Toronto-based Xanadu has announced the findings of a joint proof-of-concept with BMO and Scotiabank.

The firms worked on discovering computational speedups and improved accuracy for financial trading products. They used a quantum algorithm developed by Xanadu, known as quantum Monte Carlo. Xanadu said that institutions currently use Monte Carlo’s estimation to model and price derivatives, which often run in huge data centres of parallel CPUs and GPUs. BMO, Scotiabank, and Xanadu said that the project predicted speedups hundreds to thousands of times faster.

“Quantum Monte Carlo is perhaps the strongest evidence yet of the huge impact quantum will have on finance.”

“Scotiabank is committed to investing in cutting edge technologies, like quantum, as part of our wider digital transformation,” said Stella Yeung, senior vice-president and CIO of Scotiabank global banking and markets. “This collaboration gave us the opportunity to explore using next-gen quantum computing to optimize what we are able to offer our global customer base.”

“Our expertise in the derivatives space enabled Xanadu to successfully build a quantum Monte Carlo model, with impressive results. Leveraging quantum computing to accelerate data collection and insights will enable speed to market and benefit our customers.”

As part of the proof-of-concept project with BMO and Scotiabank, Xanadu built a software suite to simulate quantum Monte Carlo on several trading products. Xanadu, Scotiabank, and BMO were working to solve the time-consuming problem banks face in pricing portfolios of trading products, since they must consider different market scenarios.

“Quantum Monte Carlo is perhaps the strongest evidence yet of the huge impact quantum will have on finance,” said Tom Bromley, researcher and project lead at Xanadu. “This project allowed us to forecast the disruptive potential for derivatives pricing over the coming years, paving the way for near real-time pricing and significantly lower power overhead.”

“BMO is constantly working to leverage technologies that will help us better serve our customers, and improve the operations and efficiencies of our bank. Our collaboration with Xanadu was informative, providing valuable insight into quantum computing as an emerging technology,” said Lawrence Wan, BMO’s chief architect and head of enterprise platform services. “With the growing dependence on data analysis, and technologies such as AI, the promise of quantum computing to vastly speed up delivery of insights may benefit functions across the financial services industry.”

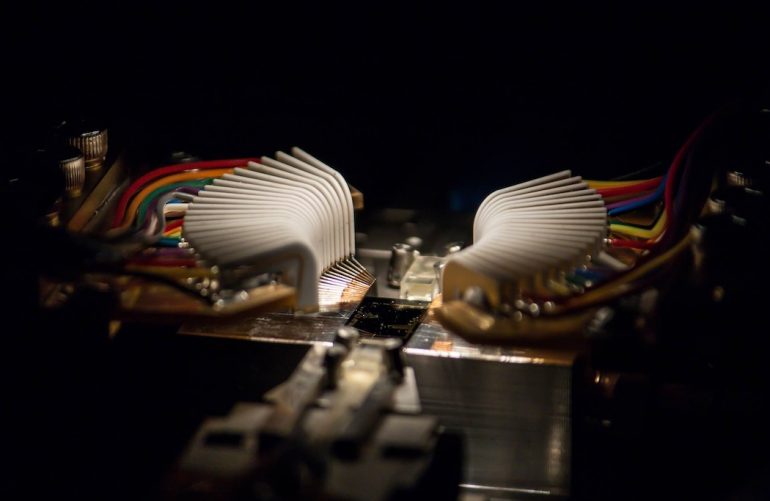

In June, Xanadu raised a $32 million Series A from Georgian Partners, Radical Ventures, Real Ventures, Silicon Valley Bank, and Tim Draper. The company uses photons, or particles of light, to perform exceptionally fast and complex computations at room temperature. In November 2018, the company launched PennyLane, its open source software for quantum machine learning. That same year, the company also launched the Strawberry Fields software stack for quantum computers.