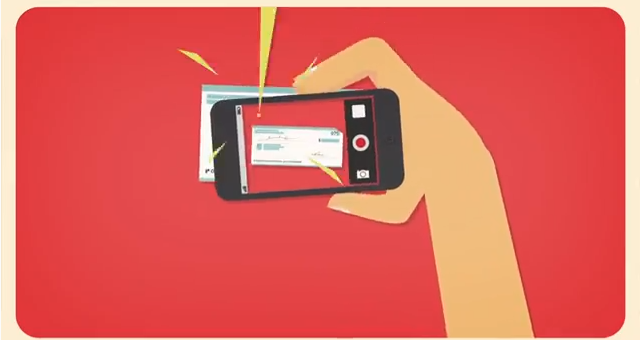

Canadian banks have been quick to adapt to mobile technology in offering their customers the ability to deposit a cheque simply by taking a picture of it.

In fact, Canadians have used their mobile phone to deposit more than 1,000,000 cheques since the Canadian Payments Association approved the cheque image rule last year to allow for mobile remote deposit capture (RDC), according to data from NCR Corporation. NCR makes software which makes mobile deposits possible.

Mobile deposits have actually doubled every quarter since April 2013 when Canadian banks began deploying the technology to their customers.

“While cheques have been used as a form of payment for a long time, the application of a mobile phone puts a modern twist on the process to make depositing a cheque faster and easier,” said NCR’s Steve Nogalo. “Canadians have embraced this technology because it is convenient and secure. NCR continues to find new ways to apply mobile technology to make everyday transactions easier for consumers.”

More than 20 financial institutions in Canada are now offering mobile cheque deposit to their customers, including CIBC and Tangerine. For North America including the U.S., which adopted RDC several years ago, people have deposited more than 100 million cheques using the NCR’s solution alone.

After signing in to their financial institution’s mobile banking app, consumers use need only to take a photo of the front and back of a cheque using their phone’s camera. The cheque image is moved through the financial institution’s processing system using NCR’s software, and the image of the cheque is sent on to be cleared in the same manner as a physical cheque.