This week, several Canadian institutions and companies made strides in the cryptocurrency space in Canada. Here’s the latest on developments in the emerging industry.

Mogo launches MogoCrypto

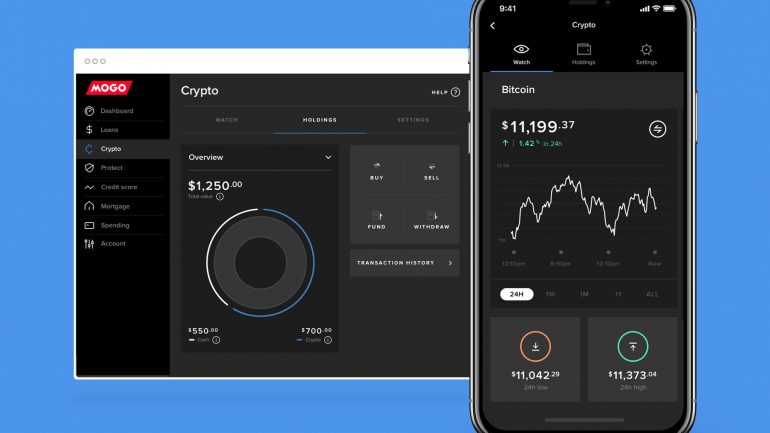

Mogo has launched MogoCrypto as part of its suite of MogoAccount products, a new offering allowing Mogo users to buy and sell bitcoin at real-time prices from their mobile, including free funding transfers and withdrawals.

The company launched the platform after finding that trading in bitcoin could be intimidating for the average user, with particular challenges to sell holdings and withdraw Canadian dollars. Through the MogoAccount, members can add money from their bank account with Interac e-Transfer, and it can be available in at least 30 minutes. Users can sell at any time and withdraw the funds into a Canadian bank account.

“Canadians are looking for a trusted and simple solution to buy and sell bitcoin, and that’s the need we’re addressing with MogoCrypto,” said David Feller, founder and CEO of Mogo. “Canadians can sign up for free and in three minutes open a MogoAccount, have the account funded for free, and begin buying and selling bitcoin. This is the sixth product available in Mogo’s app which was built to provide consumers with an easy way to manage their financial health and further strengthens the value proposition for MogoMembers.”

OMERS Ventures invests in OB1

OB1, the company behind the decentralized online marketplace OpenBazaar, has raised $5 million USD in a Series A funding round. OMERS Ventures is among the investors that joined the round.

“We have enjoyed getting to know OB1’s management team over the past couple of years,” OMERS said in a Medium post. “Brian, Sam and Washington are amongst the most knowledgeable and passionate experts in the blockchain community. OB1 stays in constant communication with their thousands of community members and contributing developers, and active with hundreds of daily messages on Reddit, Slack and Telegram channels. OB1 has a world class team which is core to our investment thesis.”

OB1 previously raised a $1 million seed round from Union Square Ventures, Andreessen Horowitz, and angel investor William Mougayar in May of 2015 to launch OpenBazaar.

The company plans to use the funding to improve its open source software and grow its peer-to-peer community. “After launch, we were so excited to see how people have been using OpenBazaar, and with this new funding we’re confident it will allow us to bring the benefits of truly free and open trade to the world,” said CEO Brian Hoffman.

For its part, OMERS Ventures is watching the crypto space closely. The firm is among the partners in Ethereum Capital, a company looking to raise $50 million to invest in ethereum-based companies.

TODAQ Financial launches decentralized mobile marketplace

Toronto-based TODAQ Financial announced its official launch, including a mission to enable peer-to-peer value transfer and individually controlled asset ownership.

The company says it’s built the world’s first working version of a mobile-only, completely decentralized and distributed blockchain-based marketplace that would support private and secure digital asset ownership and peer-to-peer mobile transactions.

“It became clear to me some time ago that the financial services industry has become too big and extracts too much value out of the productive economy. I became passionate about changing that, which is what first drove me to found Quantius, my first company, a provider of non-dilutive capital to growing knowledge-based companies,” said Hassan Khan, CEO of TODAQ Financial. “I spent years looking for a fourth generation blockchain solution that could provide an increase in efficiency that would enable access to the 80% of the world’s population left behind.”

TODAQ Financial has launched industrial and commercial partnerships across Asia, the Middle East, Africa and Europe in the healthcare, education, energy, clean tech and financial services sectors.

The first digital asset on the TODAQ marketplace will be 125 billion backstopped Toda Notes (TDN). The TDN supply is distributed with transparent rules by a trust which also manages the TDN asset reserve. The TDN was designed to be the first digital note of choice for frictionless commerce, whether local or cross-border.

“Decentralization creates the opportunity to create a world where everyone can securely and privately own and manage their own data without the prohibitive costs that reduce access to markets and trade. We are giving people the opportunity to truly own their identity and their property,” said Hassan.

TODAQ is planning to launch a series of commercial projects this year with small and medium-sized merchants, enterprise level commercial and industrial partners, and global device manufacturers.

TODAQ is powered by the TODA protocol, a decentralized, distributed, layer zero, ledger-less blockchain at the same level as TCP/IP that enables every ledger-based blockchain to scale to billions of users and handles millions of on-chain transactions per second at less than 0.1% cost. The company says the TODA Protocol enables P2P atomic swap exchange between blockchains without depending on third parties, such as exchanges.