Helped along by a surge in both deal volume and investment, Québec’s tech market remained active and abundant in the second quarter of 2023.

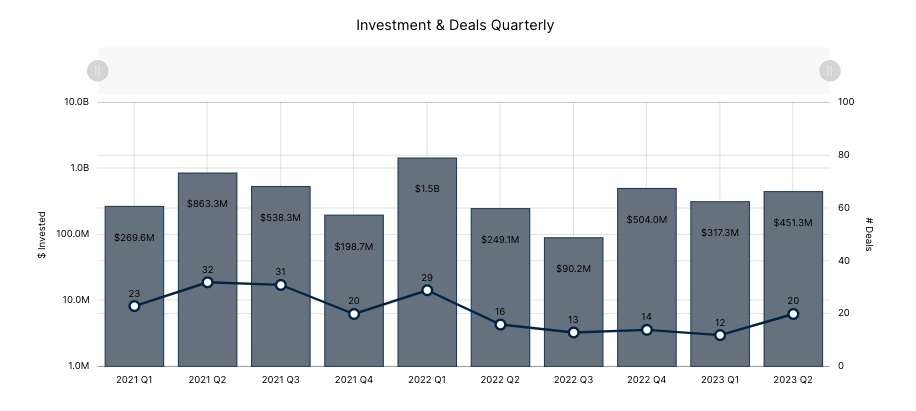

According to briefed.in’s latest report, Québec tech startups cumulatively raised $451.3 million through 20 investments in Q2 2023. Investment in the province increased 42 percent from Q1 2023 and 81 percent year-over-year.

As of the end of Q2 2023, Québec is 33 percent of the way to matching the investment raised in 2022.

Venture funding in Québec has remained relatively high in the last three quarters, a notable divergence from other Canadian tech ecosystems, which by and large have seen venture funding drop amid a tougher macroeconomic backdrop and fundraising environment. In fact, Québec attracted more investment than any other Canadian ecosystem tracked by briefed.in in the first quarter of 2023.

While the province did not continue its winning streak in the second quarter (Toronto reclaimed its top spot in terms of dollars raised), Québec has been a bright spot in an otherwise bleak Canadian venture landscape. When most other ecosystems saw investment decline dramatically between 2021 and 2022, Québec companies raised $2.3 billion in cumulative funding in 2022, compared to $1.9 billion in 2021. As of Q2 2023—50 percent of the way through the year—Québec is 33 percent of the way to matching the investment raised in 2022.

David Charbonneau, managing partner of Montréal-based Boreal Ventures, suggests that Québec’s recent divergence from the rest of Canada could be attributed to the province’s unique network of investors.

“Québec has the particularity of having a large pool of mission-driven institutional [limited partners] who require a portion of their money to be reinvested in the local economy,” Charbonneau said. “These players act both as LPs and also as later-stage direct investors. This makes it so that Québec as a market is far more stable than other provinces as far as venture capital availability goes.”

Two examples of these institutional investors include Caisse de dépôt et placement du Québec (CDPQ), which manages public pension funds, and Le Fonds de solidarité FTQ, which was created by one of Quebec’s largest labour unions. Both invest directly in Québec-based companies as well as venture funds as limited partners. Both organizations are mandated to contribute to Québec’s economic development.

Both CDPQ and Fonds FTQ were very active in the Québec tech ecosystem in Q2 2023. CDPQ made a $125-million investment in Montréal-based GSoft, which was the largest round raised in the province during the quarter. At the end of Q2, it was announced that Fonds FTQ had backed i4 Capital’s targeted $60-million deep tech seed fund.

Québec’s government is also a major contributor to local fundraising through various initiatives, tax incentives, and agencies. Investissement Québec, the investment arm of the provincial government, is routinely among the province’s most active investors in a given quarter, thanks to its investment matching programs like Impulsion PME.

Bridging the early-stage divide

Investment was not the only metric that increased in Québec during the second quarter. With a total of 20 deals tracked by briefed.in, deal volume increased by 67 percent quarter-over-quarter and 25 percent year-over-year.

Unlike investment, deal volume is a metric that has consistently declined in Québec in the last three years, with the province seeing the most notable drop in activity in 2022. As of the end of Q2 2023, Québec’s deal volume is 44 percent of the way to match deal volume in 2022, indicating that despite the quarterly jump in activity, deal-making activity is unlikely to return to pre-pandemic levels this year.

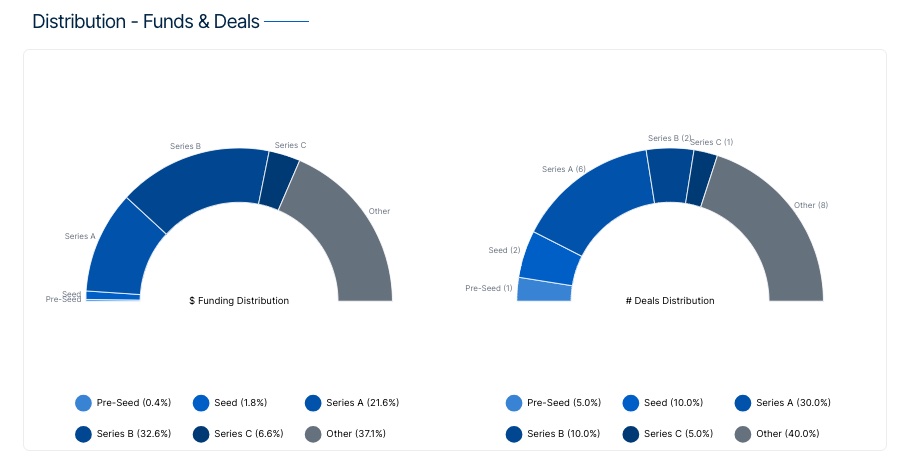

Québec’s lower deal volume in recent months has been most evident in early-stage investing. In Q2 2023, briefed.in tracked just three pre-seed and seed-stage deals in Québec, including Eli Health’s $5-million seed-stage funding round, Obeo Biogas’ $3-million seed funding round, and Oamo’s $1.7-million pre-seed funding round.

Scott Loong, Montréal-based partner at Panache Ventures, said it’s not clear whether the three early-stage deals reported by briefed.in actually closed in Q2 or were closed beforehand and announced during the quarter—in which case, early-stage activity would be even slower.

“Whether the number is three or lower … the broad takeaway is that there was effectively zero pre-seed and seed funding in the province during Q2,” Loong said. “Obviously, this is a difficult situation for Québec entrepreneurs with businesses at the pre-seed and seed stages.”

Charbonneau has noticed early-stage activity slow in the last few quarters, though he believes this result was to be expected, given the ripple effect of the broader market contraction in the last year.

“Most companies have already raised enough through internal bridges for the most part, sometime in 2022 to withstand what was foreseen as a harsher fundraising environment,” Charbonneau said. “I’m expecting some of these companies to come back to market sometime this fall to prepare for Q1 [and] Q2 2024 closings.”

Charbonneau added that these internal bridges are typically not announced publicly, and since briefed.in’s data is collected from founders who submit their deal information directly, or from online, public sources, these bridge rounds were likely not captured.

Sustaining Québec’s momentum

Québec’s positive Q2 2023 results aren’t the only positive indicator for the local tech sector. In recent months, new funds have come online locally. One of these was CMD Capital, which was recently launched by long-time Canadian startup investors Matt Roberts and David Dufresne. This month, i4 Capital also launched its own fund, and some out-of-province investors such as Vancouver-based Pender Ventures recently upped their presence in the region.

Charbonneau said the fundamentals of the province’s ecosystem are also healthy from his vantage point, and he expects to see an uptick in the number of companies raising new rounds in the fall of 2023, with those rounds likely closing in Q4 2023 or early 2024.

Charbonneau said he is hopeful that the emergence of new funds, the maturation of early-stage companies through local incubators and accelerators, and more companies seeking capital later this year will sustain Québec’s venture funding activity in future quarters.

briefed.in is owned and operated by Communitech. BetaKit receives data from briefed.in as part of a media partnership with Communitech and retains full editorial control of all articles that reference the data produced by briefed.in/Communitech.