The shift in the way that people work gave Andrew D’Souza, formerly of Nymi and Top Hat, an idea to do banking differently. So the entrepreneur founded Clearbanc to serve the needs of independent contractors, the self-employed, and, yes, entrepreneurs.

“Working for yourself as a freelancer or an independent contractor is a really rewarding way to live,” D’Souza told BetaKit. “You decide how much you want to work, how much you want to make, and where you can add value. It’s a big cultural shift. And our generation really embraces this idea of flexibility and freedom. The companies are looking for more flexibility in their workforce, and technology platforms are accelerating that shift, so we see the rise of companies like Uber and Instacart.

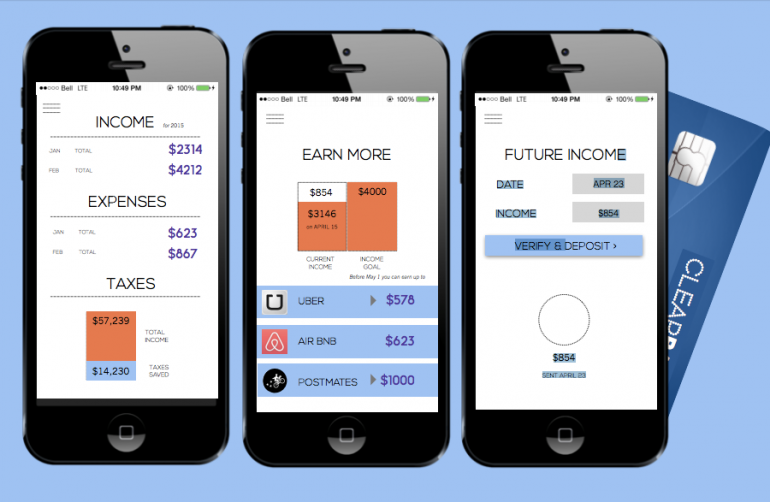

“But the administrative side can be frustrating: setting up corporation, budgeting, understanding cash flow, tracking expenses, dealing with banks to get credit or a loan,” D’Souza continued. “If this huge shift is happening, there really should be a financial institution designed for people who are self-employed.”

Clearbanc’s big bet on Uber (drivers)

Cleabanc’s first product is a service for Uber drivers that allows them to get paid instantly instead of waiting up to 10 days. With Clearbanc, Uber drivers receive a Visa Debit card where their earnings are deposited instantly so they get paid every time they drive. Every Uber driver who signs up with Clearbanc receives a seven-day trial period free of charge. After that, the cost is $2 for each day that Clearbanc deposits funds into the driver’s account. Drivers are only charged for the days they work and they can cancel anytime, according to Clearbanc.

“We know we’re not going to solve everyone’s problems on day one,” said D’Souza. “Freelance and self-employed professionals are a pretty complex group. Uber has over a million drivers with a pretty consistent set of needs, like getting access to their cash faster. Lyft is doing instant payments, but Uber isn’t setup to do that. We’ve heard from Uber drivers that they’d be really interested in that. We want to integrate with whatever platforms freelancers are using, and we’re starting with instant payments for Uber drivers, but that’s just the beginning.”

Clearbanc’s big idea is to serve freelancers and self-employed professionals facing similar financial challenges: unstable cash flow, tax planning, variable income, and limited borrowing options.

Pedigree and opportunity

Y Combinator announced an experimental program this year geared to early stage startups, and Clearbanc got accepted as one of just 33 startups, selected from over 6,500 applications. “The timing worked really well for us,” D’Souza said. “YC has been a part of many important companies, and getting access to that expertise on how to build something people really want and how to grow quickly is amazing.”

“We want Clearbanc to be the front-door to your financial life if you’re self-employed.”

While D’Souza indicated that YC was a great catalyst to bring a team together, he also said he intends to move Clearbanc back to Canada and grow the company here. They’ll return at a time when Canada is impatient for disruption in financial services.

“We’re seeing this huge shift in the way people work, and if we can reduce the risk and headaches associated with becoming self-employed, it’s a valuable thing to focus on. Then we would allow more people to take the jump and think about gaining financial independence and freedom,” D’Souza told BetaKit.

“There’s a huge upheaval happening in financial services. I did a lot of work with banks and have invested in a couple of FinTech companies. Banks are looking for ways to engage with tech companies and changing customer base. What are the implication of that change? The financial services need to adapt.

“We want Clearbanc to be the front-door to your financial life if you’re self-employed.”