PwC recently released its latest MoneyTree report for Q2 2018, highlighting the top five Canadian tech markets by deal volume. For the first time since PwC has produced the Canadian report, Calgary was amongst those cities, seeing a significant spike in venture capital funding throughout the quarter.

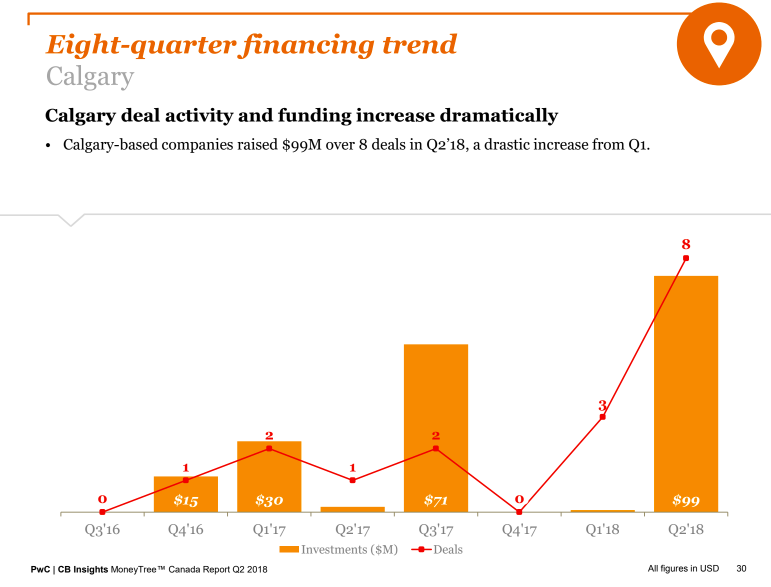

Per MoneyTree, Calgary-based tech companies raised $99 million over eight deals in Q2 2018, up from $900,000 over three deals in Q1 2018, and an eight-quarter high in both deals and dollars. Calgary’s Q2 deal volume was one deal shy of matching the combined total of the previous seven quarters.

“I think that there’s a renewed energy towards building the ecosystem in Calgary.”

The uptick in dollars was driven by largely by wind energy company Greengate Power’s $100 million ($78 million USD) funding round, which was the second largest deal in Q2 2018. PwC’s report also highlighted Circle Cardiovascular Imaging’s $16 million raise to help physicians diagnose cardiovascular diseases.

According to Joon Chan, Alberta technology sector leader for PwC, the uptick in deals and dollars stems from the maturation of the Calgary tech sector, fostering a greater diversity of companies after the city faced an economic downturn.

“Our tech sector is growing. It’s maturing,” said Chan. “I think what you’re seeing now is some really interesting companies popping up. If I think about where Calgary and Alberta’s evolution was in 2014, a lot of people left oil and gas, and I think many of them have flown into technology-related companies. So I think now we’re seeing that upcycle of companies with some of those people are getting funded.”

While the tech community might think that Calgary’s growth is driven primarily by energy-related companies, Chan said other verticals such as FinTech, IoT, AI, and consumer software, as well as the rise of community-led initiatives and startup programs, also play a role.

“I think over the last few years or so, there has been a lot of accelerator or incubator type activity, or what I would call movements, around tech working cohesively as one ecosystem,” said Chan. “I think some of these groups, these accelerators…are all doing their part to help companies become more investment ready.”

Patrick Lor, a managing partner at Panache Ventures, agreed with Chan, telling BetaKit that Calgary-based programs dedicated to building tech companies are encouraging more VC activity in the city.

Launched in May 2017, CDL-Rockies focuses on startups developing innovative solutions for the energy market by leveraging the region’s expertise in the oil and gas industry. Other initiatives include Rainforest Alberta, an organization to improve Alberta’s innovation ecosystem; and Protospace, Calgary’s member-driven makerspace that offers access to workshop space, education, and shared tools for different projects.

“To me, it’s going to take a lot of work to get Calgary to true top five in Canadian VC activity.”

“I think that there’s a renewed energy towards building the ecosystem in Calgary,” said Lor. “Calgary was hit really hard with an energy price drop, and I think over the past couple of years we’ve been wrestling with both a struggling economy and trying to rebuild the future. So I think those two have really contributed to us having a renewed energy towards strengthening the economy.”

Lor added that the wide range of existing funds, investors, and programs can help take Calgary’s tech ecosystem to the next level. In recent months, Calgary’s tech community has received greater support from the Alberta Enterprise Corporation, which invests in Alberta-focused VC funds that finance early-stage tech startups in the province; the Accelerator Fund, an angel co-investment fund available to Alberta’s technology companies, and the $100 million Opportunity Calgary Investment Fund, which aims to support businesses using tech, are also contributing to the spike in deals and dollars.

“Calgary has a lot of high net worth wealth and that was brought on by the oil and gas economy. So you see angels being able to cut significant cheques into the ecosystem,” said Lor. “There are also some significant family funds out there that are able to do the same thing…So I think what we’re doing is we’re creating the right ecosystem. I don’t think that all the VCs are necessarily cutting a ton of cheques but we’re certainly in there – we’re talking to companies. Hopefully, what we’re doing is bringing that VC education and some of the perspectives to help companies get aligned with what VC’s are looking for.”

While a spike in deals and dollars and the efforts to scale the ecosystem are good in Calgary, Lor said he was surprised to see Calgary in the top five markets in the PwC MoneyTree report, stressing that it will take more work for Calgary’s tech ecosystem to continue seeing an upward trend in future quarters.

“I think there’s a lot of great stuff happening here but I think that a lot more time and investment is necessary to bring it to a level to where we’re satisfied,” said Lor. “To me, it’s going to take a lot of work to get Calgary to true top five in Canadian VC activity – and by true top five, I mean that if you look at Toronto and Montreal grabbing the lion’s share, I think the math tells you it’s not an even distribution. But I think even amongst the top five, Calgary’s proportion is lacking.”

BetaKit is a PwC MoneyTree Canada media partner. Photo via Unsplash.