Welcome to the FinTech Times, a weekly newsletter covering the biggest FinTech news from around the globe. If you want to read F|T before anyone else, make sure to subscribe using the form at the bottom of this page.

Portag3 appoints Chris O’Neill as partner, as firm looks to “plant a flag” in the Valley(BETAKIT)

Toronto-based FinTech VC firm Portag3 Ventures has appointed Chris O’Neill as partner, who will be based in San Francisco.

Local non-profit turns to FinTech to help struggling Calgarians(CED)

Managing your finances and getting rewarded for saving rather than spending is the idea behind a new collaboration between a Calgary-based non-profit organization and a fintech company from New Brunswick.

Revolut lets you purchase gold(TECHCRUNCH)

Revolut works with a gold services partner (London Bullion Market Association) so that money you spend on gold exposure is backed by real gold held by this partner.

Islamic FinTech startups on the rise in Southeast Asia(FORBES)

The prime Southeast Asian market is Indonesia, home to the world’s largest Muslim population, at over 230 million.

FinTech in the United Kingdom after Brexit(COINTELEGRAPH)

Many FinTech companies chose London because of its strong financial regulation, but how will Brexit affect the industry in Europe and the U.K.?

Mastercard, Samsung tie-up lets consumers pay on demand(PYMNTS)

Mastercard is partnering with Samsung to bring digital technology to emerging markets and accelerate connectivity and smart devices, Mastercard said on Thursday (March 12).

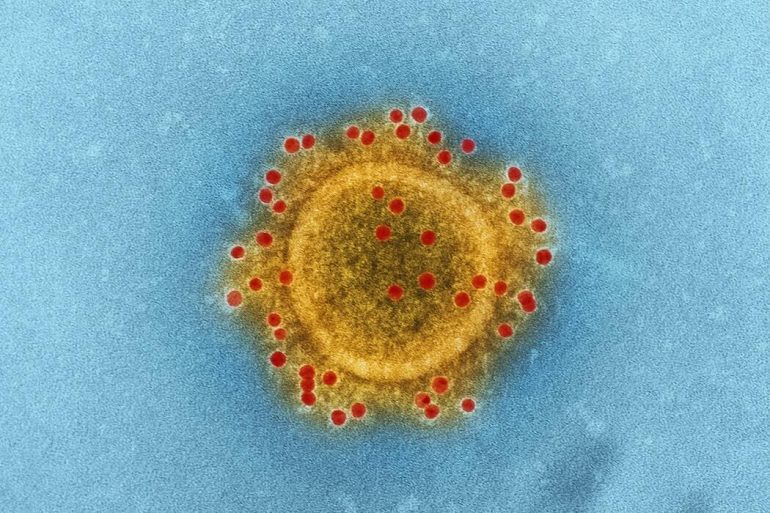

Could the coronavirus be a catalyst for FinTech?(FINANCEMAGNATES)

Could the coronavirus outbreak potentially act as a boon for FinTech companies who can act efficiently and thoughtfully?

Switzerland awards first FinTech banking license(SWISSINFO)

The new digital bank plans to challenge the traditional retail banking sector with personalized accounts tailored to individual clients.

Amazon Delivery exec leaves for FinTech SoFi(PYMNTS)

At SoFi, based in Silicon Valley, Renz will lead the FinTech startup’s credit card, brokerage and bank account businesses, one of the sources told WSJ.

$57.9B deployed into FinTech so far this year, Canada one to watch(NCFACANADA)

In the first half of the year, Canada saw $263 million invested in fintech deals across VC and M&A, including a $65 million raise by Wealthsimple.

Visa partners with Paga on payments and FinTech for Africa and abroad(TECHCRUNCH)

The new arrangement allows Paga account holders to transact on Visa’s global network. It will also see both companies work together on tech.

Will consumers warm to subscription banking?(PYMNTS)

Given the atmosphere around COVID-19 and the economic instability that has followed in its wake worldwide, will consumers be ready to try something as new as subscription service banking?