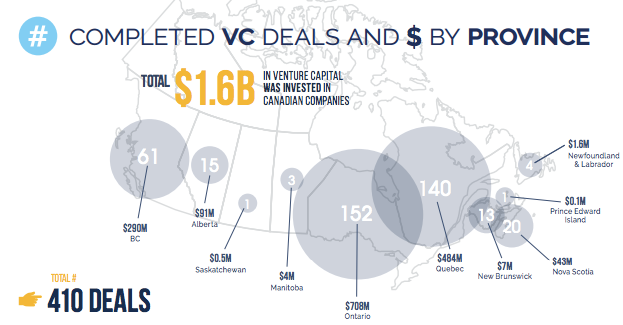

Ontario took a big chunk of VC funding in the country with $708 million (152 deals) in investment, while Quebec and British Columbia following behind with $484 million (140 deals) and $290 million (61 deals) respectively. Shopify, unsurprisingly, was number one on the top five list of completed VC exits.

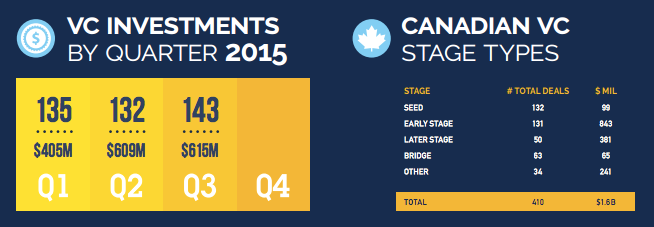

The industries that garnered the most interest from VCs included the information and communication technologies sectors, life sciences, cleantech and agribusiness. Early-stage investing captured the vast majority of activity with 131 deals, and $843 million. Seed investing accounted for 132 deals, at $99 million, while late-stage accounted for 50 deals and $382 million.

The entire report can be found here.