Québec City-based autonomous vehicle software provider LeddarTech cut 95 percent of its staff as it raced to pay its debts, but it appears to be too late.

The company announced the cuts shortly after it warned investors that it could default on its credit facility with Desjardins, which requires the company to hold at least $1.8 million CAD in cash from April onward. LeddarTech had $9.2 million at the end of March, but just $4.1 million by May 8.

LeddarTech will no longer call back laid off employees after discussions with a “significant potential commercial counterpart” fell through.

At the time, LeddarTech said the “temporary layoffs” affected approximately 138 individuals in all of its locations and across all departments within the organization.

The reductions were part of an effort to preserve company cash and provide LeddarTech additional time to pursue discussions with lenders, the company said in a statement.

The cuts were also meant to give LeddarTech more time to consider alternative strategies to address the situation, including a sale of the business or certain assets, strategic investments, or seeking creditor protection under the Companies’ Credit Arrangement Act.

On June 9, LeddarTech announced Desjardins agreed to temporarily postpone certain interest payments until January 2026, and that it had called some of its employees back to work. Just two days later, LeddarTech said that, due to its financial situation, it will no longer call back any previously furloughed employees after discussions with a “significant potential commercial counterpart” fell through.

The company said it will continue to review a potential sale of either its business or its assets, as well as insolvency proceedings, and that it does not expect to resume active operations.

UPDATE (06/18/2025): On June 17, 2025, LeddarTech announced that it intends to file for bankruptcy under the Bankruptcy and Insolvency Act. The company said it was unable to find a suitable acquirer, secure a commercial partner, or raise capital. LeddarTech expects its shares trading on the Nasdaq will be halted and ultimately delisted.

In its situation, LeddarTech had to share a financing plan with its lenders by May 16, and raise $9.7 million USD (about $13.6 million CAD) in additional equity investments by May 23, deadlines the company did not believe it could meet. It warned its ability to operate might be “materially and adversely affected” if it couldn’t honour those deadlines.

RELATED: Canada’s auto tech industry crashes into a triple emergency

While LeddarTech said it was working with Desjardins and bridge lenders on a “potential solution,” the company still hadn’t secured relief from its obligations under the credit facility or any additional finance, until its June 9 announcement.

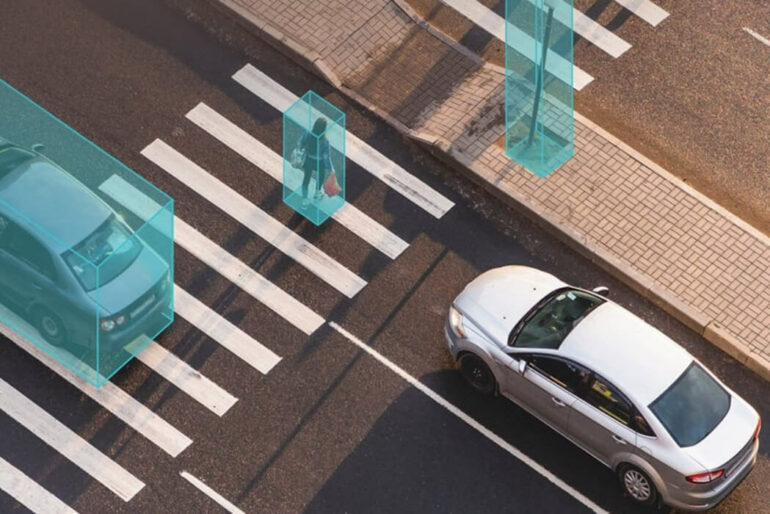

Founded in 2007, LeddarTech develops environmental-sensing solutions for autonomous vehicles and advanced driver-assistance systems. The company went public on the Nasdaq stock exchange in December 2023, just under two years after it closed $140 million in equity Series D funding and debt. The company already faced trouble once, when Nasdaq warned its share price has fallen below the $1-USD minimum required to maintain its listing on the Nasdaq Global Market.

LeddarTech’s stock price opened 2025 trading at $1.28 USD per share, and even peaked up to $1.75 USD per share at one point. It has since dropped more than 75 percent of its value, trading at $0.30 USD per share, with a market cap of $11.1 million USD, as of noon on May 22. Following its June 11 warning that it does not expect to continue operations, LeddarTech stock was trading at $0.23 USD per share.

UPDATE (06/11/2025): This story has been updated with additional information following a June 11 announcement that LeddarTech does not expect to continue operations.

Feature image courtesy LeddarTech.