Atlantic Canada startups reined in a record-setting $166.6 million of private capital last year, up 43 percent from $116 million in 2017, according to a report released by Entrevestor.

Entrevestor’s Atlantic Canadian Startup Data Report 2018, which measures the performance and growth of the regional startup community, found that New Brunswick accounted for $84.7 million of private capital raised, most notably New Brunswick’s IT sector, with Fredericton-based companies like Sonrai Security raising $24 million, Introhive raising $20 million, and Resson raising $14 million.

“Atlantic Canada has a young, growing startup community, and this study shows it features a core of scaling companies.”

– Peter Moreira, Entrevestor

“Entrevestor’s report demonstrates the impact that Atlantic Canadian startups have on the region’s economic growth, and represents an increased collaboration between key stakeholders in our innovation ecosystem,” said Jesse Rodgers, CEO of Halifax-based innovation hub, Volta.

“More people and organizations are working together to collect and share information to highlight the Atlantic region’s contribution to Canada’s innovation economy, and that enthusiasm towards collaboration will be a fundamental part of catalyzing Atlantic Canada’s ecosystem so it can reach its full potential,” he added.

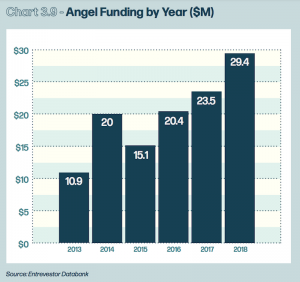

There was also a heavy investment across the region by angel investors and founders. The report tracked $29.4 million in angel investments for 2018 alone, more than any year since Entrevestor began its reports in 2013. Despite this year’s closure of First Angel Network, Entrevestor attributed last year’s increase in angel investments to organizations like Creative Destruction Lab (CDL) Atlantic, which it said have brought business leaders into the angel community. CDL venture manager Gillian McCrae told Entrevestor that fellows and angels involved in the group have invested $7 million in the CDL-Atlantic companies in the last two years.

“The great myth in the Atlantic Canadian startup community these days is that there is a problem with angel investing,” the report said. “Our analysis shows East Coast startups are receiving more money from individual investors than ever before.”

RELATED: Tech firms added $6.1 billion to Atlantic Canada economy in 2017, report finds

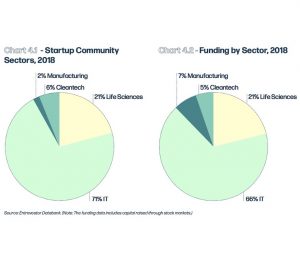

Five-hundred-and-fifty “innovation-driven” companies were recorded throughout the region, with 115 new companies added last year. On average, the number of companies in Atlantic Canada has increased about 15 percent annually, the report found. IT remains the dominant sector in both number of companies and funding, taking up 71 percent and 66 percent of the region’s shares, respectively. Atlantic Canada had 365 IT companies that collectively raised $128.7 million last year.

Entrevestor found that the life sciences sector is making some of the strongest progress in the region with regards to the number of companies, the number of employees, and revenue generated. Twenty percent of Atlantic Canada’s biotech companies were launched last year, with 24 new life sciences companies created in 2018, up from six in 2014. Ocean-tech seemed to also take off, thanks in large part to the progress of the federal government’s supercluster initiative, which saw the opening of the Startup Yard incubation facility at the Centre for Ocean Ventures and Entrepreneurship.

“Some people believe the next phase in the ecosystem will be to determine an area of specialization for the Atlantic Canadian ocean industries segment,” the report said. “With the number of ocean-tech hubs growing, some believe Atlantic Canada will have to distinguish itself by specializing in a sub-sector, such as marine life sciences.”

Entrevestor noted eight exits in 2018: Adfinitum Networks, EhEye, Envenio, Kivuto Solutions, Marcato Digital, Nautilus Biosciences Canada, Panag Pharmaceuticals, and WoodsCamp Technologies. The biggest acquisition Entrevestor noted for last year was the sale of Panag Pharmaceuticals, which was worth as much as $27 million.

“Atlantic Canada has a young, growing startup community, and this study shows it features a core of scaling companies whose products are reaching international markets,” said Entrevestor principal Peter Moreira, who authored the report. “The region still needs bigger companies with larger sales, staffs, and valuations, but the stronger companies in the region are producing impressive metrics.”

Read the full report here.

Image courtesy Unsplash