Every year, thousands of venture-backed startups ambitiously go to market, challenging entire categories and industry incumbents. Companies like Airbnb, Casper, WeWork, and more demonstrate how a dedicated team with a great idea can knock the pins out from under the fiercest market giants.

Most underdogs, however, stay underdogs whenever an industry giant has secured a chokehold on value chains, distribution channels, and media coverage. Peeling away customers from a monolithic and iconic brand can take years unless someone introduces a dramatic change that wins the hearts of consumers, often by solving a problem they didn’t even know they had.

To successfully take on long-established leaders, startups must define what they want to be in the world, the customer they are serving, as well as who the incumbents are and the playbook they follow. Practically, this translates to the development of:

- A powerful value proposition;

- A clear target customer and;

- A strong competitive response.

I’ll break out each of these, with links to helpful resources for startup founders and teams to reference as they prepare to go to market.

Value Proposition

A value proposition is your promise to your customers. It must:

- Tell them how you solve their problem

- Quantify the value you deliver

- Explain why they should choose you

The Jobs To Be Done framework by Clayten Christensen is a must-read for getting into the right mindset to develop your value proposition. According to Christensen, whenever we buy a product, we essentially “hire” it to help us do a job. If the product does the job well, we tend to hire it again. And if it doesn’t, we “fire” it and look for an alternative.

A thorough understanding of what your customer hopes to accomplish will help you build a product that will be hired again and again. More so, you’ll be better positioned to communicate your offering to win new customers, because you can speak to their frustrations and offer a winning solution. When done right, your product will pass the ‘Switching Question’ test – is your product so good that your audience would “fire” their current product in order to hire yours?

Below are examples of strong value propositions to guide creating yours. What’s great about each of these is that they’re clear, concise, and hit on the specific job to be done.

Greenlight: Greenlight helps parents raise financially smart kids.

Fair: Get a car on your phone.

Jiffy: Home maintenance without the hassle.

Mejuri: Fine jewelry that’s actually for your everyday.

Zwift: The at home training app connecting cyclists around the world.

Unbounce: Build, publish, and A/B test landing pages without I.T.

Waze Carpool: Save time and money by riding together.

Target Customer

Identifying a target customer allows you to focus your marketing dollars and brand message on a specific market that is more likely to buy from you. You’re looking for the 20 percent of the market that will make up 80 percent of the revenue.

A simple, inexpensive place to start is with an online review of your competition.

Competitor Online Review:

- Analyze competitor social media feeds and online reviews to understand their target and identify unmet needs. Often customers leave complaints in the comments sections of social media pages and on external review sites. These comments help you understand important, unmet needs that your competitors’ customers may be willing to hire your product to solve for.

- Sign up for their email list to learn how they engage. Assess the language that their customers respond to, the frequency that email communication is sent and the kind of promotions that your competitors run to drive purchases.

- Use Facebook and Instagram to find real people that represent your target. Follow the people that follow your competitors’ social media accounts. Analyze other accounts that these people follow. From there, you can effectively understand who they trust, where they shop and what they value.

Once you’ve browsed competitors online, you can dig deeper with freemium and paid tools.

Competitive Research Tools:

- Alexa – Identify customer targets.

- MOAT – Understand competitor ads.

MOAT is a fast way to see the creative of all your competitors’ display ads, all at once. Just enter the brand name and click search. - Claritas – Determine target demographics.

Claritas allows you to analyze markets based on geo-demographic segments and identify target consumer groups for your product. - SEMrush – Determine target psychographics.

With SEMrush you can view the backlinks of competitor brands to see the websites and blogs that drive traffic to them. From there, you can better understand the attitudes and behaviours of people that read those sites, which are prospective customers of your competitors. - Facebook Audience Insights – Build out potential audiences.

Facebook Audience Insights allows you to create an advertising audience targeting your potential customers. You can add geographic, age and gender filters. It will then give you insights on demographics and behaviours for your potential customers. You can then refine further to your core target and use it later – when you’re ready – for Facebook ads leading to your website.

Alexa, which is owned by Amazon, ranks websites based on traffic volume. It provides deep analytics of bounce rate, daily pageviews per visitor, time spent on site, demographics, etc.

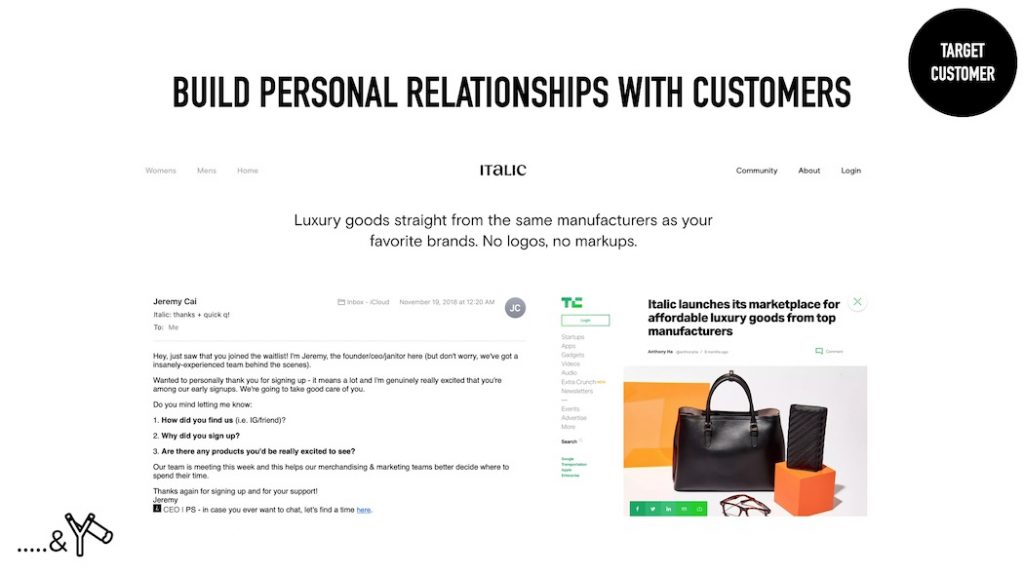

It’s important, however, not to limit yourself to online engagement. Talking to customers in real life is one of the most valuable resources you have access to. What do they read and watch? Who do they trust? What other brands do they buy? Building relationships with customers is key.

During the early outreach stage, building personal relationships is essential. When challenger brand Italic launched their waitlist after a huge press push in November of last year, the CEO was at the forefront of communication with prospective customers. This first interaction made a big impact on how people positively viewed the brand – especially in the luxury space that they were disrupting that wouldn’t traditionally have the CEO reach out.

Competitive Response

The competitive response helps you understand your competitors and anticipate their reaction to your market entry.

Both humans and organizations are creatures of habit and tend to respond formulaically to challenges. Sometimes all that your competition will do is just ignore you. Other times, they come back fighting or work to discredit you. Either way, knowing how they’re likely to respond allows you to develop a strategy to chip away at their market share, if not pull the rug out from under them entirely.

Consider the questions below to help prepare your response:

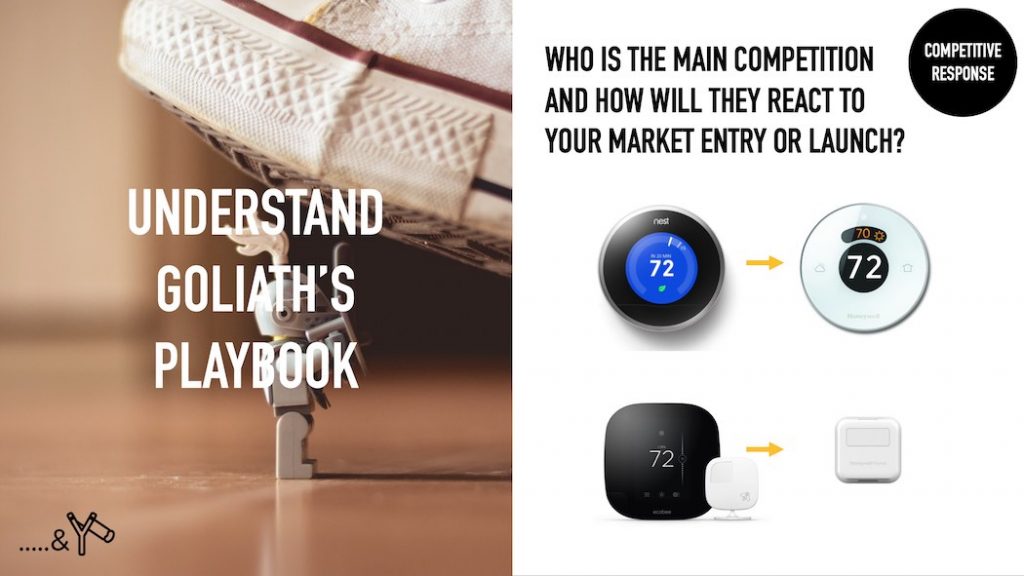

When I joined the Canadian smart thermostat company Ecobee, there were two incumbents in the industry: Honeywell, leading B2B, and Nest, leading B2C.

The typical response of Honeywell was to tighten its relationships with contractors. Instead of simply selling thermostats, the company started to give them away as a gift with purchase when you bought equipment like air conditioners, furnaces, etc. Its playbook was, “we can always beat you on price because we’re a multibillion-dollar conglomerate that is not dependent on thermostat sales alone.”

In the case of Nest, the company default was to silence you by ramping up advertising and marketing spend, and continue to stress its design credentials. Honeywell was the original creator of the thermostat, so it relied on legacy, and Nest redesigned it.

At, Ecobee we responded to our competitors by:

- Aiming to win with the consumer. We worked to become the number one consumer brand, not just the number one contractor brand. We did this by developing strong relationships with our customers, supporting them with installation, and going out of our way to do right by them. They rewarded us with exceptional reviews at scale.

- Designing a beautiful product that addressed the fundamental design flaw in all thermostats – they only measured temperature in one location but were responsible for delivering comfort throughout the home. To resolve that we introduced room sensors that measured the temperature in the rooms you were in, not just where your thermostat is located. That was a big, big unlock because we were able to clearly differentiate ourselves from the competition and solve a real issue that made our product the better choice.

We had the raw materials ready to take on the industry incumbent. We positioned Ecobee as the thermostat “for homes with more than one room.” Digging at the competition, we knew that Nest had a strong industrial design, but hadn’t thought as deeply about the design of the product functionality.

Within 12 months of launch, we unseated Honeywell and became the number two thermostat brand in North America. Two years later, sales were 12 times and we won more than 30 percent market share. It was a great example of how a challenger can unseat industry incumbents.

Final Thoughts

The world often underestimates challenger brands. They must fight from a position behind incumbents to win customers and, ultimately, prized market share. Peeling away customers from an iconic brand is tough, but not impossible. With a powerful value proposition, clear target customer and strong competitive response, your startup can fight smarter and take down industry leaders.

Image courtesy 5&Vine