As many Canadian tech ecosystems saw venture funding fall in 2022 amid a trying economic landscape, Québec and Alberta managed to defy the national trend, with both provinces experiencing growth in venture funding year over year.

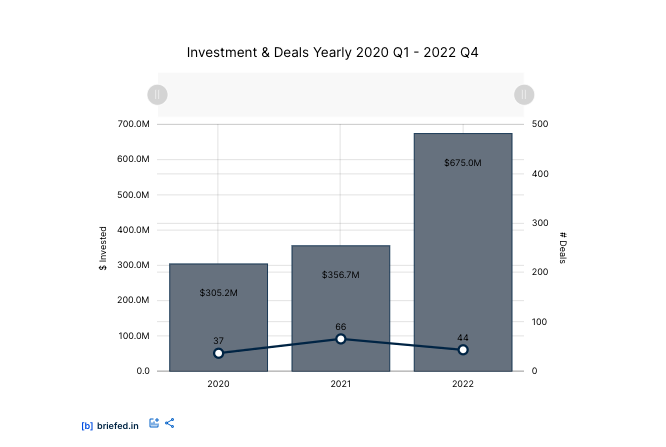

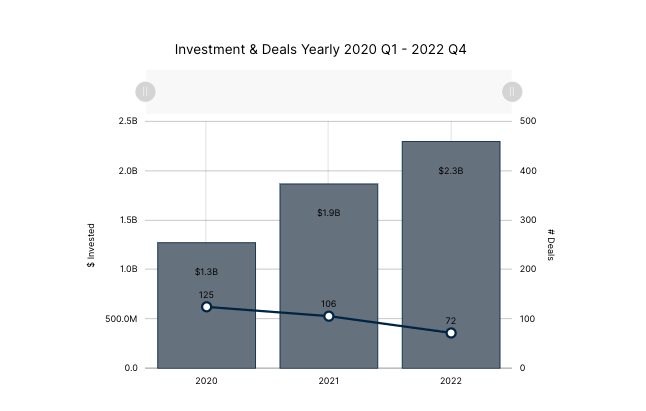

According to new data from briefed.in, Alberta tech companies raised a collective $675 million in 2022, an 89 percent increase from 2021 and a 121 percent increase from 2020. In Québec, venture funding totalled $2.3 billion in 2022, a 21 percent increase from 2021 and a 76 percent increase from 2020.

Alberta and Québec were unique among all other regions tracked by briefed.in, as the only regions to see year-over-year venture funding growth in 2022. In other regions tracked by briefed.in, venture funding fell from what was a record-breaking 2021 for Canadian tech, against a backdrop of high inflation, rising interest rates, and a focus on cash preservation from both companies and investors. What’s more, both regions have seen venture funding increase every year since 2019.

Megadeals drive investment momentum

Alberta, which is home to a much younger tech ecosystem compared to other Canadian regions like Toronto or British Columbia, showed signs of maturity in 2022, with companies like Neo Financial and Attabotics managing to raise deals close to or more than $100 million. According to Shelley Kuipers, co-founder and co-CEO of The51, Alberta’s maturation can be attributed to several factors, including the recent influx of entrepreneurial talent to the province, as well as Alberta’s abundant growth programming.

“We have built Alberta into an attractive province for both entrepreneurs and investors, through the sheer will of the leaders in this community alongside our government allies,” Kuipers added. “We do the work — the real work — and we don’t wait for others to lead; we step into leadership positions as a collective to drive this positive change.”

Québec’s venture funding growth in 2022 was buoyed by significant deals from companies like Hopper, Paper, RenoRun, and Ventus Therapeutics. However, Scott Loong, a partner at Panache Ventures in Montréal, held a somewhat different view from his Alberta counterparts regarding the performance of his home province. Loong acknowledged the positive momentum of Québec’s venture funding in 2022 but added it’s not a trajectory he’s confident the province can rely on going forward.

“In the private markets, things take time because data is far slower to hit the street,” Loong told BetaKit. “I am a pre-seed and seed-stage investor and can say that, in general, 2022 was a busy year in terms of deals and deal flow. I would be curious if that perspective would be shared by growth-stage investors in the province.”

In fact, some of the companies in Québec that raised significant deals in the last two years, including RenoRun and AlayaCare, have executed layoffs and other cost-cutting measures in an effort to weather turbulent venture capital conditions.

Québec and Alberta also tracked a year-over-year decline in deal volume in 2022. In Québec, briefed.in tracked a total of 72 deals in 2022, down from the province’s 106 deals in 2021. Deal count in Alberta fell from 66 in 2021 to 44 in 2022, but still exceeded the 37 deals closed in 2020.

Daniel Armali, partner at Montréal-based Amplify Capital, said he sees a silver lining in the decline of deal volume, noting that “it’s paradoxical that the best time to invest is in times of heightened uncertainty,” which are “also the worst times to fundraise.”

“I don’t believe ‘more’ is necessarily better,” Armali added. “Over the long run, the trendline should be positive, but quality companies being backed has more economic and financial impact than more companies of lesser quality.”

Different soil, same seed struggles

Alberta and Québec shared yet another commonality in their venture funding results in 2022: both provinces saw early-stage deal volume decline compared to years prior. Alberta’s seed-stage activity reached a four-year low of just 12 deals in 2022, down from 19 such deals tracked in 2021.

Per briefed.in’s data, Alberta’s seed-stage firms are also taking longer to get to the next funding stage, as 30 out of 46 seed-stage companies in the province have not raised a Series A round in the 18 months since their seed round. Tiffany Linke-Boyko, principal at Edmonton-based Flying Fish Partners, believes that Alberta’s talent crunch may be hindering local early-stage startups from graduating to the next funding stage.

“In all sectors, locally and globally, companies were having trouble hiring and dealing with high compensation expectations, but this had a more significant impact on startups with constrained budgets,” she added.

Despite some growth in Alberta’s talent pool in recent years, the local tech sector still faces a shortage of skilled labour. It’s a problem the provincial government recently pledged to address in its latest fiscal budget, though the budget’s focus on the tech sector specifically was limited.

In Québec, seed-stage deals fell from 42 in 2021 to just 29 in 2022, which also marks a four-year low for the province. Loong said his firm is among the few generalist investors that are willing to lead early-stage rounds in the province, though he has noticed the establishment of more sector-specific funds in 2022 and expects more will arrive in Québec this year that may help to bridge the gap.

Armali also noted several positive developments in Québec’s early-stage ecosystem that could give activity a much-needed boost in 2023, such as Real Ventures’ recent relaunch of the FounderFuel accelerator in partnership with Panache Ventures and Inovia Capital.

“I believe the mentorship and access to capital are there, at least for Montréal,” Armali added. “For Québec City and Sherbrooke, the challenges they face are getting the visibility that could be afforded somewhere like Montréal, but they both possess world-class talent in very important—and what I believe will be—more dominant sectors in the decade to come.”

Will investment momentum continue in 2023?

For all the similarities shared between the Alberta and Québec tech sectors in 2022, the outlook from local stakeholders for 2023 differs wildly between the provinces.

Judy Fairburn, co-founder and co-CEO of The51 believes the Alberta tech sector’s results demonstrate it is “increasingly the place to be in Canada,” thanks to its compelling investment opportunities, strong founders, and defendable IP. Linke-Boyko said she is hopeful that 2023 will be “another fantastic funding year for Alberta.”

“The number of deals and quality [of companies] our firm is looking at thus far in 2023 is higher than in 2022, so I am optimistic that it is not an aberration but a start to another great year of funding,” Linke-Boyko added.

For Québec, Loong’s outlook was slightly less rosy. “It’s not clear to me that Québec’s tech sector will be shielded from the greater macroeconomic situation that’s unfolding in Canada and globally,” he said, adding that he is seeing a “very difficult” fundraising environment so far this year, a situation he expects to “get worse before it gets better.”

Armali also does not expect 2023 to be a “banner year” for Québec venture funding, but said such a result would constitute a “healthy reset and refocus on building” a strong foundation of local companies.

“Investing in innovation has a long payback period, but certainly a positive and asymmetric one if you can get it right,” he added. “I believe that in these last few years, much of that has come to fruition, which sets off a positive flywheel effect.”

briefed.in is owned and operated by Communitech. BetaKit receives data from briefed.in as part of a media partnership with Communitech and retains full editorial control of all articles that reference the data produced by briefed.in/Communitech.