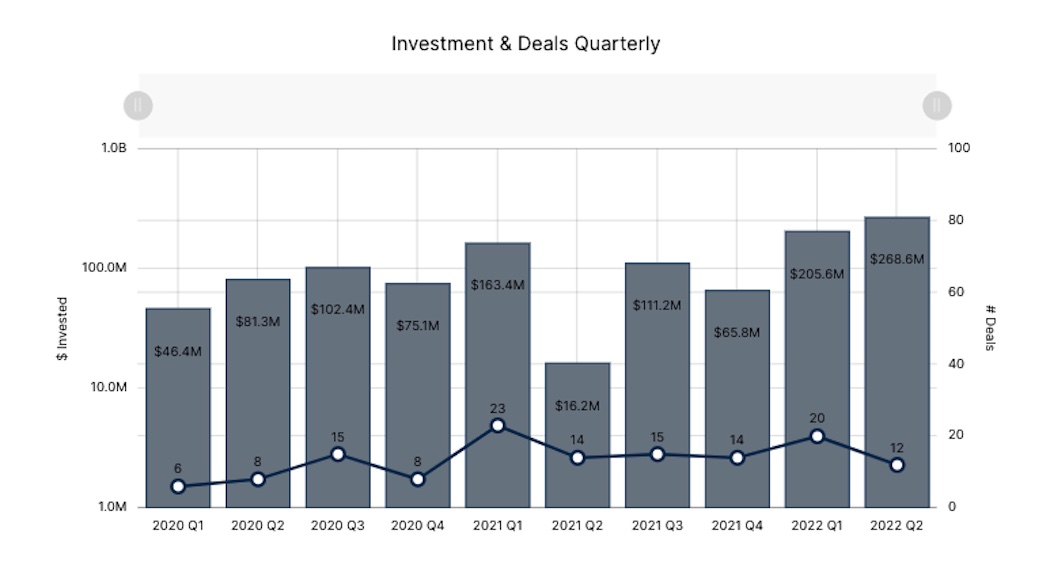

For most Canadian tech ecosystems, the second quarter of 2022 saw venture funding slow from the breakneck pace of 2021. This was not the case for Alberta, which managed to set a new record for venture funding in the second quarter, according to briefed.in’s latest report on the province.

Alberta’s tech companies raised $268.6 million through 12 deals in Q2 2022. The province saw a 31 percent increase in total investment quarter-over-quarter and a 1553 percent increase year-over-year. Deal volume, on the other hand, fell by 40 percent from last quarter and 14 percent year-over-year. While the second quarter represented a record high for Alberta in terms of investment, it also marked a six-quarter low for deal volume.

“Venture funding across the board has been on fire until recently, and I don’t see Alberta being immune from the overall cooling.”

– Tiffany Linke-Boyko

Among all five Canadian tech ecosystems tracked by briefed.in, only Alberta and Waterloo Region failed to see a slowdown in venture funding in Q2 2022, with the latter doing so due to a massive deal raised by dual-headquartered Faire.

Tiffany Linke-Boyko, Edmonton-based principal at Flying Fish Partners, told BetaKit that while it is hard to know if Alberta is delayed in matching up with other tech markets, the province’s Q2 2022 results are nonetheless worth celebrating.

“2021 was a record-setting year, and I think that momentum from that continued, and that is why we are seeing 2022 have such significant numbers thus far,” Linke-Boyko said. “So as a whole, the ecosystem had been gaining momentum and growth.”

Prairie Unicorn

Of the $286.6 million raised in Alberta during Q2 2022, roughly 68 percent of it was raised by one company, Calgary-based challenger bank Neo Financial. In May, Neo secured a unicorn valuation when it raised a $185 million Series C round of funding, the third consecutive round with participation from Peter Thiel-backed Valar Ventures, which marked a rare megadeal for the Alberta tech ecosystem.

While nine-figure rounds were a once rarity in most Canadian ecosystems, they were certainly more prolific across Canada in 2021, except for Alberta, which is comparatively smaller than Vancouver and Toronto.

“Alberta is a relatively nascent market for startups, with a lot of early-stage companies maturing into Series A [and higher] companies,” said Zack Storms, founder and chief organizer at Prairies-focused tech non-profit Startup TNT. “Because of this, there weren’t a lot of mega-deals in 2021. We’re starting to see some, and so the comparison year-over-year is still positive because the companies are still maturing.”

Neo Financial’s success speaks to the mafia effect that local anchor companies and their founders can have on a burgeoning ecosystem. Two of Neo’s founders were also the founders of Prairie-born startup, SkipTheDishes, which was acquired in 2016 for $110 million. The startup has also received the support of Alberta-based venture studio Harvest Builders, which was launched by another SkipTheDishes co-founder, Chris Simair.

“Megadeals continue to be an example to other founders, investors, and community members that Alberta is a place to build and scale a company,” added Linke-Boyko. “I believe that more and more of these examples will continue to inspire current and new founders to develop and scale their companies in Alberta and continue momentum within the ecosystem.”

Series A startups feeling the valuation pinch

According to briefed.in’s data from previous quarters, the Calgary tech ecosystem has exhibited signs of an early-stage funding gap in the past, which was concerning for a smaller ecosystem where young companies play a critical role in the long-term health of the tech sector. However, when examining trendlines from a yearly perspective for Alberta, seed and Series A-stage deal volumes have, on average, increased from the beginning of 2019 to Q2 2022.

briefed.in tracked seven deals in the pre-seed and seed stages and two Series A funding rounds in Alberta during Q2 2022. Storms noted that while trends can be harder to glean on a quarterly basis for a smaller ecosystem like Alberta’s, “this could be an indication of VCs conserving, or being more cautious with, their capital.”

Linke-Boyko believes the decline in Series A deal volume could also indicate that the broader tech market correction is impacting valuations for Series A companies in Alberta, a trend she expects to continue in future quarters.

“We are advising our portfolio companies that if they can, they should delay raising a Series A until they have strong numbers to go out in the market for fundraising,” she added. “Expectations around traction have changed, especially because many companies that raised in the last couple of years have healthy valuations and would like to see that continue into their next round.”

Province not immune to a funding slump

While the Alberta tech sector has much to celebrate from the second quarter of 2022, stakeholders who spoke with BetaKit indicated they expect venture funding to align with the broader cooling taking place in other markets.

Storms noted from his vantage point that the Alberta tech ecosystem is generally nervous of a potential slowdown, but also optimistic, particularly as more VC funds continue to launch in the province this year to execute more deals. Storms’ organization, Startup TNT, saw over $1 million deployed through over 10 deals at its most recent summit.

“Venture funding across the board has been on fire until recently, and I don’t see Alberta being immune from the overall cooling,” Linke-Boyko added. “But if you look at the overall stats, VC funds are still attracting record levels of investment and have dry powder, and this needs to be invested in companies.”

BetaKit is a briefed.in Tech Report media partner.