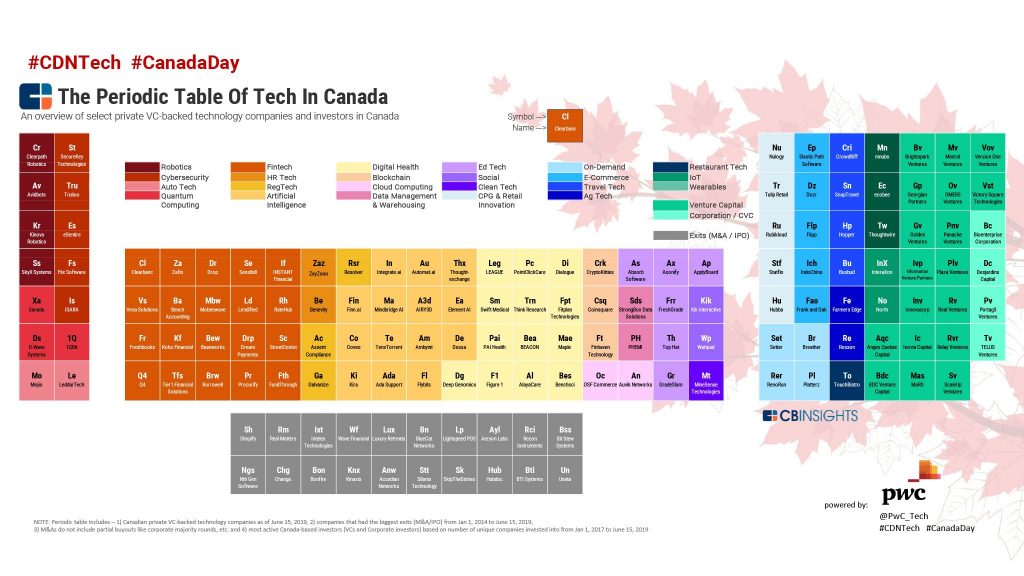

Each Canada Day, PwC and CB Insights join forces to release the Periodic Table of Tech in Canada, which exhibits 150 of the most prominent Canadian venture-backed technology companies, investors, and exits. The country’s anniversary is a fitting occasion to display and celebrate the abundant ambition and achievement in Canada’s tech sector.

The elements of the Table

The 2019 Table is comprised of 108 venture-backed technology companies, 20 investors, and 22 exits. Those listed on the Table were selected using a methodology that focuses exclusively on the venture-backed ecosystem in Canada. The details of the methodology can be found here. The use of this methodology means that some deserving companies don’t appear on the Table simply because they didn’t raise venture capital.

Other stakeholders that aren’t represented on the Table but deserve recognition are the many organizations doing important work to increase diversity and inclusion in Canada’s tech sector. Some high-profile organizations driving the sector forward include #MoveTheDial, Female Funders, and The Big Push. I applaud their work, and the work of many other organizations pushing us toward a truly inclusive Canadian tech sector.

Evolving the Canadian exit strategy

A number of major 2019 exits earned spots on the Table. The top exits of 2019, with all figures in US dollars, are:

- Intelex’s $570 million acquisition by Industrial Scientific;

- Wave Financial’s $405 million acquisition by H&R Block;

- Aeryon Labs $200 million acquisition by Flir Systems Inc; and

- Lightspeed’s IPO that raised $179 million.

Each of these exits is a validation of the talent and grit of Canada’s innovators. However, a look at the Table’s list of exits — particularly acquisitions at mid-market valuations — evokes mixed feelings for some. Every founder, investor, and employee that takes risks, wins ethically in the market, and gets acquisition offers at premium valuations deserves not only our congratulations, but our admiration. At the same time though, news of Canadian tech company acquisitions is a reminder of a perennial challenge. Canadian tech companies often sell before they max out, meaning the long-term benefits of homegrown innovation and intellectual property accrue to the buyers, most typically organizations outside of Canada.

Of course, an exit may be the right choice for any given set of founders and investors. But I’d suggest that it shouldn’t be the default choice. There needs to be a greater set of attractive options that incentivize continued scaling in Canada.

RELATED: Canadian tech needs to redefine its sense of scale

Two adjustments would act as levers here: increased sources of secondary capital and increased access to Canadian depth in senior venture capital and growth-oriented private equity. Each would give tech entrepreneurs optionality when considering next steps. They would provide alternatives to acquisition that still enable early investors to get their returns, founders to reduce personal risk, and companies to get the cash they need to scale.

This thought about acquisitions doesn’t detract from the praise that the founders who have sold their companies deserve. It is instead a look into one potential future in which all of the ingredients for scale are in place making the option to pursue it more attractive and practical. The road to later-stage growth should be open to all Canadian founders who have the talent and desire to take it.

Collaborating to catch the consecutive waves of tech

AI and digital health companies comprise one-quarter of all companies listed on the Table. The number of companies in each category has jumped dramatically in just one year: there are 17 percent more AI companies and 44 percent more digital health companies on the 2019 Table than there were on last year’s.

These changes are a great sign for these two important sub-sectors within #CDNTech. They show that the focus in AI is continuing to shift from fundamental research to application and adoption, and that the point solutions being developed with machine learning and deep learning have real commercial value. They also show that digital health entrepreneurs are continuing to generate and commercialize solutions that deliver good patient care, create efficiencies, and address rising health care costs driven by chronic disease and an aging population.

There are 17 percent more AI companies and 44 percent more digital health companies on the 2019 Table than last year.

The rapid rise of AI and digital health companies is also indicative of a larger dynamic: the accelerating speed at which new value is being created in the tech sector. Consider how the AI wave stacked up right on top of the blockchain wave, which itself came not long after the advanced analytics, IoT, and mobile waves. There’s no break in sight. Hints of the next potential waves are already apparent. Take quantum computing for instance, which continues to progress, build momentum, and rise in profile.

Incumbent business leaders can’t ignore the attention and capital that each new wave commands. They’re forced to remain alert, and they’re rightfully cautious not to dismiss anything new. The accelerating emergence of new tech-related business value also means these leaders have ever-shortening timelines to determine if the hype around a given new technology is real, whether to adopt it, and how to do so.

The Periodic Table of Tech in Canada is a curated source of potential partners that can help incumbents and non-tech companies navigate the currents of technology and ride the waves of new value. One of the great qualities of the Canadian tech sector is how welcoming it is to people from all industries. Curiosity and interest are the only prices of admission. We are in an era in which every company needs to know how it will apply new technology, generate intellectual property, and adapt its business model — an era in which every company is a tech company. It behooves incumbent leaders to get involved in Canada’s tech ecosystem, speak with Canadian entrepreneurs, and do business with the Canadian firms that understand these waves of innovation. Those who do may find the battering seas become a little more friendly.

Celebrating today and compounding tomorrow

This Canada Day, let’s celebrate the successes of today with an eye to the progress we’ll strive to make tomorrow. Let’s build on what we’ve established, and create a tech sector with more Canadian scale-ups, more collaboration, and more companies deciding Canada is far and away the best place to stay, build, and grow.