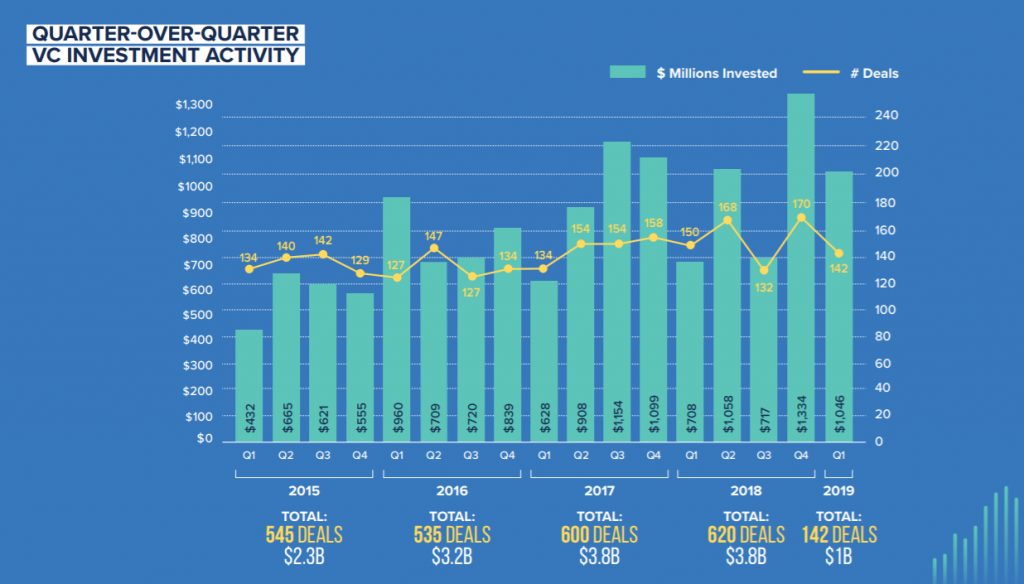

Canadian venture capital investments in the first quarter of 2019 marked another billion dollar quarter, the fifth billion dollar quarter since 2013, with the number of investments almost doubled since the same time last year.

The report, conducted by the Canadian Venture Capital and Private Equity Association (CVCA), looked at Canada’s VC and PE investments for the first quarter of 2019. VC data only included completed equity or quasi-equity venture capital deals.

A total of $1 billion was invested over 142 deals, up 48 percent from the same quarter in 2018. Comparatively, Q1 2018 saw $690 million invested in 139 companies, a much smaller six percent increase from Q1 2017, which saw $649 million invested.

Most of the deals (54) were made in Ontario companies, followed closely by Quebéc, which saw 51 investments. However, on trend with previous years, Ontario-based companies received 46 percent ($481 million) of VC dollars, while Quebéc companies only received 19 percent ($198 million). BC companies saw only 18 deals, but received 17 percent ($173 million) share of investment dollars.

In the fourth quarter of 2018, $1.3 billion was invested in more than 165 deals, and included fifteen mega-deals of $50 million or more. This quarter saw a smaller number, with seven mega-deals of more than $50 million, making up over half of the total dollars invested.

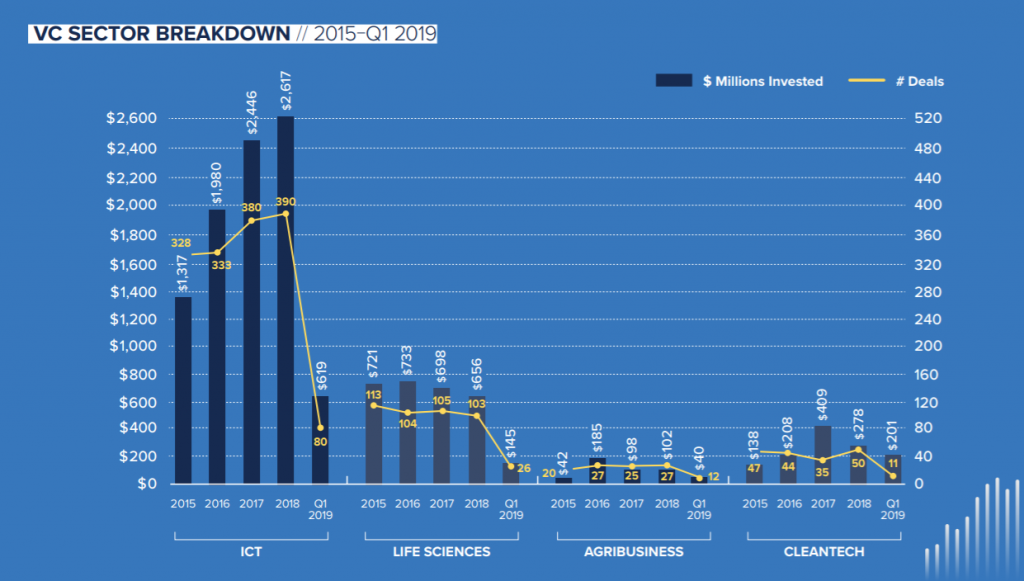

Tech companies made up some of the largest VC deals this quarter; ICT companies accounted for the majority of dollars invested. ICT companies saw $619 million or 60 percent of total dollars invested in Q1, while cleantech received $201 million or 19 percent.

Top companies included Toronto-based Vena Solutions, a FinTech company, which secured $115 million in funding as one of the top VC deals in Q1. Cleantech company Carbon Engineering closed $90 million in funding for its direct air capture technology, and Montreal-based Enerkem secured $76 million in funding. Last year, Enerkem also closed a $287 million in Q1 2018.

This quarter also saw Lightspeed make the largest (and only) Canadian tech IPO exit since 2017, listing on TSX with a market cap of $1.1 billion. After listing, price shares jumped by 18 percent on its first day of trading.

“It’s great to see continued momentum across the Canadian VC industry with this fifth billion-dollar quarter in less than 10 years,” said Kim Furlong, CEO at CVCA. “Lightspeed’s exit this quarter is another proud accomplishment for the industry. We will be keeping an eye on the exit environment throughout the remainder of 2019.”

The report also broke down the number and value of deals made between seed, early stage, later stage, and growth equity rounds. Later stage companies received almost half, or $493 million, of all investments, its largest share since 2014. Growth equity investments made up 13 percent of all deals.

The most active VC firm was Desjardins Capital, which held 13 rounds. The size of the total rounds amounted up to $35 million. Fonds de solidarité FTQ held eight rounds, although the size of the total rounds amounted up to $161 million.

Featured image via Burst.