Vancouver-based Payso, one of Canada’s first peer-to-peer payment services, has decided to shut down its consumer operations and focus attention on business clientele. The iOS and Android app launched last year and attempted to make it easy for Canadians to send and request money.

FinTech, which is described as technology to make financial services more efficient, is a tough game in Canada and is still considered to be in early days.

The space is dominated by Interac and PayPal, and Payso stated on its site, “a year ago we set out to bring Canadians an easier, more fun and free way to share small amounts of money with friends. We had great success coast to coast and helped Canadians share nearly a million dollars in small payments between friends. It’s with a heavy heart that we have decided to wind down our peer-to-peer product to focus on our business product.”

For those who still have cash in their Payso wallet, Payso says it will connect with you to “cash it out through the App before 24 April 2016.”

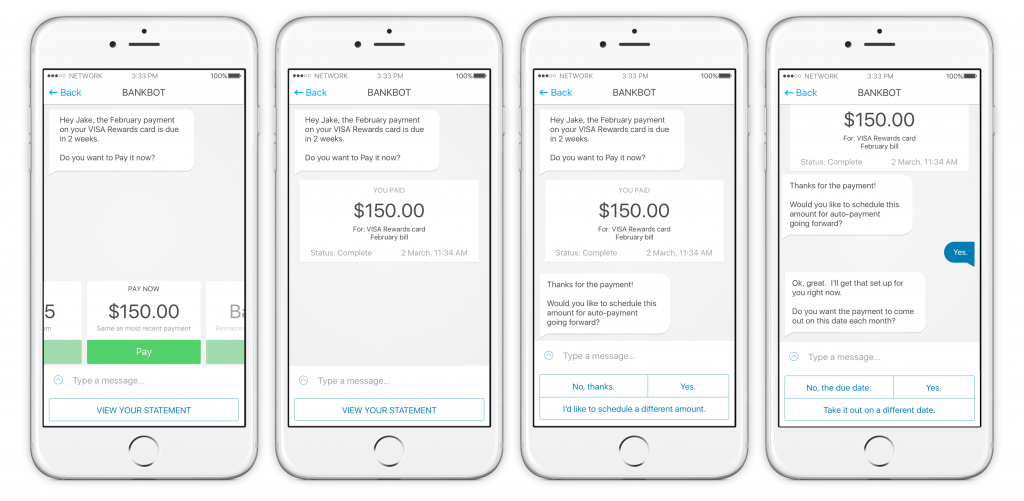

As for Payso’s next steps, the company will be taking a conversational banking approach and white labelling its app for banks or credit unions. “Bots, AI, and conversational interfaces will have a profound impact on the way we access services on the Internet. Platforms like Messenger, Kik, Telegram, Slack, WeChat, and others are the new browsers and bots are the new websites and apps,” said Jake Tyler, founder and CEO at Payso. “As this happens we have an opportunity to re-think how banking services are delivered.”

Payso has been participating in the Plug and Play FinTech cohort in Silicon Valley, and Tyler said that in meetings with banks from all over the world, there has been an interest in a white-labelled product like Payso.

“Our view is that the biggest players in FinTech in the next three to five years will be WeChat, Facebook, Google, Apple, Kik and other major consumer tech companies,” said Tyler. “These players start by offering payments products (they already do in the US), then extend to offer basic savings, lending and other services. WeChat already does this at scale in China. We’re following an opportunity with banks and credit unions, helping them to leverage their installed user base, great infrastructure and established brand to take advantage of the opportunities in mobile.”

Tyler confirmed that bots are a major part of the product roadmap, and pointed to his Medium post hinting at what the product might look like, which includes receiving and paying credit card statements, a ‘savings bot’ to remove friction in savings accounts, and being able to send messages to a bank while travelling.

“We had great success coast to coast, helping Canadians to share nearly a million dollars in small payments with friends. We’ve seen more uptake in addressing the problem in a different way so we are stopping the peer to peer product to focus on our enterprise offering.”

This article was originally published on MobileSyrup