Coming off a B grade on my predictions for 2016, it’s time to make some predictions for 2017. This time I’m trying to be more specific in some areas of Canadian technology and financing, and making some guesses as to where I see the investment opportunities for OMERS Ventures emerging through the year.

1. Industry investment pullback

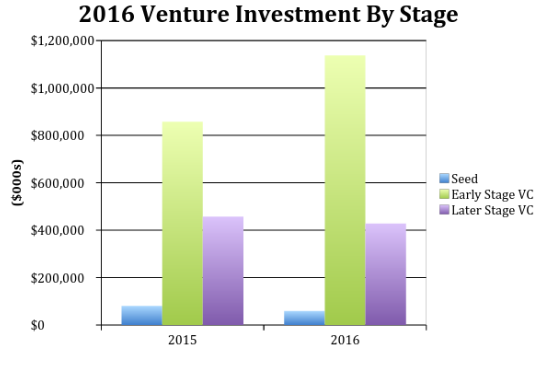

Although we don’t have the full picture for 2016 just yet, data from the CVCA combined with OMERS Ventures estimates shows that total venture capital invested into Canadian startups increased by about 15% versus 2015. All of that increase went into early-stage (pre-revenue, or just in revenue) startups, and follow-on investment in late-stage companies contracted.

Anecdotally, the valuation pull-back that we saw in 2016 in the US began to hit Canada in the latter part of the year, and I expect that trend to continue in 2017. With reductions in valuations, so too goes the amount invested (caused by a desire to limit dilution to founders and previous investors). So, for 2017, while our industry will remain healthy, I think we will see a slight (10%) reduction in total capital invested in Canadian startups versus 2016.

2. US investor pullback

In the IT startup sector, trend data from the CVCA shows that investment from non-Canadian investors (predominantly US) increased along with the Canadian investment, and also increased as a percentage of the total capital invested into the ecosystem. US investors provided about 52% ($559M) of all capital invested in Canadian IT startups in 2016, versus 49% ($482M) in 2015. With an overall pullback in US venture continuing, I expect the amount of US investment into Canada to decrease; this will particularly impact the later-stage Canadian companies where US investors are typically most active.

3. OMERS Ventures investment mix to return to early and late-stage

All four new OMERS Ventures investments for 2016 were pre-revenue seed and Series A investments (AmpMe, Nudge, one unannounced seed investment, and one unannounced Series A investment). With the contraction in valuations and the reduction in US investment in Canadian late-stage companies mentioned above, I expect 2017 to return to our traditional 50/50 new investment mix in both early and late-stage companies.

4. Tech IPO revival

The Canadian technology and startup ecosystem is beginning to realize that liquidity events are desirable and help to drive the industry forward in many ways. Although 2016 didn’t have any IPOs of Canadian venture-back technology startups, I’m calling for at least three in 2017. This will be partially propelled by a successful Snap IPO south of the border.

5. Bitcoin and blockchain startups make an impact

Bitcoin was the best performing currency of both 2015 and 2016, and I expect that to continue in 2017 as the currency becomes more common in cross-border transfers and a safe haven versus many other fiat currencies. Blockchain-related applications and Ethereum smart contracts will move beyond the proof-of-concept (PoC) stage to become ever more prevalent in banking and other industries. This year should also see several Initial Coin Offerings as newer protocols begin to take hold at the infrastructure level. Within Canada, I expect to see the Canadian banks progress beyond their PoCs, and an increase in the level of startup funding in the area.

6. Virtual reality/augmented reality

Within the virtual reality category, we should see a number of trends emerge. In mobile VR, Google Daydream should gain a stronger prominence versus Samsung Gear. And in the platform sector, beyond games, we should see stronger development of content that capitalizes on the uniqueness of what VR offers over other mediums. Applications beyond entertainment should begin to emerge in areas such as education, healthcare, and travel. Within augmented reality, the story for 2016 was clearly Pokémon Go. For 2017, brand name AR devices should begin to emerge, but like VR in 2016, adoption will be very limited. We should begin to see a number of Canadian startups emerge in both VR and AR through the course of 2017, as funding to the sector will increase.

7. Canadian machine learning (ML) startups will raise more capital in 2017 versus 2015 and 2016 combined

In recent years, ML has generated much interest, seen practical applications, and led to significant M&A and VC funding in the US. For 2017, we should see acquisitions by non-tech companies (retail, banking, automotive) in this sector as they seek to take advantage of the data that has been captured by their Internet of Things and big data initiatives. Despite all the activity in the sector, for some reason 2016 was a down year for venture investment in Canadian ML startups. I think that will change in the next 12 months, as Canadian ML startups seek to raise their next rounds of financing and their innovations become recognized by the broader community.

8. Cybersecurity startup renaissance

In recent years, when asked about post-social, post-mobile trends, VCs often pointed to blockchain, AR/VR, and ML as key trends. Cybersecurity was mostly be a trend of the past. Given the recent attention in the area, and Canadian expertise in a number of cybersecurity subsectors, I expect funding of Canadian startups in this sector to increase dramatically in 2017.

9. The empires strikes back (with help from the startup rebels…)

Over the last several years, startups have been chipping away at incumbent market share in areas such as retail, banking, and transportation. However, a new class of startups is beginning to emerge—those that develop technologies to help the incumbents successfully compete. In retail, for example, numerous retailers are beginning to adopt startup software to transform shopping into an experience.

In banking, we should see further trials and proofs-of-concept in the blockchain area and additional focus on small and medium-sized businesses, both areas that FinTech startups have begun making incursions into.

Finally, startups will seek to empower existing auto companies in areas such as connected, autonomous, electric, and shared vehicles (to help the GMs of the world compete against Tesla). Startups selling to these incumbents adopt a B2B business model—technology proof points are challenging and sales cycles are longer but ultimate market share can be larger versus the “go-it-alone” approach. I expect Canadian companies to excel in these areas, and predict at least two “scale-up” funding rounds into these “empower the incumbent” startups in 2017.

10. Foreign friends redux

My prediction for 2016 that an Asian technology company would hit the US mainstream as a consumer brand just didn’t happen. But, with the offerings of Xiaomi and TenCent bubbling just below mainstream consciousness, I still believe it’s coming. Bringing this one back and calling it to happen in 2017 instead.

As always, I’ll come back in a year to revisit these predictions at the end of thee year to see how I’ve done. Any comments or thoughts? What are your predictions for 2017? Leave them below.