When it comes to managing finances, Canadians have more choice than ever: they can stick with the traditional financial institutions they’ve used and trusted for years, or turn to the rapidly growing FinTech sector.

FinTechs — companies that use technology to make financial services more efficient and user-friendly — are popping up globally, including in Canada, where they’re slowly gaining traction. The EY FinTech Adoption Index shows that 8.2 percent of digitally active Canadians have used at least two FinTech products within the last six months. Individual FinTechs tend to focus on a specific service offering, but collectively, they offer a wide range of financial products including insurance, payments, financing, investments, and advisory services.

While FinTechs might not pose a serious threat to Canada’s banks today given the significant trust and brand equity they’ve built over the years, there are lessons that traditional financial institutions can — and must — learn from them to remain relevant tomorrow.

The digital difference

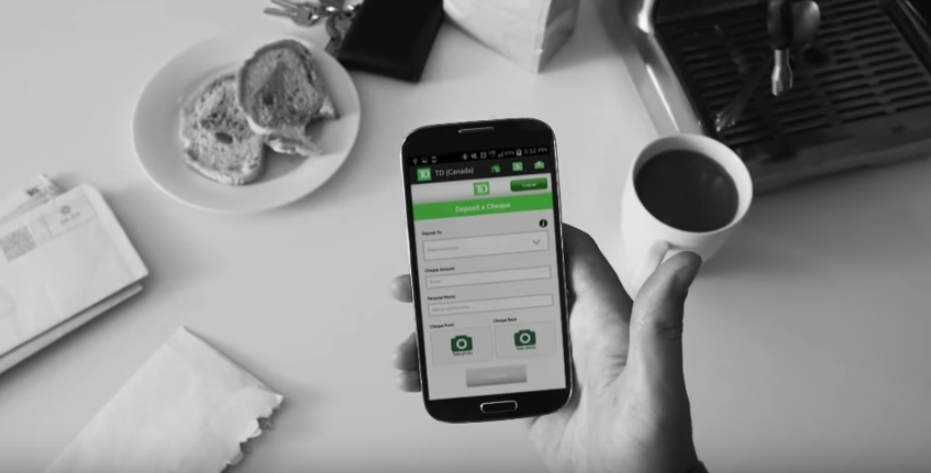

These lessons hinge on technology, which has intrinsically changed the way Canadians manage day to day tasks – including how they bank. According to a Salesforce survey of 1,000 Canadians conducted by Ipsos, nearly eight out of 10 (79 percent) of Canadians bank online using a laptop or desktop, and 64 percent say they either currently perform banking tasks online using a mobile device or would be willing to do so. Three quarters (74 percent) of Canadians use mobile apps and among those, over six in 10 (62 percent) have used one to access/manage their finances in the past 12 months.

The reasons for this adoption make sense. According to the survey’s respondents, technology enables consumers to access their accounts anytime and anywhere (79 percent); it’s easier to pay bills online than it is going into a branch (74 percent); and ultimately, it saves time (68 percent).

But while FinTechs put technology first, financial institutions have, until now, deprioritized this important factor. Here are three ways banks can maintain their position with Canadian consumers by embracing and leveraging technology.

1. Innovate and disrupt

While it’s true that Canadian banks continue to maintain a firm position in Canadian consumers’ lifestyles — 60 percent have visited a physical branch of a financial institution in the past month — these institutions need to evolve at the speed of the consumer. Canadians have different expectations today thanks to the growing ubiquity of technology in their lives.

Canadian banks need to take a page from their FinTech competitors and elevate the digital experience.

A recent survey of 1,210 Canadians from Accenture shows that consumers are ready to broaden their banking relationship with new financial services providers if they don’t get the experiences they expect from their current bank, and nine percent actually have already done so within the past year. One of these expectations is a less-transactional, more personal level of service: consumers want banks to understand who they are, what they need, and how they prefer to bank. They don’t want forms; they want apps.

To be seen as innovators and disruptors within the industry, banks need to embrace cloud-based CRM (customer relationship management) technology. These tools provide real-time insight into customers and help organizations predict questions, changes, and potential issues, making them valuable and relevant to customers before pain points hit. This technology also helps marry the various aspects of a customer’s financial life to provide a holistic view of their individual situation — a bank will see a bigger picture of a person, not just line items in an account.

This is an area where FinTechs are leaps and bounds ahead; they know how to mine consumer data and feed them the right information at the right time. If banks follow suit, it could be a real game-changer for the industry.

2. Frictionless finance

With most Canadians (72 percent) from the Salesforce-Ipsos survey stating they will still go to major banks for their banking needs five years from now, one might assume that the customer service currently being offered is adequate. However, according to Accenture, 77 percent perceive their relationship with their bank as transactional, not advice-based.

At the same time, an FIS Global survey found that 75 percent of Canadians believe that bank performance falls below their expectations. There’s a real opportunity for FinTech companies to take the lead.

FinTech disruptors have an advantage because many of their solutions offer real-time performance modeling, analytics, and the ability to set alerts.

Canadian banks need to take a page from their FinTech competitors and elevate the digital experience from simply paying bills and moving money around into a more relevant one that incorporates an advisory element. By using CRM technologies, financial institutions can create automated one-to-one journeys for their customers around common administrative tasks, such as basic account updates, while stepping in when advice is needed, like adding to an RRSP, pursuing a mortgage, or opening an RESP.

This kind of frictionless customer service experience is more important in today’s time-starved society than ever before, and is something FinTechs are addressing head on. Banks would do well to emulate this experience.

3. Mobile matters

With more than 2 billion smartphones in use today across the globe, according to Ericsson’s Mobility Report, and more than 2.3 billion active social media users worldwide, customers now expect to receive the service they want, when they want it. In fact, the Salesforce-Ipsos survey revealed that Canadians are cashing in on convenience with 77 percent of respondents indicating that online banking is now part of their everyday life. The survey also revealed that Canadians will check their finances online almost anywhere: watching TV at home (48 percent), in bed (38 percent), in transit (26 percent) and while waiting in line (23 percent).

FinTech disruptors have a clear advantage because many of their solutions offer real-time performance modeling, analytics, and the ability to set alerts for specific events. Unfortunately, the majority of traditional banks are saddled with IT systems that put their customers and products into silos, with no way to collaborate with customer service reps through social channels.

A cloud-based financial management solution, for example, can provide traditional banks with the ability to extract real-time insights, helping them to cultivate meaningful client relationships for the digital age.

Change is the only constant in today’s markets and it’s clear that the digital disruption in financial services is well underway. However, the disruption coming from these tech-driven upstarts doesn’t have to spell the end of traditional financial institutions and their unique abilities to serve customers. By embracing new technology solutions — with a foundation of CRM, including built-in mobile, social and analytics capabilities — Canada’s large financial institutions can stay relevant to Canadians for years to come.