A new report from Simplii Financial sheds light on how Canadians use technology, pointing to excitement—and tension—about tech’s role in their daily lives.

The digital banking brand has released an in-depth report, a “Deep Dive on Digital Trends in Canada,” which surveyed 3,040 randomly-selected Canadians. The report asked respondents about their motivations for using technology and the mobile apps they use, and identified both the challenges and opportunities.

“If you think about 10 years ago, the smartphone frenzy was just occurring. We didn’t even have the iPad at that point; fast-forward 10 years, and digital is such a big part of everyone’s lives,” Aayaz Pira, senior vice-president of CIBC Digital and direct banking, and head of Simplii Financial, said about why the bank conducted the report.

“In financial services, we’re really simplifying people’s lives, so we wanted to ask Canadians how they really feel about digital in other parts of their lives and find out if we can honestly say that it’s changing Canadians’ lives for the better.”

BetaKit spoke with Pira for more insight into the report’s main findings and how consumer expectations will drive the next generation of tech offerings.

The positive and negative of constant connection

The report found that just over three in four Canadians say digital services have made a positive impact on their lives. The biggest driver for Canadians to use technology is to simplify their lives, with 43 percent of respondents identifying it as their main motivation. Saving time and completing tasks from anywhere followed close behind, at 40 percent and 38 percent, respectively.

“Tech is so ingrained in our everyday lives, be it managing our kids’ sports schedule or being able to video chat with relatives.”

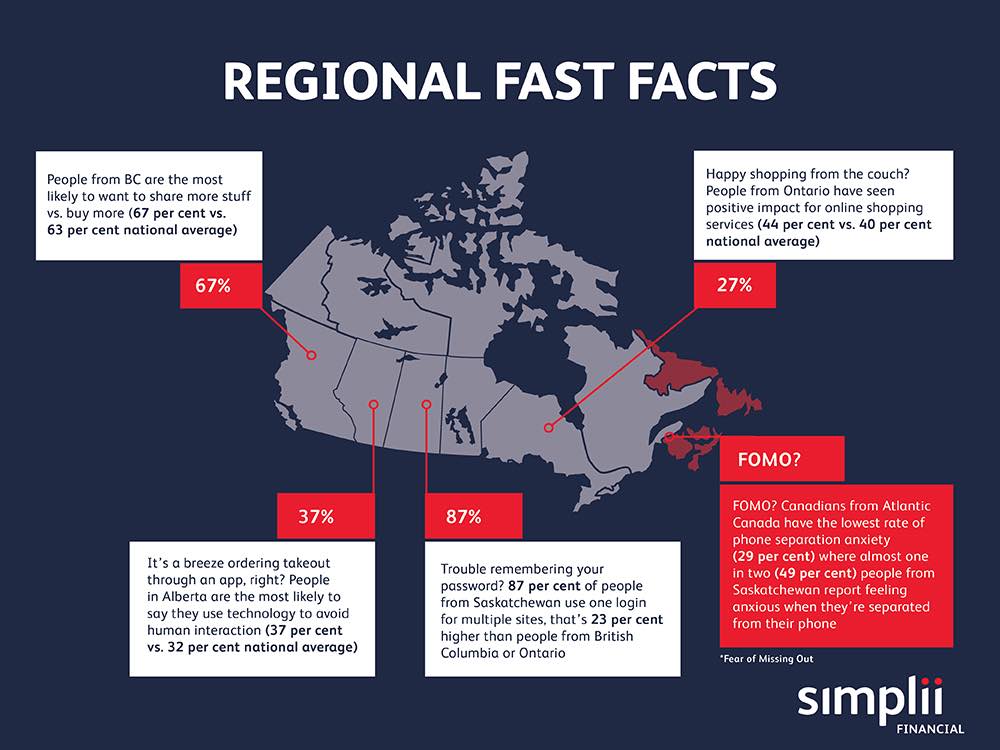

For some Canadians, there is an underlying tension associated with this use of technology; 36 percent of Canadians agreed that technology can leave them feeling empty, and 37 percent said they felt anxious when separated from their mobile devices. Saskatchewan reported the most anxiety when asked about phones, with 49 percent of respondents in the province agreeing with the statement.

“Tech is so ingrained in our everyday lives, be it managing our kids’ sports schedule or being able to video chat with relatives. When our phone battery dies or the wireless network is down, we worry about being unreachable to loved ones,” said Pira.

That’s why Canadians are particular about the functionality of the digital tools they choose to use, explained Pira, noting that many Canadians—69 percent—turn to purging apps they no longer use. Almost half of Canadians have under 20 apps installed on their phones, and 46 percent said most of the apps they download aren’t really useful to them. While 27 percent of Canadians have between 10 to 19 apps, only 16 percent use that many apps daily. Seventy-eight percent use between one to nine apps a day.

“Canadians want experiences, services, and products to really add value, versus just a rinse and repeat of what they’ve seen before,” Pira said. “If it doesn’t simplify their life, if it doesn’t allow them to do things faster, and if it doesn’t add efficiency, then they’re just going to abandon it.”

Pira also noted that, despite anxiety around phone use, many Canadians still felt that technology enriched their lives in several ways. Forty-eight percent said technology helps them take better care of their physical and mental well-being, and 64 percent said technology has improved their connection with family and friends.

Interestingly, 58 percent of Canadians said they use the extra time created by technological efficiencies to spend more time on tech platforms. However, Pira noted that they’re not just doing things like checking work emails; they’re connecting to other aspects of their lives like checking in with family.

“You’re still using your smartphone to be productive, but for different reasons,” Pira said. “You’re saving time on one hand and being more productive on the other hand. I think digital has become so central to the way people run their lives, and the nice thing about it is that you can choose both personally and professionally when you use it.”

How Canadians are using tech

While being mobile-first is an important strategy for businesses, the report provided insight into when Canadians prefer online and in-person interactions for getting things done.

Overwhelmingly, Canadians would rather do banking tasks online (80 percent), and 75 percent would rather pay by card than cash. Almost half (45 percent) reported that banking, investing, and budgeting tools had a positive impact on their lives.

Only nine percent of Canadians do their everyday banking in a branch…services like financial planning must be integrated into the digital experience.

Meanwhile, 62 percent of Canadians preferred to shop in-store, and 63 percent preferred to share items rather than buy new ones. Digital plays a key role in enabling those sharing services, with 49 percent of Canadians reporting the use of a reselling platform like eBay.

Pira said Canadians’ preference for in-person retail likely stems from the desire to see and feel products in real life. He added that the Canadian market has, in the past, been slower to adopt online shopping.

“Sometimes people want to shop globally, and it’s not possible for them because some companies don’t ship to Canada, so they have limited options,” Pira said.

Despite these challenges, 40 percent reported that online shopping had a positive impact on their lives.

Pira noted that what consumers expect from banking is also changing. The report said that only nine percent of Canadians do their everyday banking in a branch, meaning important services like financial planning must be integrated into the digital experience; 48 percent and 34 percent of Canadians use online and mobile banking, respectively, to do everyday banking.

“With banking, you can open an account and start using it…you don’t actually have to see a physical person or physical location, and that has helped make digital banking commonplace in Canada today.”

Over the next three to six months, Pira said Simplii will roll out products like its recently-announced global money transfer to add value beyond regular banking.

“[Simplii clients] continue to use online and mobile banking, they’ll log in to do their everyday banking, and they’ll also log in when they’re not doing banking to get information on items that will add value to their financial health awareness and education,” he said.

Access the full report here.

Image courtesy Simplii Financial