No one starts a company in order to sell it for talent. But unfortunately, not everyone makes it to the Unicorn promised land, so it helps to have soft landing options available.

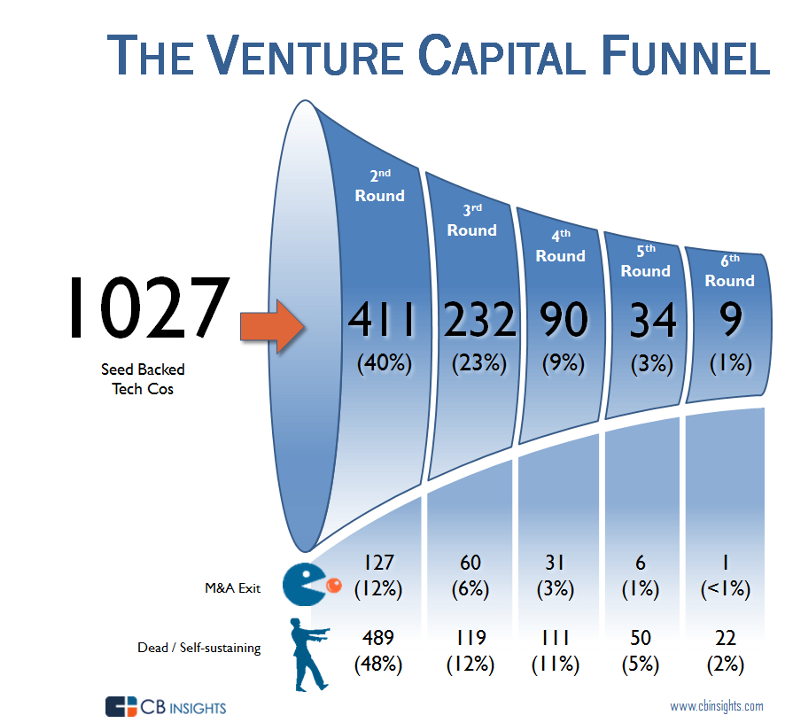

According to the handy folks at CB Insights, about 40 percent of the companies that raise a seed round go on to raise an A. Just over half of the A-funded companies raise a B.

At each stage in the VC funding journey, there is considerable churn from companies that can’t raise more money.

When it comes to acquihires (buying companies for talent), most of the action happens post-seed and pre-series A. This coincidentally is also the time when most startups fail to secure follow-on capital.

What’s happening now…

The current environment for acquihires has cooled off considerably from its 2014 highs. I have talked to buyers who have a taken a deliberate strategy of waiting out their target’s runway. They may be interested in your business, but they know that you’re burning cash. With the Series A crunch alive and well, these buyers believe that if they just wait, you will be out of cash and therefore much cheaper to buy. In the extreme case, they may want to just hire your team rather than buy it.

How to create your soft landing

The path to an acquihire is similar to the path to any kind of exit. You need to build the relationships before you need them. With acquihires specifically, that means that you need to get to know product leaders inside potential buyers. If the product managers there see that you have built a great product team, and your team is aligned with the culture of the buyers’ team, then they may very well be interested in picking you up.

As I said, no one starts a company to end up in an acquihire, but these deals can deliver some financial return and a chance to keep your team together. In the best cases, that team will continue working on its vision, just in a new home.

This article was syndicated with permission from Mark MacLeod’s Real Exits.