While Canada’s FinTech ecosystem is a big driver of small to medium-sized enterprise (SMEs) in Canada, it has experienced a notable decline in new companies created over the last four years, according to a new report from FinTech Growth Syndicate (FGS).

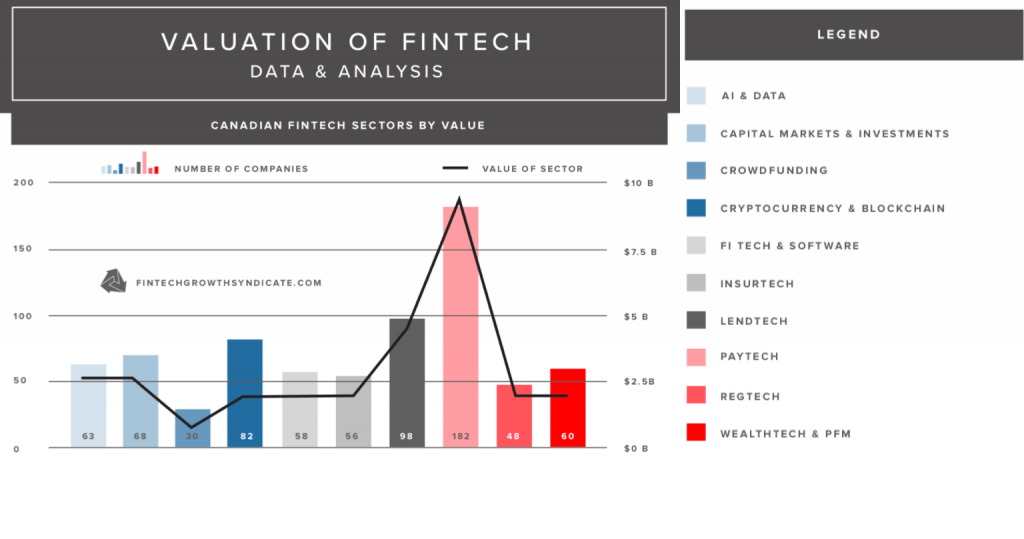

The report found that PayTech is, by far, the largest FinTech sector in Canada.

The report, which was prepared for the Government of Canada, found the formation of new companies peaked in 2014, with 101 new FinTechs created in Canada that year. In 2018, however, the report captured only 28 new FinTechs created, a 72 percent decrease in just four years.

FGC stated that given the timing of its report, its data for 2018 is likely inaccurate, but noted the overall decline as a trend is a reliable data point.

“Some explanations for the decline could be issues with access to funding, ability to scale in Canada, access to a competitive market, adoption rates, maturing segments, or increased innovation by [financial institutions] as a deterrent,” the report stated.

Christian Lassonde is the founder and managing partner of Impression Ventures. He said he saw roughly 200 Canadian FinTechs created last year and just under a quarter of that number created in 2019. He added that these figures fall in line with those from 2017, and had a more optimistic outlook on the trend of new FinTechs in Canada.

“While it’s almost impossible to assign year of formation dates to these companies, taken in aggregate, this data is suggestive of a [healthy] stable-state of FinTech company creation in Canada,” Lassonde said in a statement to BetaKit. “Obviously, we would love to see these numbers [increase] versus staying flat – so let’s continue to get those creative forces going.”

FGS’ report found Toronto accounted for 62 percent of the country’s FinTech ecosystem, while a similar report from Toronto Finance International in March, found that Toronto accounts for only 43 percent, a 19 percent discrepancy. While the percentages may differ, the reports agree that Toronto accounts for the majority of FinTechs in Canada.

RELATED: Which Canadian city has the best FinTech ecosystem?

The findings of Toronto Finance International’s report also suggested that the Toronto region has a smaller share of global FinTech investment, with regards to the number and size of deals compared to other major financial centres such as San Francisco, London, and New York.

A KPMG ‘Pulse of FinTech’ report found that Canada’s overall FinTech sector saw a high volume of deals in the first half of 2018, but the value of those deals declined compared to the year before, suggesting access to funding could indeed be a significant reason for new company decline in recent years.

FGS’ report found approximately 80 percent of all FinTech firms in Canada are valued at less than $50 million, with PayTech comprising the majority of the industry’s value. LendTech, cryptocurrency and blockchain, and capital markets and investment were the next most highly valued FinTech startups.

In terms of adoption, another report from Ernst & Young found Canada has one of the lowest FinTech adoption rates around the world, with only 18 percent of survey respondents in Canada reporting they have used two or more FinTech services in the last six months, compared to 33 percent globally.

Legacy financial institutions have also undoubtedly pushed innovation efforts recently. Just this year, Merdian, Ontario’s largest credit union, launched its very own digital service Motusbank. Scotiabank did something similar, launching a digital platform for mortgage applications, Scotiabank eHOME.

Driving SME growth

FGS’ report found in Canada, which has 31,300 startup employees total, 80 percent of all FinTech firms are valued at less than $50 million. It also noted that nearly three-quarters (74 percent) of Canadian FinTech firms have under 50 employees, suggesting FinTech could be a large driver of SME growth in the country.

The report identified 831 FinTechs in Canada and 164 FinTech incumbents in operation. FinTech incumbents are defined as companies that occupy a large portion of the existing financial services market, mostly provide tech to banks, and do not offer alternative financial services.

The report also found that PayTech is, by far, the largest FinTech sector in Canada by number of companies, accounting for one quarter (204) of the total number of FinTechs in Canada, with FI tech and software, LendTech, and capital markets and investment following behind respectively.

The report noted all the movement in this sector as well as others suggest the stage is being set for more disruption in FinTech.

Recently, Toronto-based Wave, a platform for small business owners, announced a new payments solution created in partnership with Visa, designed to change how small businesses manage cash flow. Also, Vancouver-based FinTech startup Mogo signed an agreement this month to merge with Difference Capital Financial to create Mogo Inc.

The Ontario Securities Commission, a regulatory body, which enforces securities legislation, also created the FinTech Advisory Committee in 2017 to look at securities issues surrounding the growing industry. Some of its newest members include Andrew Graham of Borrowell, as well as members of Canada’s VC community, including Brian Mosoff from Ether Capital and Karim Gillani from Luge Capital.

Image courtesy pxhere