Alberta’s tech sector showed new signs of maturity in the first quarter of 2022, as local startups collectively passed a new record for quarterly venture funding, according to data from briefed.in.

During the first quarter of this year, Alberta-based tech companies raised $205.6 million, which represents a 212 percent increase in investment from the fourth quarter of 2021, and a 26 percent increase year-over-year.

“In Alberta, we have a very pragmatic, problem-solving economy and ventures that are solving difficult and important problems.”

– James Lochrie, Thin Air Labs

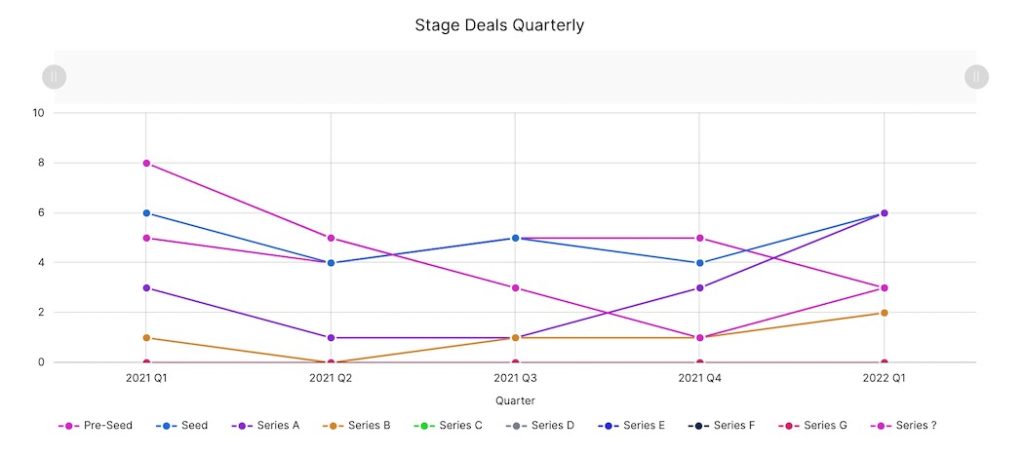

The pace of deal-making also showed no signs of slowing down in Q1 2021. A total of 20 deals closed in Alberta during Q1 2022, which represents a 43 percent increase compared to last quarter, and a paltry 13 percent decrease year-over-year.

Q1 2022 followed an impressive year for Alberta’s tech companies, which raised a total of $356.7 million in 2021. In the first quarter of 2022, Alberta-based firms have already managed to raise 58 percent of the total investment raised in 2021. James Lochrie, partner at Calgary-based Thin Air Labs, believes the growth of the innovation ecosystem in Alberta is “incredibly strong.”

“Over the past number of years, there has been growing momentum in the Calgary ecosystem related to seed funding and it continues to accelerate,” Lochrie told BetaKit. “As those companies are maturing, we are starting to see a number of them hit scale and raise more significant investment rounds.”

Driving this quarter’s record performance has been an increased interest from investors outside the province. Several significant funding rounds during the first quarter included Validere’s $55 million Series B funding round, Athennian’s $33.5 million Series B funding round, and Reach’s $30 million growth funding round.

Notably, all of those rounds included a mix of local and international investors. Zack Storms, founder of Startup TNT, recently told The Canadian Press he believes at least half of that funding raised across Alberta in recent months has originated from outside the province, though local investment in tech is quickly catching up.

“More and more local investors are participating in the opportunities in their own backyard, but just as importantly, global capital is paying more and more attention to opportunities in Alberta,” Lochrie added.

Over the last few years, Alberta has made a concerted effort to market itself as a tech destination to the rest of the world. Most recently, the provincial government announced a tech worker immigration stream as part of its broader innovation strategy. The province has also focused on attracting global investment into its economy through the Invest Alberta Corporation. While it’s not clear how successful those initiatives will be, the new highs for venture funding point to significant momentum in Alberta’s budding tech sector.

Funding gaps remain for early-stage startups

According to briefed.in’s report, a total of nine deals closed in the pre-seed and seed stages in Alberta during Q1 2022, which represents no change from the previous quarter. While smaller deals are often not publicly announced, the Calgary ecosystem (where more than 94 percent of dollars in Alberta went in Q1) has previously shown signs of a concerning rift in early-stage funding.

Lochrie described Alberta’s early-stage tech ecosystem as healthy, but still years away from full maturity, adding that “seed-stage funding still has many gaps as early-stage companies struggle to find the right investors.”

Some of the early-stage startups that did secure investment in Q1 2022 included Wyvern, which raised a $2.8 million seed funding round, HonestDoor, which raised a $2.2 million seed funding round, and PulseMedica, which raised $2.2 million in seed funding.

The Accelerate Fund, which is co-managed by the A100 and Yaletown Partners, was one of the most active early-stage investors across Q1 2022. David Edmonds, industry chair of the A100, noted Fund II of the Accelerate Fund made several follow-investments in late Q4 2021 and early Q1 2022 and is targeting 24 investments for Fund III.

“We are seeing strong activity in our seed-stage companies being funded across the province,” Edmonds said, adding that there were several deals not finalized in Q1 that should “balance out the quarter-by-quarter measurement.”

Alberta’s early-stage gap could be filled in the coming quarters by several new accelerator programs that recently launched for local startups. Some of these new programs include Alberta Catalyzer, a pre-accelerator run by Platform Calgary and Innovate Edmonton, Plug and Play Alberta, Alchemist Accelerator, and 500 Global’s seed-stage accelerator.

“I would like to see the impact from the various accelerator programs on the graduating startups,” Edmonds said. “Then we can determine if there are any pinch points that we need to address as a community to ensure their success.”

Can Alberta weather any oncoming slowdown?

Despite initial fears that the recent downturn in public markets in Q1 2022 would slow the pace and size of investment, most Canadian ecosystems continued to track successful raises, Alberta not least among them. However, Edmonds said with global instability, inflation, and increasing borrowing rates, he has noticed a downward pressure on valuations in certain market segments.

“That said, if we see some constriction in the market, companies generating revenue and experiencing growth based upon the value they deliver to their customers will see larger investment dollars flow to them,” he added.

Still, ongoing concerns over a technology cooldown are well-placed. Lochrie said he would not be surprised to see venture funding slow down at some point, given its feverish pace in recent months. As tech continues to play a key role in Alberta’s economy, he believes Alberta’s ability to nurture and accelerate its growth will be an important part of the story.

“In Alberta, we have a very pragmatic, problem-solving economy and ventures that are solving difficult and important problems,” Lochrie said. “I would expect Alberta to weather any slowdown quite well.”

BetaKit is a briefed.in Tech Report media partner.