Early-stage companies face countless challenges in their journey to success. Attracting talent, overcoming delays, reaching product-market fit, and so on. Out of all these lurking threats, the one that founders have the most control over is the valuation of their company.

A moderate valuation actually provides greater long-term value for everyone.

Taking investor money at high valuations is enticing, but it is a double-edged sword. It can tattoo your company with a mark that has halted many startups from raising additional capital and has even brought behemoths to their knees. This is a cautionary tale of high valuations.

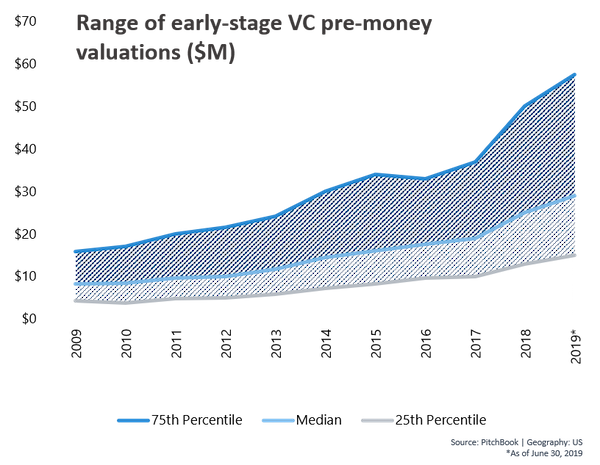

Over the last ten years, early-stage valuations have more than tripled (see graph below). Venture capital funds invested $254 billion globally in 2018, a 46 percent leap from 2017, with more than half of that landing in the United States.

There is a lot of money in the market and a real likelihood that strong founders will receive competing term sheets with varying valuations attached to them. I am making the case for founders to avoid striving for the highest possible valuation they can get, and to instead raise money at an appropriate valuation – what they are truly worth – from the best investors possible.

I certainly acknowledge that my point of view may seem conflicted in this position because advising founders to avoid high valuations is often in the best interest of investors. However, a moderate valuation actually provides greater long-term value for everyone, including the founders, the startup, and its employees.

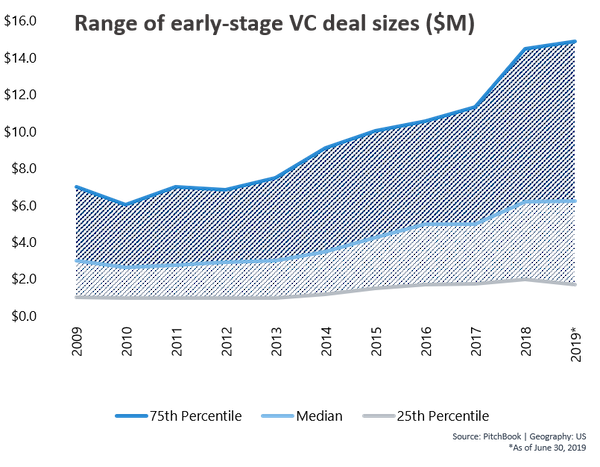

The amount of money raised by early-stage companies has more than doubled since 2009.

This is a trap that many entrepreneurs fall into. A strong founding team might raise money from friends, family, and angels at a relatively high valuation. They might even raise their seed financing from a venture fund at a healthy premium. However, eventually the rapid expansion required to ‘grow into’ a high valuation catches up to the company and it faces difficulty in raising more capital or selling itself at a premium to the last round.

Remember, the higher your valuation, the more growth you will need to show, and a failure to demonstrate that growth will lead to a smaller pool of investors and acquirers. If you raise money at a price that is higher than what your company is actually worth, you will need to spend capital from that raise to grow into that valuation, rather than using that money to grow beyond your valuation.

Be warned, because of the liquidation preferences held by outside investors, the burden of an exit at a low valuation often falls largely on the founders and employees of a company.

The root cause of this issue is often a high valuation in a previous round of financing combined with a strong desire to avoid a down round. This will make fundraising and exits more difficult, as the number of investors and acquirers who can stomach the high price drops off rapidly. Later stage companies fall into this trap as well.

Jason Luo, associate director at OMERS Growth Equity, focuses on investments in later-stage companies and has stated that “companies raising money at high valuations often feel compelled to spend their freshly raised capital rapidly to grow into their valuations. However, this may lead to price competition and decreased long-term unit economics, negatively impacting long-term valuations”.

Small or large, the cautionary tale of high valuations follows all growing companies.

Raising money at a high valuation is tempting as it results in less dilution to you, your employees, and your existing investors. However, you can limit your dilution by raising less money at a moderate valuation. The amount of money raised by early-stage companies has more than doubled since 2009. Consider carefully how much money you really need right now.

Accept a modest premium if you sincerely feel that your company has an exceptional team, traction, and product. This will help to control dilution and maintain your valuation at a level that supports the growth of your company over the long term.

What is the right valuation for your business? This is a difficult question that you should ultimately let the market decide. Ask potential investors candidly what they think of the valuation at which your company previously raised money and where they would ballpark your valuation now. Do some digging to find valuations of similar-sized competitors, or triangulate based on key metrics of those businesses.

Take these data points and have an open discussion with your board and your trusted advisors. Ultimately, I encourage you to consider whether foregoing a very high valuation will open doors for your business in terms of investor quality, exit options, and long-term growth.

Image source Pixabay