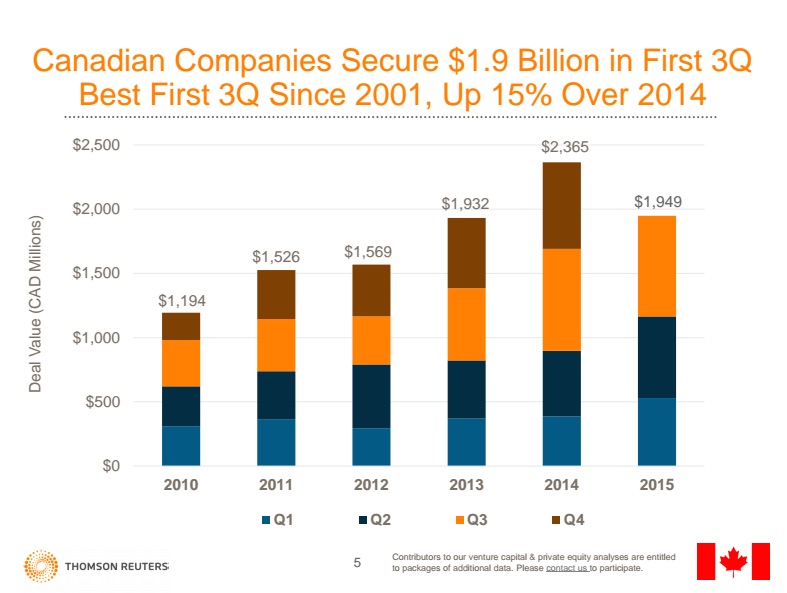

In the Thomson Reuters Canadian Venture Capital Review for the first three quarters of 2015, Canadian companies collectively raised a 14-year high of $1.95 billion in venture capital. According to the Reuters report, this amount already exceeds the full VC total for six of the past seven years, and is on pace to hit $2.4 billion by the end of the year.

Ontario led deal-making activity in the first nine months, with $1.1 billion going to Ontario-based companies.

Ontario led deal-making activity in the first nine months, with $1.1 billion going to Ontario-based companies from January to September. Quebec-based companies came second with $491 million raised, while British Columbia took the next largest share with $223 million invested in the first three quarters. Real Ventures took the top spot as the most active VC firm.

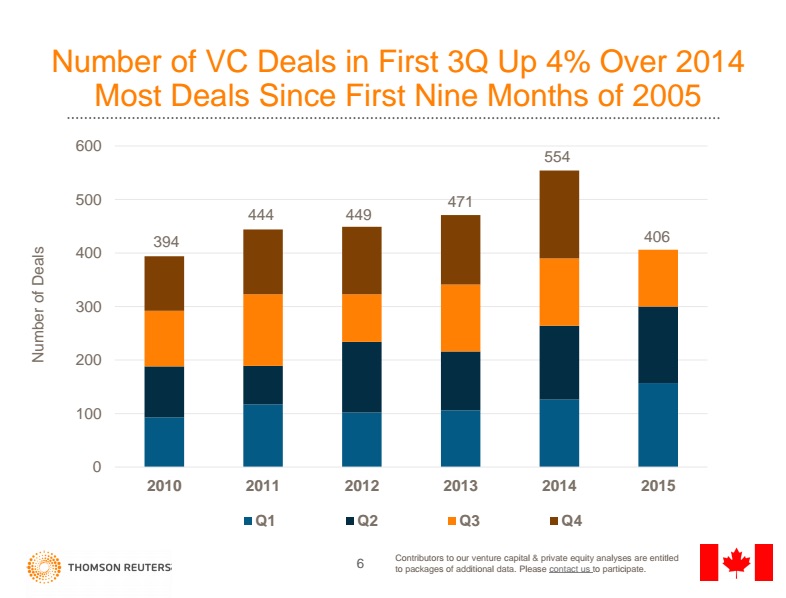

In other record breaking news, the number of deals for the first three quarters of 2015 was up 4% comparatively to last year at 406, the most since 2005.

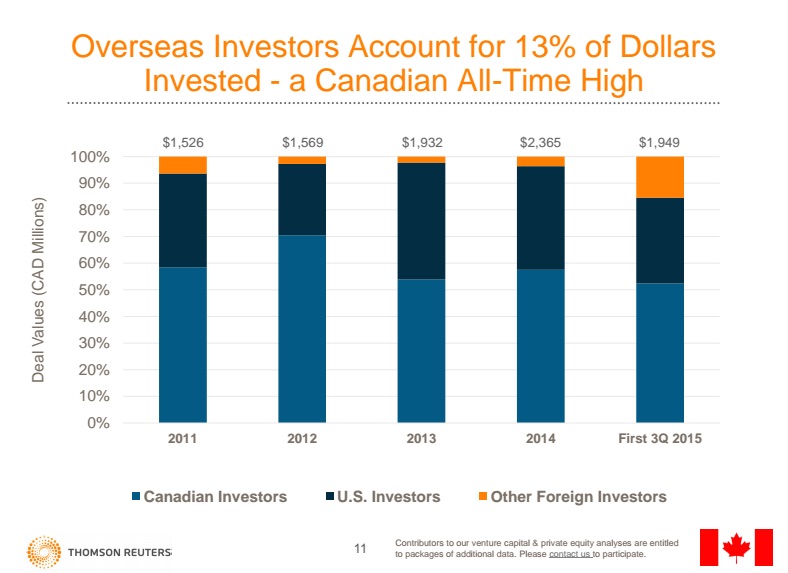

Venture capital fundraising by Canadian funds reached $1.1 billion in the first nine months of the year, a 20% increase over 2014. Meanwhile, overseas investment also accounted for 13% of total investment for the year, an all-time high for Canada.

The top Canadian venture deals included Montreal-based Lightspeed Retail with an $80 million deal value, Waterloo-based Kik Interactive raised $65.3 million and Markham-based Real Matters raised $60 million. Information technology took 61 percent of VC dollars, the highest amount, and traditional investment industries like manufacturing were actually down from the previous year.

At the same time, Reuters released its report on private equity (PE) buyout market activity in the first three quarters of 2015, and found that there was $129.6 billion in deals from Canadian firms targeting non-Canadian companies. This amount is already double the combined totals of the last four years.

“Canadian manufacturing companies accounted for the largest share of buyout-PE deal-making in the first three quarters with 54 transactions,” said the report on which industries were seeing the most deals. “Software and mining companies followed second and third.”

Though the number of deals done in Alberta declined in the first nine months, the province attracted the half of the top eight deals for the first nine months, securing $7.5 billion. Ontario-based companies attracted the second largest share, with $5.5 billion, followed by Quebec companies with $2.7 billion.