Almost 19 months after the start of the pandemic, all eyes are on how Canadian startups and SMBs plan to spend their dollars for post-COVID 19 recovery. A new Cisco Designed State of Startups survey hopes to answer those questions. With responses from over 1,000 startup and SMB leaders, the results show a potential misalignment between leaders’ stated challenges, priorities, and areas for investment.

COVID-19 accelerated digital transformation

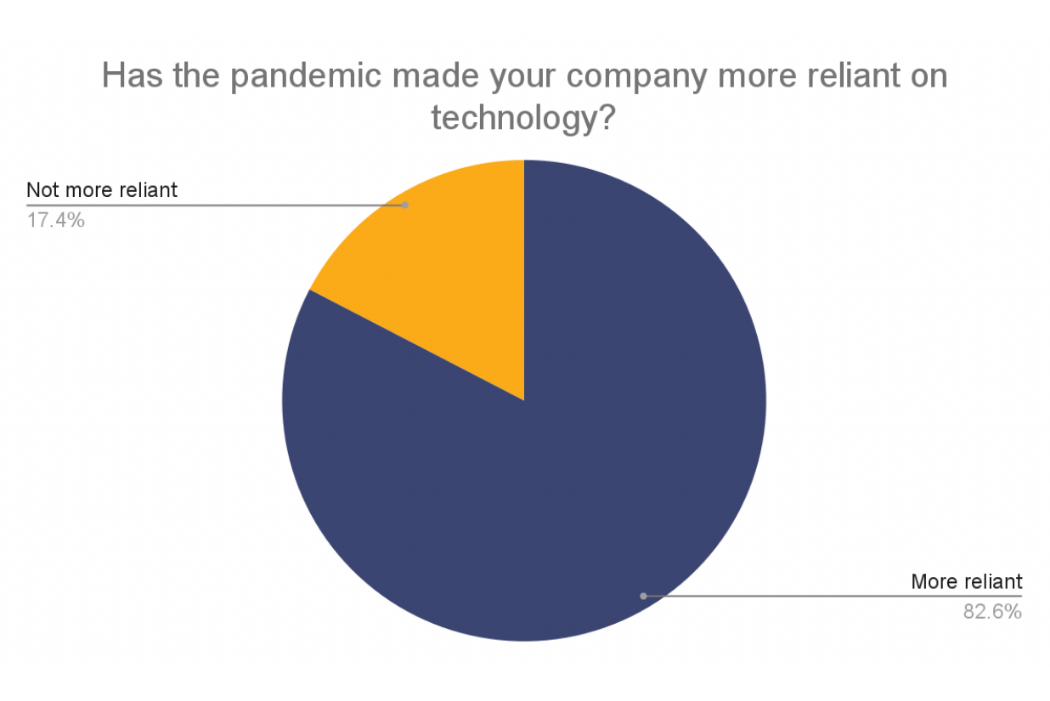

The vast majority of respondents said the COVID-19 pandemic made their company more reliant on technology, encompassing the shift to remote work, remote value delivery, and leveraging technology in other ways, such as cybersecurity.

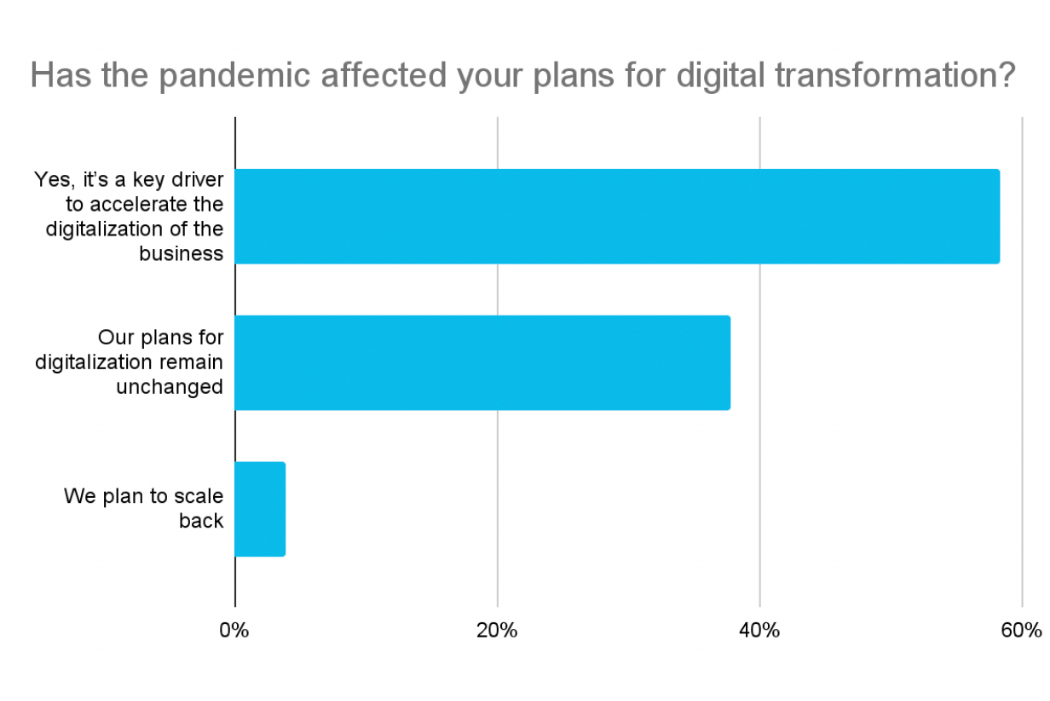

Less than a quarter said the pandemic didn’t make them more reliant on technology, but no respondents indicated the pandemic made them less reliant on technology. The majority of respondents also said that the pandemic is directly linked to accelerating digital transformation within their organization.

The war for talent is heating up but companies aren’t prioritizing employees

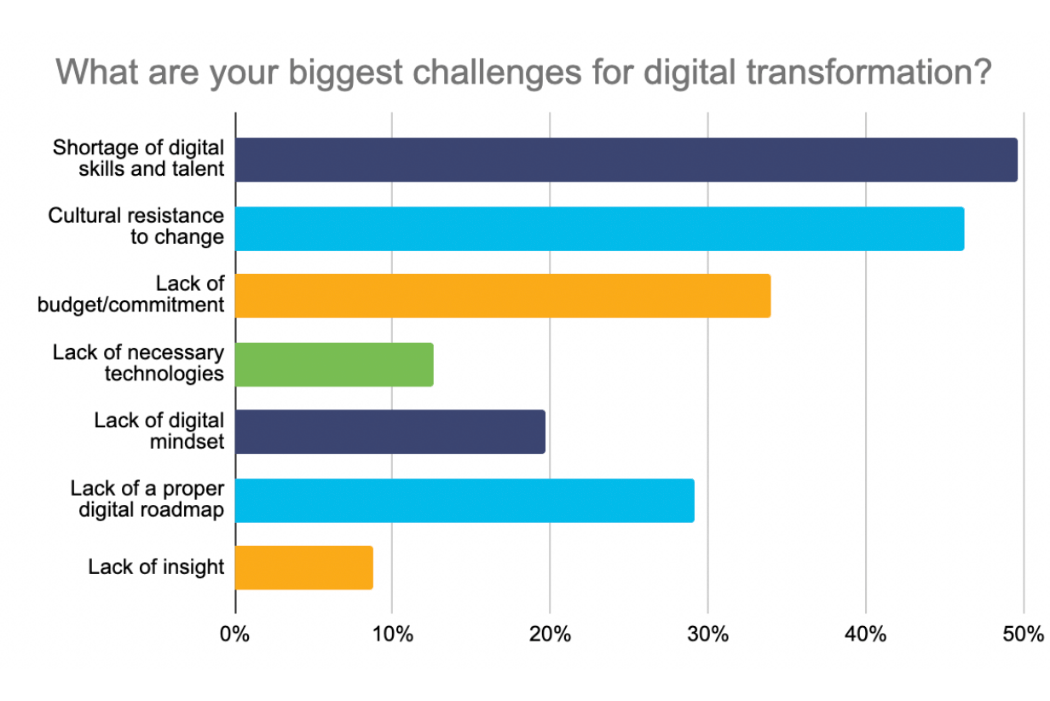

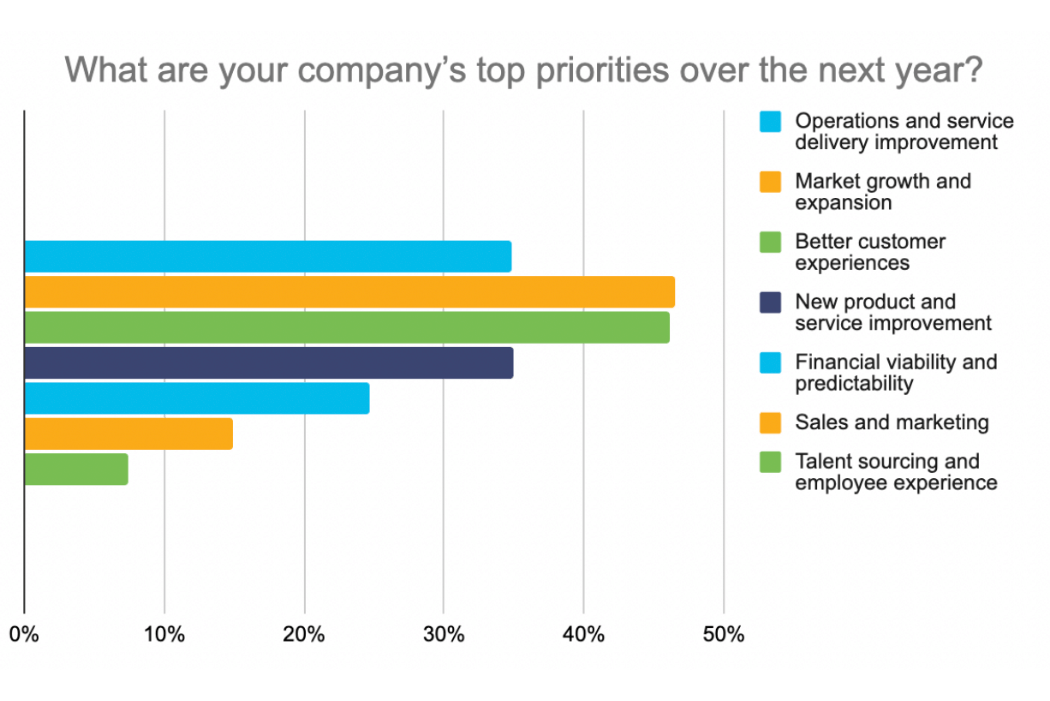

On the path toward digital transformation, challenges emerge. Talent – or a lack thereof – was cited as the biggest challenge for post-pandemic digital transformation. However, this sits in contrast to what leaders say are their company’s top priorities for the next year. Talent sourcing and employee experience is the lowest priority by a fairly wide margin, while market growth and customer experiences are nearly tied for the top two priorities.

To Andrew Popliger, the Partner & National Technology Sector Leader at PwC Canada, this is a striking contrast. He said that while it is important for growing companies to invest in the “external” things – customer engagement, sales, and digital strategy – that shouldn’t mean you ignore your most important internal resource.

“It’s one thing to invest in strategy, but you also have to invest in people,” said Popliger.

He suggested that one reason behind the limited investment in talent sourcing is that brand investments could yield talent benefits as well.

“If you’re a big-name tech company, you don’t have trouble attracting talent because people want to work for you,” said Popliger.

But he also added that it would be harder to accomplish this at smaller sizes, so it’s still a concern that talent shortages are named as the biggest challenge amongst Canadian tech but ranked lowest in priorities over the next year. His advice for company leaders worried about talent is to think about strategy holistically: while all companies need to focus on customers and market growth, you need the right team to deliver on the strategy.

To accomplish this balance of growth and team readiness, Popliger said companies should look for employees that have the right skills for today’s challenges and help them transform over time to tackle tomorrow’s challenges. He added that the skill sets tech companies need will always change over time, so the key is not to continually look for new employees but to continually invest in the team they have.

This speaks to another area Popliger recommended tech companies consider: decision-making processes. He said companies should recognize that decision making is not about siloed outcomes, but how to “empower people to make decisions and move ahead,” whether they are individual contributors or people leaders.

“You want to get to this strategy, but if you don’t have the right people, you’re not going to get there,” said Popliger.

Startups are buying cloud tools and collaboration software

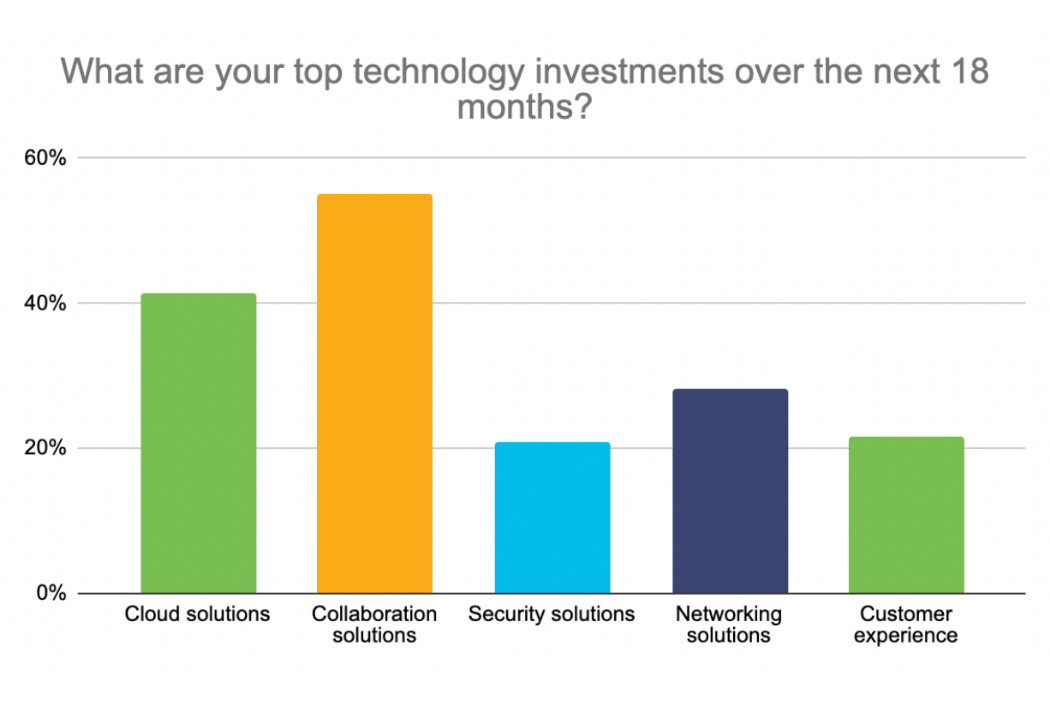

Layering on investment areas for the next 18 months adds to the picture. Despite employee experience being ranked the lowest priority on the table, dollar allocation suggests something different: collaboration solutions was the top investment area for the majority of survey respondents. And despite a lack of technology not being ranked as a top challenge to digital transformation, cloud solutions is the second most prevalent investment area.

The disconnect continues when looking at customer experience technologies, which is nearly tied for last place in terms of investment allocation despite “better customer experience” being labelled the second-highest priority area for businesses over the next year. One possible explanation for this discrepancy in future priorities vs. investment is that companies already made significant investments in digital customer experiences during 2020.

When it comes to cloud and collaboration being the two dominant investment areas, Popliger isn’t surprised. To him, it’s not about how much someone might have invested in the past, but the reality that the COVID-19 pandemic changed everything to such a degree that you have to make further investments.

“The pandemic has definitely accelerated the digital transformation in those areas,” said Popliger.

The great digital transformation continues

Taking responses point-by-point from the survey, it appears as though the business priorities, investment areas, and stated challenges of Canadian startups and SMBs don’t seem to align.

Taken holistically as Popliger suggests, the Cisco State of Startups survey provides a poignant look at the minds of tech leaders across the country, attempting to balance shifting priorities during one of the largest business shifts in the last century. It’s clear that Canadian startups and SMBs are still in the middle of that great digital transformation.

“You won’t be successful in growing your business if you are not investing in your people,” said Popliger.