According to data released by Thomson Reuters, venture capital investment in Canadian startups gained momentum in the second quarter of 2015, with a total of $636 million deployed to 143 financing rounds.

By the end of June, venture capital investment across Canada totaled $1.2 billion in 300 deals — up 33 per cent from the same time in 2014.

Ontario saw the biggest rewards from VC investment in the first half; overall, $641 million went to Ontario-based companies from January to June. Québec-based companies raised $294 million, while British Columbia took the next largest share with $179 million invested in the first six months.

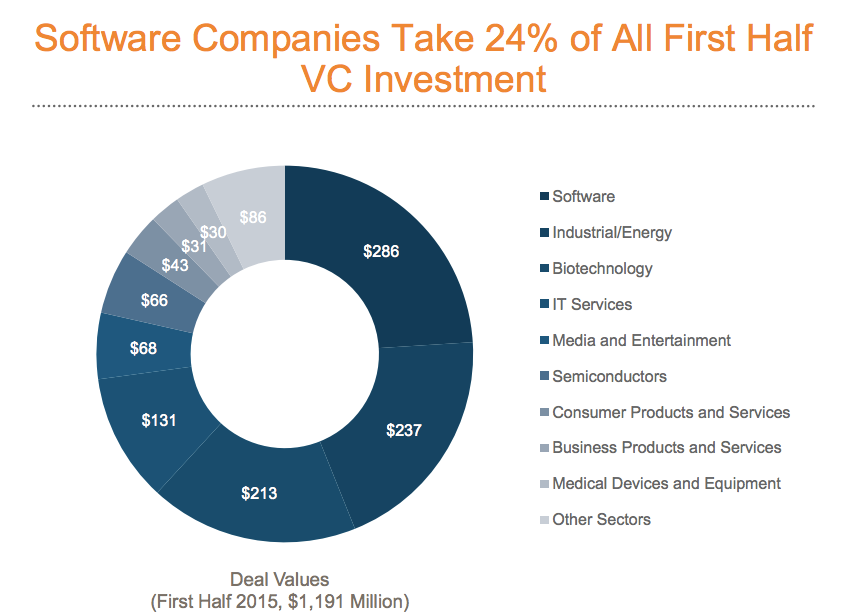

The sector that received the most funding overall in Canada was information technology, which received $650 million in the first half.

While these numbers seem like good news at first glance, the report adds that Canadian average deal sizes continued to lag far behind those in other countries. Of the world’s top ten nations as ranked by the number of VC financings, Canada’s average round size of $4.0 million in the first half ranked last, far behind the USA at $17.0 million, the United Kingdom at $13.7 million, and Israel at $10.0 million.

At the same time, venture capital fundraising by Canadian funds reached $878 million in the first half of 2015; a 21 per cent increase over the same period in 2014. While this is the best funding period for Canadian funds in three years (in 2012, $1.4 billion was raised in the first half), US VC funds raised $17.8 billion in the first half of 2015.

To read the report in its entirety, check it out here (PDF).