The Accelerator Series is a multi-part spotlight on Canada’s startup accelerators and the people who lead them.

Riding a New Program Structure, INcubes Looks to Leverage the Zlotnick Effect

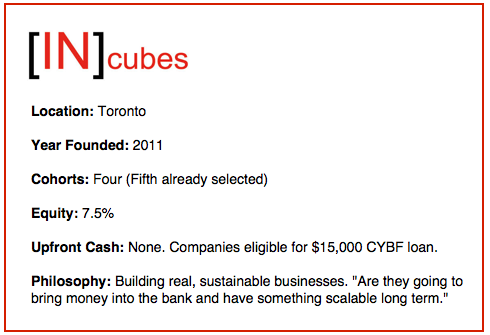

Ben Zlotnick might be the smartest guy in the Canadian startup accelerator space. After all, he’s collecting equity from companies who join the Toronto-based INcubes, while not actually giving them any up front cash.

But for the tech startups the keep coming to learn under Zlotnick’s guidance, not to mention the program’s rising profile, he’s clearly offering value (just not in terms of money).

“The issue that we have is, well, ‘you’re not giving any money up front.’ What we are giving you is access to capital if you prove yourself during the program,” Zlotnick told BetaKit. “But until they get to that level, to give them that much money is difficult, and a lot of accelerators are obviously looking at their model at what works and what doesn’t work.”

It’s a familiar refrain to hear in Canadian tech: the traditional model for accelerators is to give a handful of early-stage companies around $40,000 every year, and hope that a small number of those will make a healthy return.

Since INcubes’ inception in September 2011, Zlotnick has never given companies a dime of his own money, still collecting 7.5 percent equity stake. Those startups can take advantage of a government loan for $15,000 from the Canadian Youth Business Foundation (CYBF) through an exclusive agreement with INcubes. In return for their equity Zlotnick relies on the strength of the mentorship and guidance that these companies will receive.

And, of course, there’s ample opportunity to get in front of investors at the end of each cohort, during the program’s investor day when teams pitch their vision to a select guest list. Zlotnick also hinted at a future investment committee in which the program might actually make investments in its startups after they graduate.

Ultimately, when companies ask him “what can you do for me?” Zlotnick said he sells them on a hands-on approach in the pursuit of putting money in the bank. “Our belief from the beginning and our focus is on building real, sustainable businesses,” he said. “It’s very business-relevant. Its about operations, about your business model, what makes sense, are they going to bring money into the bank and have something scalable long term.”

It has been a positive ride for Zlotnick since he first entered the world of tech startups. He built his name in the landscaping business with several business, mainly Aden Earthworks. He’s nearly done selecting his fifth cohort of startups, and can already claim to have accelerated 18 tech startups in two and a half years.

There has been the occasional bump in the road, namely a bizarre and public ownership spat with former managing director A. Traviss Coryy, who indicated at one point he would take legal action against Zlotnick. Corey has since moved on to Smithson Martin where he serves as COO.

The positives seem to have outweighed the negatives though. One was Hovr.it’s acquisition in early December, when Calgary startup Slyce acquired the company that took part in INcubes’ Summer 2012 cohort.

Zlotnick points to Hovr.It as an example of a successful example of INcubes’ mentorship. “That’s a story of four founders that got it together, they had the tech, they had the product guy, the sales guy, the entrepreneur as CEO and they did a phenomenal job. They pivoted at the beginning of the accelerator and in 16 months they went from idea to build to expansion to exiting.”

Not every one of its companies have experienced success like Hovr.it though. Some companies might be too early-stage, and partly for that reason INcubes is splitting its program into two branches moving forward.

Those considered very early-stage can apply for the “INcubes Funnel Program”, a customized, deliverable-focused program with no specific timeline that focuses on building a product, a pre-accelerator program almost. Deliverables include putting a business model in place, devising a marketing plan, building investor presentations and pitch decks and other organization tasks like shareholder agreements and incorporation.

Once startups have graduted from the funnel program they can be accepted into the INcubes accelerator program, but not all funnel teams will get in. Similarly not every startup accepted into the INcubes accelerator program will have gone through the funnel program. The accelerator program will focus on three key areas: onboarding paying clients, setting up and solidifying partnerships across the globe and raising capital.

“Shaking the tree” isn’t a foreign concept in the Canadian accelerator space among programs searching for a structure that will be sustainable. “Ultimately not everybody is going to be a $10 million company or a $100 million company, but you want to work with those that you feel you have the best ability to work with and are coachable, that can be successful,” said the INcubes founder.

With no upfront cash, what will separate INcubes from other accelerators will be the “Zlotnick Effect”: the mentorship and growth that the father of five (and his team around him) can have on these startups.

He gives off a vibe that implies building a successful business takes time and perseverance. Just like it took time building Aden Earthworks, he’s committed to help his teams over the long term.

When I asked him in the past if he ever wanted to quit he offered that “when you know that you have payroll Friday and you only have X amount of dollars in the bank and its Thursday, and you have 50 employees that you have to feed because they need to pay their mortgage or their rent, you’re going to do whatever you need to do in order to get that money to the bank.”

Did he ever think of quitting landscaping? Absolutely, but “when you think it through, you have a growing business and you want to be successful, then you push through,” he said. “Just like everyone has challenges and there are different expansions into other areas of business, that’s ultimately what the founders job is.”

Have you check out the rest of the series?

Part One: Hyperdrive (published January 13)

Part Two: GrowLab (January 20)