Toronto-based FinTech company Wave is leaving international markets, as the small business-focused service provider pares down its focus to local markets in Canada and the US.

The announcement, made effective on November 30, has garnered nearly 300 comments since publication. The blog post highlights several changes coming into effect, including limiting new sign-ups to accounts based in Canada and the US. Wave’s Stripe connection, which offers software and APIs to accept payments and send payouts, will also end on June 30, 2021 for users outside Canada and the US.

“Our shift in focus will allow us to innovate at a faster pace and stay laser focused on solving customer pain points.”

In the post, Wave states that existing accounts will remain active, but that while the financial services provider has no current plans to close or restrict access to existing accounts for customers outside Canada and the US, this may change in the future.

Wave has also partnered with Zoho Books, a competitor in the cloud-based accounting market, providing a special offer to Wave users outside of North America. While Wave offers a free model, Zoho Books however charges for access to its accounting software.

Wave CEO and co-founder Kirk Simpson declined an interview request from BetaKit to discuss the changes. Company spokesperson Marshneill Abraham provided a statement in regards to the changes in service.

“We are focusing on our local market (US & Canada) in order to deliver exceptional products to our customers,” said Abraham, public relations and communications manager for Wave. “We have no current plans to close or restrict access to existing accounts outside the US and Canada, but we do recognize that some of our customers will begin exploring solutions that better meet the needs of their region. We’re committed to helping them navigate this change, and as part of that process, identified Zoho as a company with globally-available software that can serve the accounting needs of these customers. We worked with them on a custom offer exclusively for our customers outside of the US and Canada to ease the transition for them.”

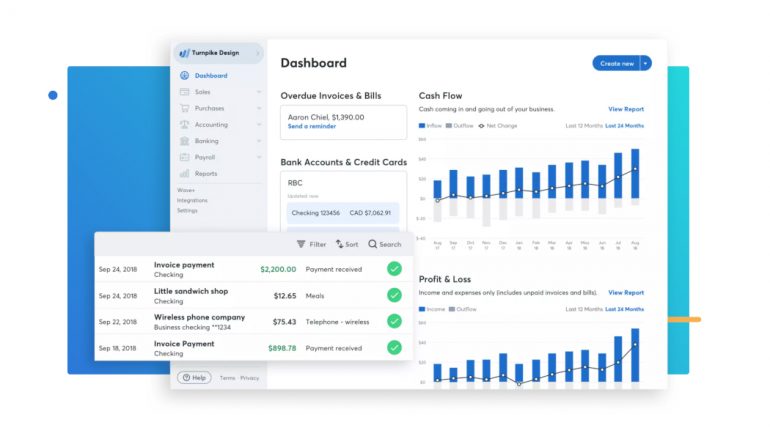

Founded in 2009, Wave offers a range of financial services for businesses, spanning accounting, invoicing, payroll, and receipts. In June, the startup launched a small business bank account solution called Wave Money, which includes a business bank account and a debit card. Wave was acquired by H&R Block in 2019 for $537 million CAD.

“We’re working hard to make Wave Money available to more customers – it’s the kind of solution that is especially valuable in our current climate,” said Abraham. “Our shift in focus will allow us to innovate at a faster pace and stay laser focused on solving customer pain points.”

The shift in focus prompted FreshBooks CMO Paul Cowan to publish an open letter to Wave, urging its competitor in the online accounting space to reconsider a withdrawal from Europe. Citing GDP growth statistics for Europe in September, the letter notes FreshBooks is opening offices in Europe, and draws a distinction between Wave’s freemium and FreshBooks pay-for-use model.

Both Simpson and Wave declined to comment on the FreshBooks letter. Cowan told BetaKit that the impetus for public commentary on a competitor’s operations stemmed from the impact that COVID-19 has had on small business and the timing of Wave’s decision.

“We wanted to reach out to Wave and say, ‘Hey, you should be supporting customers at this time,’ because although there are some that are doing OK, there are a lot that are not and we should be supporting the community,” said Cowan. “I just talked to [FreshBooks CEO and co-founder Mike McDerment and executive director Don Epperson] and said, ‘We should take a stand here and send something out.’ We also have built a full campaign to target their customers as well. It’s a coordinated effort between our sales, support, and senior management team.”

According to Mordor Intelligence, the accounting software market was valued at $12.01 billion USD in 2019 and is expected to reach $19.59 billion by 2025. The report also states that Asia-Pacific has the largest potential for market growth, but Europe and North America are considered mid-range growth regions. Wave’s decision has also sparked discussion about its impact on small businesses in the African market.

While Wave’s decision creates opportunities for competitors in Europe and other markets, Cowan acknowledged that Wave’s focus on Canada and the US could present challenges for FreshBooks in North America.

“They are going to be focusing on what they do well and if they are going to take all their activity and focus it, then we need to make sure that we’re good in our home markets as well,” said Cowan. “Accounting in the UK is different than accounting in Germany is different than Canada is different from the US. We need to make sure that we’re plugging into all the other types of tools and software being used, but then also make sure that people are compliant within those different regions. We really just see this an opportunity to keep focusing and getting a product that’s appropriate for all of those different markets and being to service customers in those markets.”