According to the Canadian Venture Capital Association, Canadian venture capital investments showed strong growth, and VC exits hit historic highs.

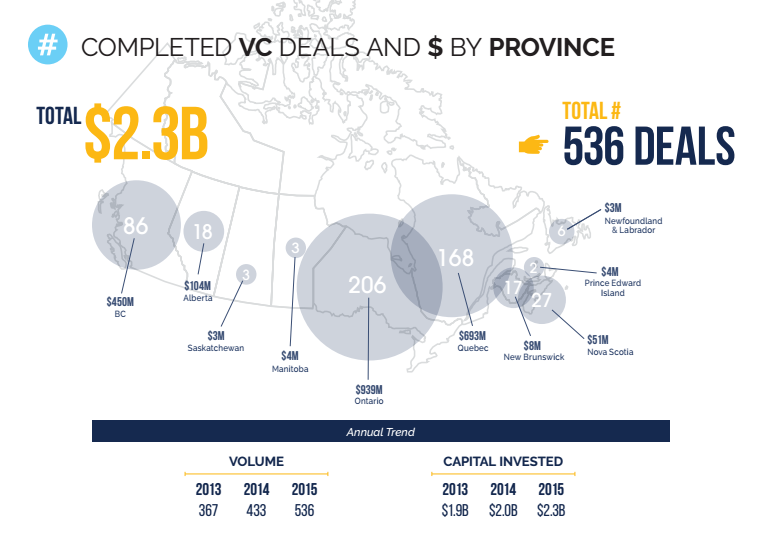

In 2015, 536 deals captured $2.3 billion — an increase of 24 and 12 percent respectively. At the same time, VC exit values reached a record high of $4.3 billion in 2015, primarily driven by Shopify — which was the top VC exit — ProNAi, and Davids Tea IPOs. For comparison, VC exit values only reached $1.5 billion in 2014.

“Venture capital investment is going through a much needed resurgence in Canada,” said Mike Woollatt, CEO of the CVCA. “The future looks brighter as exits climbed through 2015 and fundraising numbers were strong, thanks in large part to government activity on the fund of funds side.”

Lightspeed POS took the top disclosed VC deal at $79 million. Kik Interactive made it to fourth place out of the top five, at $66 million.

Ontario led the provinces in venture capital investments, accounting for $939 million from 206 deals — or 38 percent of deal numbers. Quebec was the second largest with 168 deals and $693 million invested, followed by B.C. with 86 deals and $450 million invested.

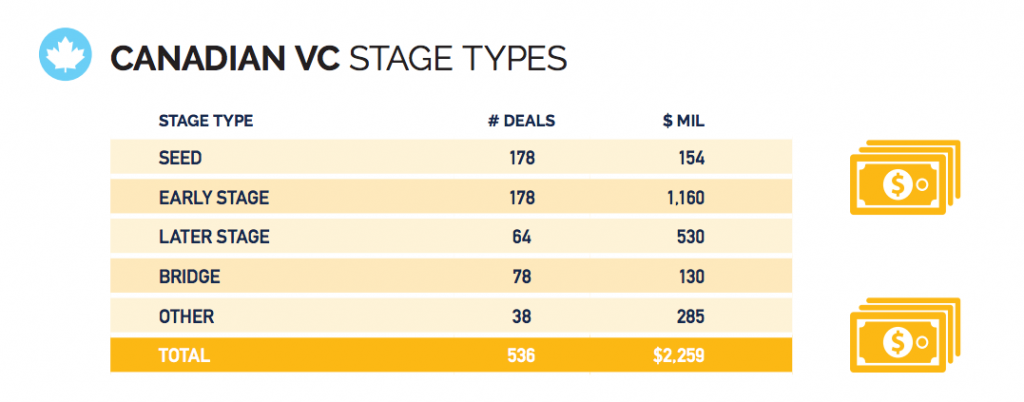

The association noted that funding by stages is shifting towards earlier stage deals rather than later stage. Seed stage investments were up 30 percent year over year with 178 deals in 2015, but growth in deal value went to early stage companies, which was up by 46 percent from 2014 because of larger round sizes.

Here is the CVCA’s full infographic.

Related: Canadian deal activity at second-highest level in 2015