FinTech startup Link Investment Management has received a $2.5 million CAD Series A strategic investment from the Canaccord Genuity Group, as the startup prepares for growth and sets itself up to compete against legacy insurance companies and banks.

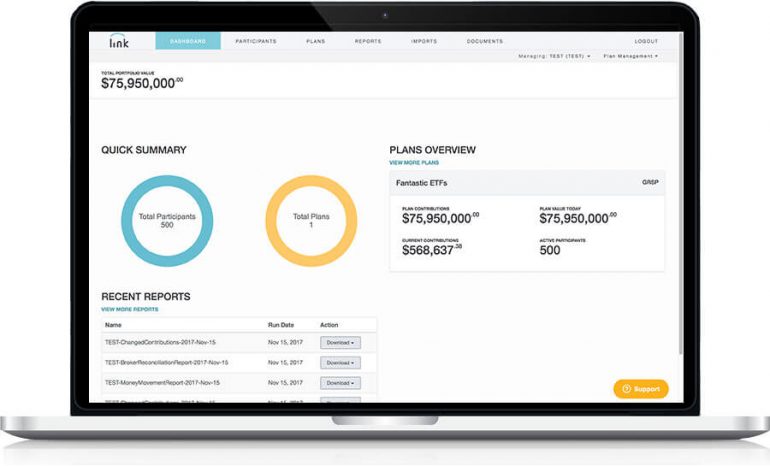

Link’s cloud-based solution is used for the administration, execution and reporting of a number of different workplace savings plans, including pension plans, and employee stock options plans.

“Our focus is to strengthen our position domestically…and to really focus on bringing workplace savings plans to a lot more Canadians who don’t have access.”

The startup intends to use the funds to strengthen its market position among Canadian workplace savings plan providers. The funding round closed on October 19. With the investment, Canaccord is taking a minority stake in Link.

Before the Series A round, Link raised $9 million CAD in pre-seed and seed rounds.

The purpose of the Canaccord financing is to really fund our growth plan,” said Brian McClennon, co-founder, president and CEO of Link. He envisions using the net new capital to add to the startup’s sales and marketing, and product development teams.

The startup built a record-keeping and administration platform, from the ground up, to manage all the different types of employee plans, which allowed it to be more efficient and offer plans at a lower cost than many of its competitors, McClennon said. The CEO noted Link can often offer fees to employees that are half of what they’re currently paying.

Even so, Link with its 20 employees, is competing against behemoths. The incumbents in the space include such massive companies as Canada Life, Sun Life Financial, Manulife, alongside banks such as RBC.

However, McClennon said those firms are also dealing with legacy platforms as well as trying to integrate new platforms from acquisitions. “It’s very challenging, analogous to trying to turn a cargo ship around in the Suez,” McClennon added.

“Our focus is to strengthen our position domestically within the Canadian market, and to really focus on bringing workplace savings plans to a lot more Canadians who don’t have access to workplace savings plans,” McClennon said.

RELATED: CapIntel signs partnership with IG Wealth Management

McClennon noted that according to Link’s research there’s some eight million Canadians working in small and medium-sized businesses that do not have access to a workplace savings plan. He added that less than 20 percent of businesses under 100 employees offer a workplace savings plan, and only about half of companies from 100 to 500 employees have plans.

“Employers are really looking for a modern platform to attract, reward, and retain the top talent that’s out there,” McClennon said. “So, as these companies are coming back online out of COVID and growing, they’re looking for something that differentiates them from other employers.”

Founded in 2016, Link markets through multiple channels, but says its focus is with direct sales activities where the company actively approaches employers that fit into that “sweet spot.” McClennon said, “Companies with less than 500 employees oftentimes can be underserved and overcharged.”

McClennon pointed out that in most plans, it’s the employee who bears the cost of that service through fees. But when McClennon and his four co-founders looked at the space they saw an opportunity to make plans more affordable for employees participating in them.

“We think Link provides a very strong value proposition through potentially reduced fees to the employee, a great user experience for the members and administrators of these plans. We have the advantage of being very nimble and flexible in our offering,” McClennon said.