Koho is a litmus-test startup. Ask anyone in the Canadian FinTech space for their thoughts on the company, and you’ll get a familiar binary of responses: extreme excitement at the potential; polite pessimism that such disruption can happen in Canada.

Today, the HIGHLINE portfolio company announced a $1 million seed round, led by Ferst Capital, Hedgewood, Stanley Park Ventures, and notable angel investors such as Joe Canavan. An amount nearly double what the company hoped to raise, the seed round could be taken as a tipping point of opinion, or just another of the many steps Koho has taken towards launch after announcing itself late last year.

“These financial institutions are starting to shift the way they think about risk. ‘If we don’t start to innovate, if we don’t start to take on some of these risks, that is in itself a risk’.”

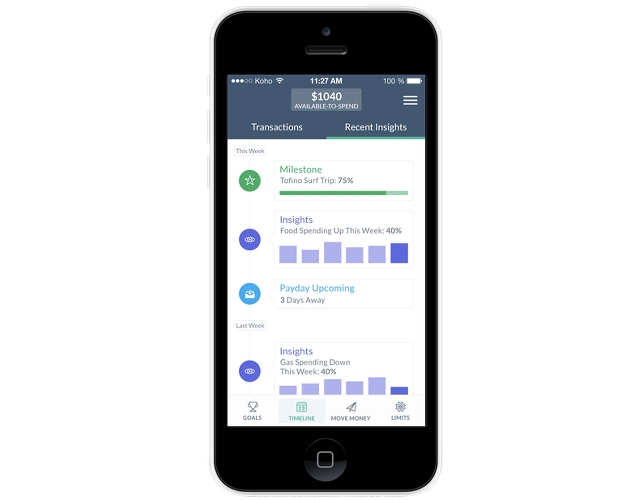

Koho’s premise is simple: it wants to disconnect the consumer banking experience from the banks themselves. The company has partnered with a financial institution to hold consumers’ money, while building out a mobile-first and millennial-focused customer experience (you can read more about it here). In an interview with BetaKit, the audio of which you can hear below, Koho co-founder and CEO, Daniel Eberhard, made it clear that that while members of the financial community might be undecided, a generation of young people across Canada is craving change.

“The reason that we launched the way we did is that we wanted to know whether we are the only ones that feel this pain and this frustration with banks and the status quo,” Eberhard said. “We were just pleasantly surprised at not only how many people signed up but how many people emailed us using really strong language.”

“This is why we launched early, we wanted to have as many early engagements with customers as possible.”

That said, Koho is making inroads with the financial community it’s trying to disrupt. The company recently won the FinTech Innovation Award for Best Financial Technology Company at the Nasdaq Startup Reception for NY TechDay. Eberhard explained how the rate of financial change is directly tied to the perception of risk.

“These financial institutions are starting to shift the way they think about risk,” he said. “For a very long time they were paid to avoid risk. But they’re starting to look at this from the angle of, ‘if we don’t start to innovate, if we don’t start to take on some of these risks, that is in itself a risk’.”

Koho still has a lot of work ahead of it as it moves towards a Q3 launch date. As expected, the real heavy lifting hasn’t been in creating a compelling user experience, but in properly tying that experience to an underlying financial process that customers benefit from, but never have to worry about.

“At the end of the day, what people need is stored value,” Eberhard said. “Our key driver is getting those relationships and making sure the underlying structure is there.”

To that end, Eberhard and company have mostly been keeping their heads down, connecting with those excited customers and preparing to make a big slash. “Some people still don’t think we can get this to market, or are sort of unfamiliar with the model,” Eberhard said. “But we’ve been getting the relationships that are required to do so.”

Disclosure: BetaKit’s East and West Coast offices are housed in HIGHLINE’s Vancouver and Toronto co-working spaces.