Lending platform Borrowell announced today that it has received $6.4 million in operating and loan capital from Equitable Bank, Hedgewood, and Power Financial Corporation. Other participating investors include Oakwest Corporation, Adam Felesky, founder and former CEO of Horizons ETFs, and Freycinet Investments, a fund that supports knowledge-based businesses.

The big name today is financial giant Power Financial, which also invested in Wealthsimple’s $30 million Series A.

The amount is one million more than the $5.4 million Borrowell raised in December of 2014 to launch its lending marketplace. Equitable Bank is a follow-on investor from that round, but the big name today is financial giant Power Financial, which also invested in Wealthsimple’s $30 million Series A.

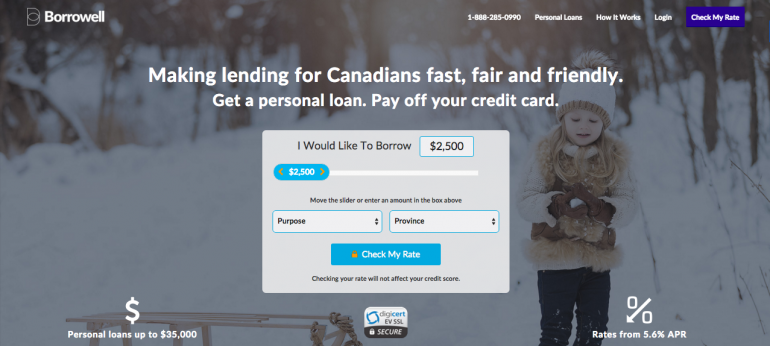

“Every month, the number of people applying for, and receiving, loans with us is growing,” said Andrew Graham, CEO of Borrowell. “In fact, we’ve recently hit half a billion dollars in applications. We’re thrilled, and this investment allows us to scale up our team and efforts to help more Canadians pay off their credit card debt.”

According to an Ernst and Young report, consumer adoption of FinTech in Canada is set to triple in 2016. However, FinTech adoption across the country has been relatively slow to date, with the biggest barrier to growth being a lack of awareness rather than a lack of trust. As part of an effort to break into the mainstream, Borrowell recently partnered with Wealthsimple to help Canadians with RRSPs.

There’s that Wealthsimple name again. It should be noted that at the time of the partnership, Wealthsimple CEO Mike Katchen said that the coming months could see a ‘rebundling’ of banking services, as Canadian FinTech startups buddy-up to deliver a more robust offering (a prediction that has already played out). No one from either company has indicated such, but this year could see not only a partnership of Canadian FinTech services, but also a consolidation of Canadian FinTech companies.

For now, Graham and the Borrowell team remain focused on their service, which has processed over $500 million in loan applications from thousands of Canadians.

“Canadians are ready for better financial services. We now have both a critical mass of great technology companies offering compelling products and services, and also a critical mass of consumers who want them,” said Graham. “Our customers understand that our technology is every bit as secure as a bank, just faster and more user-friendly.”

Related: Borrowell is betting on team and good credit to disrupt lending in Canada

Disclosure: Wealthsimple is BetaKit’s FinTech sponsor and the reason we deliver the FinTech Times hot and fresh every week.