Following a record-setting Q2, total tech funding in Montréal was propped up by one megadeal into a locally-born but now US-headquartered e-commerce startup, according to the BDO Hockeystick Montréal Tech Report.

Without AppDirect’s deal, total funding in Montréal in Q3 would have declined by a staggering 66 percent from last quarter.

Hockeystick’s data is sourced through exclusive partnerships with organizations like the Canadian Venture Capital and Private Equity Association (CVCA) and the National Angel Capital Organization (NACO). Hockeystick also compiles data from startups using its platform, as well as public data sources. The data includes not only deals featuring Canadian companies, but also deals that impact the Canadian ecosystem in a significant way.

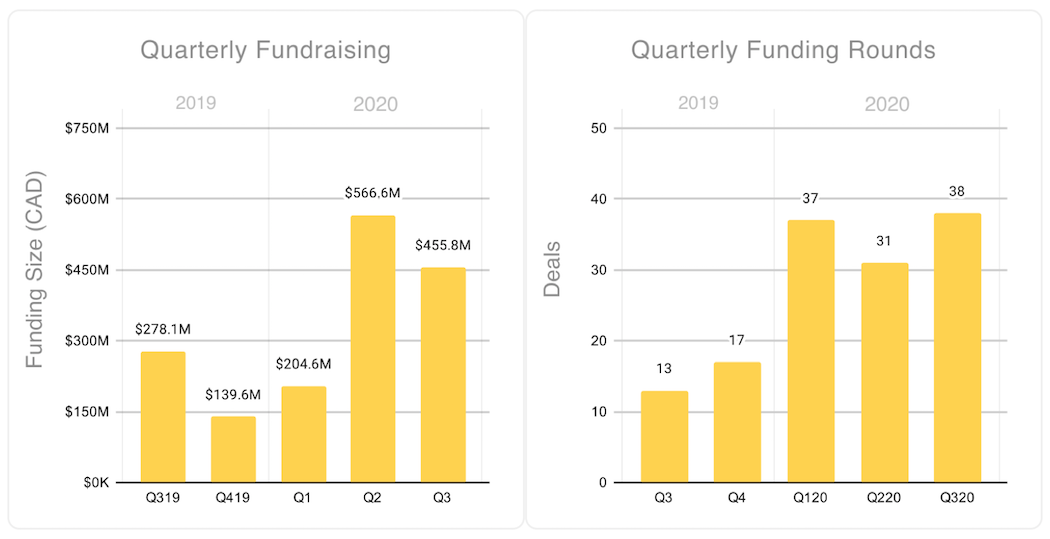

Startups in Montréal raised a total of $455.8 million in Q3, representing a 20 percent decrease from last quarter’s $566.6 million. More than half of the region’s total funding in the quarter can be attributed to e-commerce startup AppDirect’s $250 million round.

Founded in Montréal, AppDirect is currently headquartered in San Francisco, but its roots in the city remain strong. Investors in AppDirect’s round included notable Québec firms Caisse de dépôt et placement du Québec (CDPQ) and iNovia Capital. Some of the capital raised by AppDirect will go toward hiring new team members in its Montréal office, which would make Montréal the company’s largest outpost by headcount.

Although it is encouraging to see mature startups like AppDirect and Sonder renew their commitment to the city, Montréal’s reliance on large deals from startups that are no longer headquartered in the region could signal a worrying trend.

Without AppDirect’s deal, total funding in Montréal in Q3 would have declined by a staggering 66 percent from last quarter, putting the region behind the Greater Toronto Area, British Columbia, and the Waterloo Region.

“The top four deals this quarter, including AppDirect’s $250 million deal, accounted for $380 million, or 83 percent of total deal value,” said Sumeet Pelia, director of research at Hockeystick. “When looking at the city level, this is a typical characteristic across each Canadian ecosystem, where the presence or absence of megadeals has the biggest impact on deal value.”

AppDirect’s deal was followed in size by Inversago Pharma’s $43.7 million Series B round, Dialogue’s $43 million equity investment, and GHGSat’s $39.5 million Series B round. GHGSat marks the entry of cleantech into one of the three most dominant verticals in Montréal over Q3.

Hockeystick tracks the most active investors in Montréal on a rolling 12-month basis based on the number of investments closed. Overall, 52 investors participated in Montréal deals in the third quarter of 2020, down from last quarter’s 58 investors.

The top investor in early-stage deals was Real Ventures. Late-stage investors included Fonds de Solidarite FTQ, Investissement Quebec, CDPQ, iNovia Capital, and the Business Development Bank of Canada.

“This surge in early-stage activity is a very sign of health in the ecosystem, and a strong indicator of future potential deal value as these seed startups mature.”

– Sumeet Pelia

One of the more encouraging signs for Montréal was seen in funding activity over Q3. Deal volume increased 22.5 percent during the quarter from 31 to 38, representing an impressive 192 percent increase year-over-year, and the highest deal volume since at least as far back as Q1 2019. This surge was driven by a strong showing at the seed stages.

“This surge in early-stage activity is a very sign of health in the ecosystem, and a strong indicator of future potential deal value as these seed startups mature,” said Pelia.

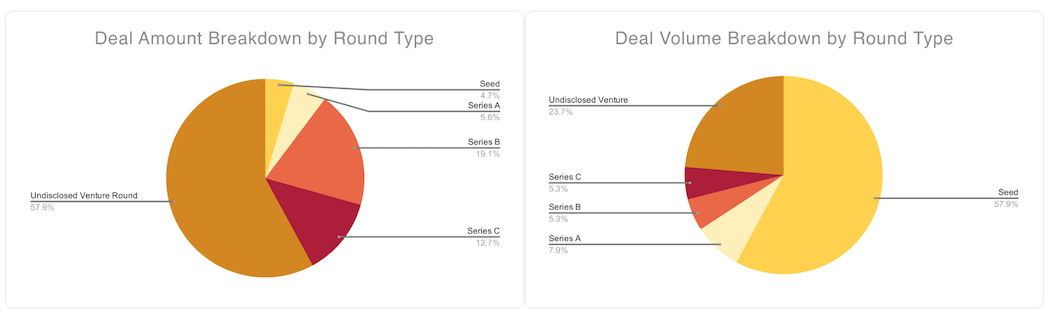

During the quarter, 25 of 38 deals (65 percent) were either pre-seed, seed, or Series A rounds. This represents a slight increase from last quarter, during which early-stage activity accounted for 54.9 percent of deal volume. Twenty-two seed-stage companies raised funding in Q3 with funding amounts ranging from $100,000 to $6.5 million.

“Q3 saw a high level of early-stage activity from Real Ventures and Anges Québec,” Pelia noted. “These investors are stepping up and ensuring there isn’t a gap at the early-stage. This is a very healthy indicator and distinguishes Montréal from other ecosystems.

Montréal saw an uptick in late-stage funding activity in Q2 and the region kept the momentum in Q3, with late-stage activity continuing in Q3. Overall, four deals that closed in Q3 were classified as Series B or C, while for nine deals, the round was not disclosed.

Cleantech companies in the Montréal region raised five rounds totalling $53 million in Q3.

Inversago Pharma and Dialogue’s rounds pushed the life sciences and healthtech sector (which Hockeystick combined into one category) to the second on the leaderboard in terms of funding raised, behind only e-commerce. Life sciences and healthtech startups raised $90 million across seven deals during the quarter.

Despite some positive signs, Hockeystick’s report warned that total funding in the Montréal region is expected to drop in coming quarters, as the top few deals will likely be smaller than those in Q2 and Q3 of 2020. Pelia said the key watch item for Q4 is whether the strong seed activity is followed by early-stage startups maturing into the mid-range (meaning Series A and B deals).

“If this occurs, there is a strong probability of sustained high quarterly performance in Q1 2021 and onwards,” he said.

Those interested in receiving the BDO Hockeystick Montréal Tech Report can sign up for an English version here and a French version here.

BetaKit is a Hockeystick Tech Report media partner.