Talking about death can be uncomfortable; it’s unsettling to think about a loved one’s mortality, and can bring up thorny family disputes. Toronto-based will-creation startup Willful wants to make the process a little simpler.

According to a LawPro study, 56 percent of Canadian adults don’t have a legal will — and Kevin Oulds, Willful’s CEO and founder, used to be among that number. Oulds got the idea for the company after the unexpected death of a family member. They had never made a will, making an already difficult time more challenging for his family.

“I saw the issues our family faced and started to look into it a big deeper, wondering how often this happens and how big the problem actually is,” he said. “And it turned out to be a big problem.”

“We want to try to make that conversation a little less scary.”

A couple of his own subsequent near-death experiences made him realize he himself was part of that problem. “If something happened to me I’d potentially put my family through the same situation, because I had not had those difficult conversations,” he said.

Oulds quit his job and launched Willful last October. The company aims to use technology to make end-of-life planning simpler, and encourage more Canadians to create a will.

“What we found early on is people can’t talk about death,” Oulds said. “If you can’t have this conversation face-to-face, we can allow [you] to have a plan in place digitally that we can pass on to family members so they aren’t scrambling and second-guessing.”

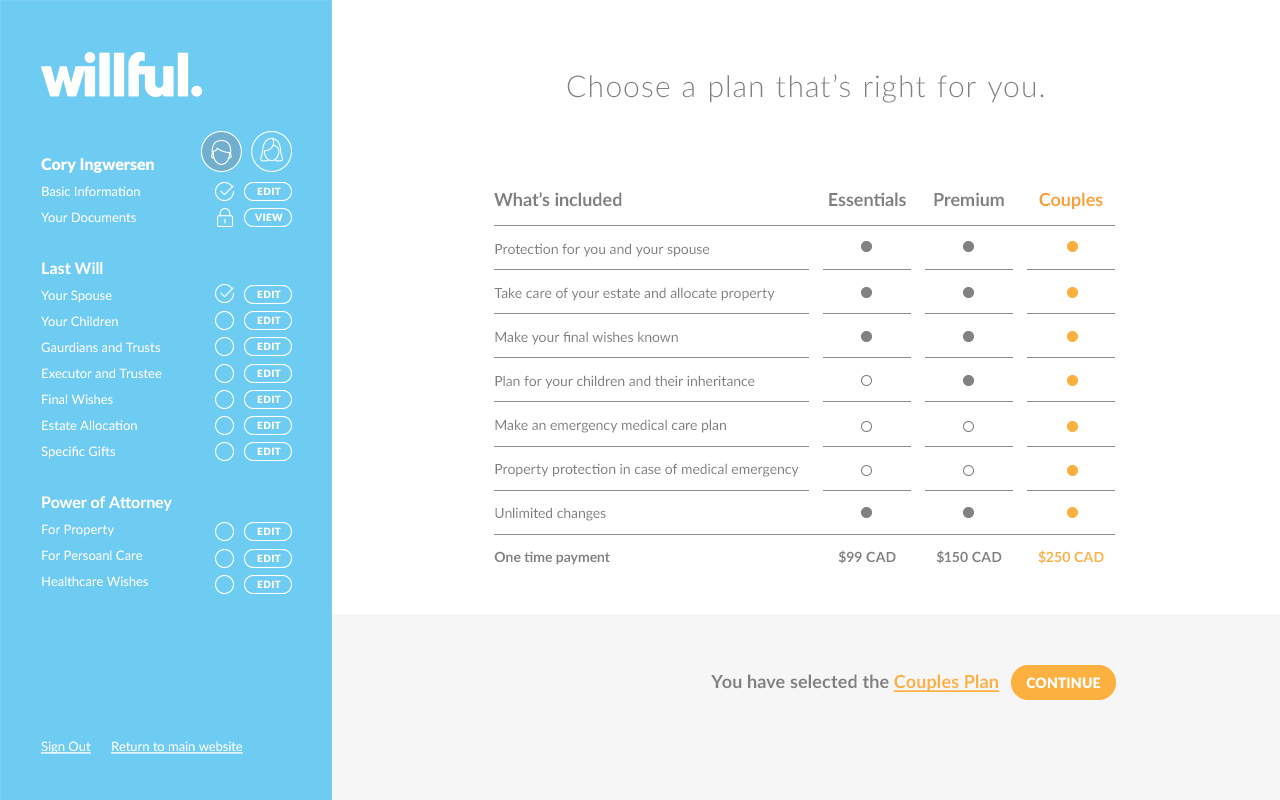

When a user logs into the Willful dashboard, the website will take them through a series of questions about their current life situation, including their marital status and if they have any children or pets and suggest a plan based on those answers.

Once they’ve picked a plan, the user will fill in information about who they choose to be the executor of their will, their beneficiaries, and how they want to divide up their estate. They can also specify funeral preparations. The PDF they print off has instructions for how to make it legally valid.

They can also choose to create a power of attorney for property and personal care — which, Oulds noted, could end up being even more important than having a will. “In case of a medical emergency, you have someone to act on your behalf,” he said.

Willful has three plans — one for just a will, which costs $99; one that allows you to create a will and to designate power of attorney for $150; and one that allows couples to create their wills and powers of attorney together, for $250. The company estimates that they can save users between $200 and $850, compared to visiting a lawyer. All plans come with unlimited updates to the documents.

The company has created more than 2,000 documents, and is operating in both Ontario and Alberta.

The company worked with estate lawyers to help create all the legal content and flow of the documents. “[Our legal advisors] are there to make sure the documents are in line with the provinces we’re live in,” Oulds said. They’ll also help if there are any changes to provincial laws that would require a change to Willful’s documents.

Oulds said many people don’t realize the importance of having a will in place. “If you have any assets, you should have a will,” he said. He noted that while young people may not have assets yet, they often have pets, which can be accounted for in Willful’s documents by designating a pet guardian and allocating some money for its care.

He said the typical “inflection point” for people to get a will is when they become parents. “If you have a child the biggest problem you want to solve is picking a guardian if something was to happen to you and your spouse. There’s been court cases because there hasn’t been a proper plan in place,” he said. “Have something right now and you can always change it after more discussion.”

Willful has grown quickly in its first year. The company has created more than 2,000 documents, and is operating in both Ontario and Alberta. Oulds said he hopes to be operating in British Columbia in less than a month.

The company initially raised a friends-and-family round initially to get off the ground, and isn’t backed by venture capital. Oulds said Willful is currently trying to raise a seed round of $500,000, and just began reaching out to investors in the summer. But, he said, the company is currently funded through its revenue, so it isn’t “do or die.”

Willful is also in talks with life insurance companies and financial institutions to offer its services to their clients. Wills would be a natural complement to life insurance products, and an estate plan is the “last building block” of someone’s financial plan, Oulds said.

He said he wants to see the company expand to cover the rest of Canada, and possibly other countries. “There are not enough people that have an estate plan,” he said. “We want to try to make that conversation a little less scary.”

Photo via Unsplash.