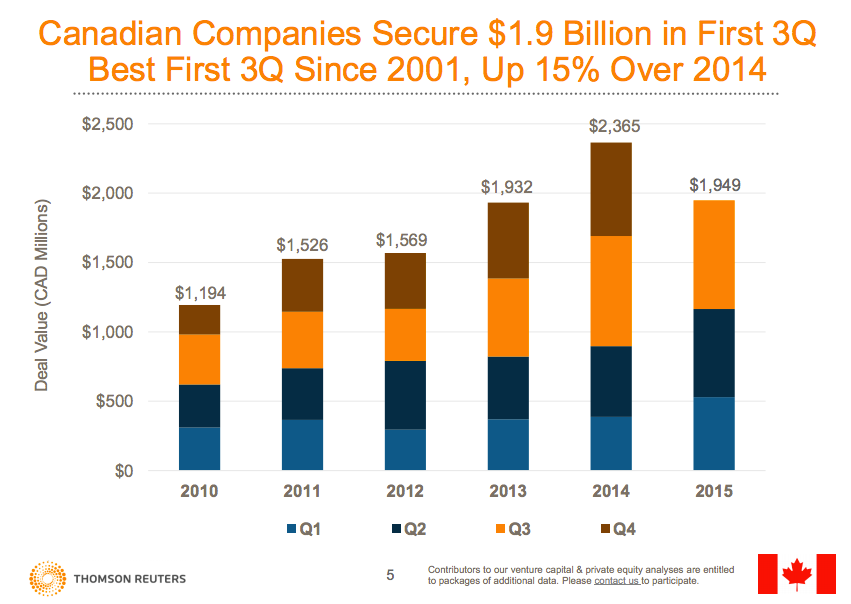

Thomson Reuters has so far reported good news for Canadian VC investment in 2015; the organization first reported that Q1 2015 was the best year for Canadian startup investment since 2007, while the first three quarters of VC investment in 2015 was at a a 14-year high.

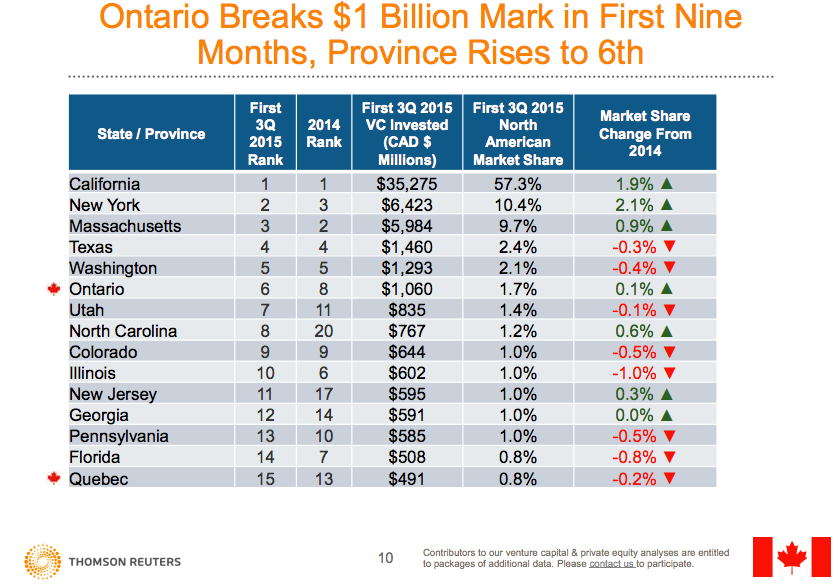

Reuters is now reporting that venture capital in Canadian companies totalled $2.6 billion in 579 deals in 2015 — up 11 percent over last year. As with last year, as well, most deal-making activity was in Ontario with $1.1 billion in investments and six of the top ten deals completed in the province.

Québec-based companies raised $491 million, up 17 percent over the first nine months 2014, while British Columbia took the next largest share with $223 million invested in the first three quarters.

“With more large Canadian VC deals, the average round size in Canada in the first nine months stood at $4.8 million, up substantially from $4.3 million last year,” the report said. However, Canada still ranked last among the world’s top ten nations in terms of VC financing, which includes the USA at $17.9 million, France at $14.5 million, and Israel at $9.6 million.

While IT took the largest share of VC dollars in a similar trend to 2014, the cleantech industry is getting the attention of Canadian VCs — cleantech companies received $216 million in the first nine months, an 11 percent share of all investment. It’s a huge jump from the 4 percent share cleantech companies received in the first three quarters of 2014. The report also noted that traditional industries like industrial and manufacturing companies took only seven percent of total deals, which was down from 2014.

The full report is available on the Thomson Reuters website.