Vancouver-based FinTech company Mogo has announced the launch of MogoMortgage, a new product designed to gamify the process of managing mortgages.

Mogo, which focuses on building tech to make it easier for consumers to manage their financial health, will offer its new product in Ontario, British Columbia, and Alberta. The company says MogoMortgage will make the experience of getting a mortgage “transparent, less stressful, and more convenient.”

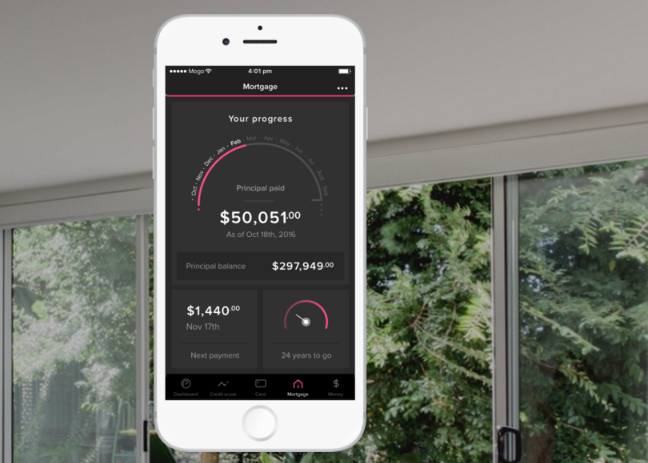

Through MogoMortgage, consumers can manage their mortgage, from pre-approval until the mortgage is renewed, both online and through their mobile. They can access experienced mortgage specialists via online chat, email and phone to help get the right mortgage, and use an interactive dashboard that gamifies the experience of becoming mortgage-free. The company is promising to reward users for making milestone payments, as well as offer perks like dinner and celebratory champagne after funding a mortgage.

“We’re excited to launch our new MogoMortgage, which has simplified the mortgage experience by bringing a new level of transparency to not only the interest rates but also the process of getting a mortgage,” said Dave Feller, the founder and CEO of Mogo. “In addition, unlike any other mortgage experience in Canada, we focus on keeping our members on track through an interactive dashboard that is designed to encourage and reward members for paying down their mortgage, which is perhaps the single biggest thing Canadians can do towards their goal of achieving financial freedom.”

In recent months, Mogo has taken several steps to expand its services. In September last year, following the launch of its new digital banking account, the company announced that it has reached 250,000 members. The company was also featured on The Disruptors to talk about some of its struggles after going public.

“Entering Canada’s $1.4 trillion housing loan market represents a massive business opportunity and is a natural progression for us,” said Greg Feller, president and CFO of Mogo. “This also marks our expansion into fee-based products. As a mortgage broker, we have no capital requirements or credit risk, positioning us to drive high-margin, transaction revenue from our mortgage offering.”