Toronto-based FindBob has raised a $1.6 million seed round.

The round was led by Grinnell Mutual, with participation from the MaRS Investment Accelerator Fund and Ames Seed Capital. The Global Insurance Accelerator and Canadian and US-based angels added follow-on investment.

The startup aims to solve a big problem in the insurance and financial services industry: a lack of a succession plan. The average age of the North American independent producer is 59 years old, with over $2.5 trillion in assets under management controlled by producers in their sixties. These producers often don’t have plans for transitioning their book of business to a new partner, leaving it to unexpected events like death, disability, retirement, or loss of license.

“We have an incredible opportunity to make a meaningful impact on one of the industry’s biggest threats, which is the lack of continuity within financial services,” said Chan. “Insurance and financial advice matter, and by aligning the interests of advisors, agents, and their companies through the effective use of digital transition management platforms, we’re helping orchestrate growth and perpetuation like never before.”

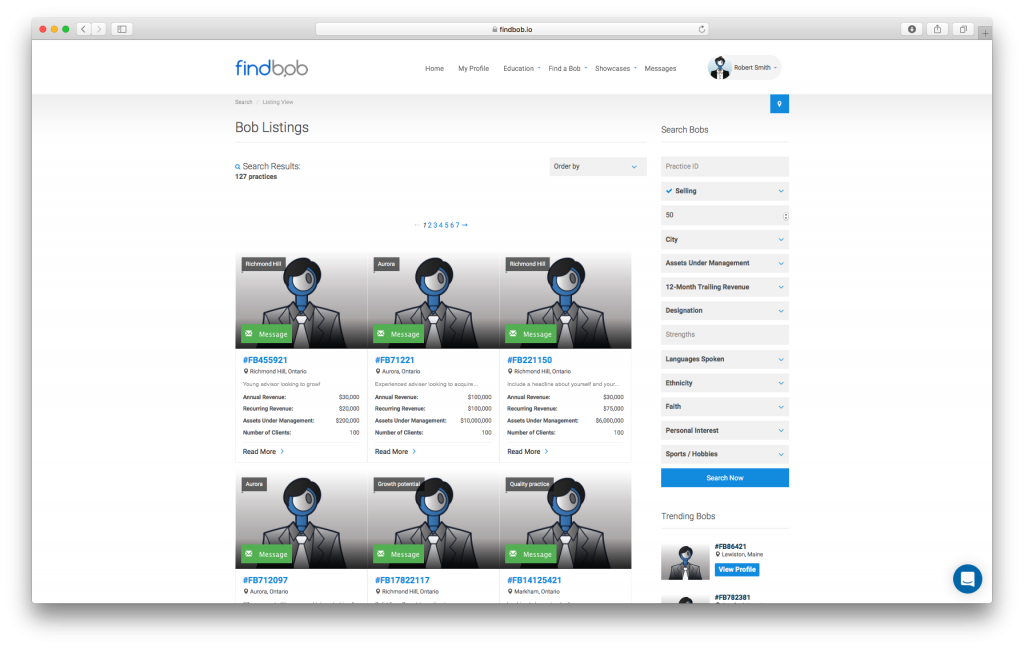

Founded in 2015 by Roland Chan — himself a successor to a life insurance MGA, and a participant in the Founder Institute — the white-label platform allows users to discover opportunities to buy, sell, merge, partner, or address succession for their businesses. He says that agents and advisors aren’t planning for transitions because the process seems daunting, and there’s no easy way to find a partner. “It’s ironic, considering these individuals spend a lifetime providing advice to families and small businesses on continuity and succession for a living,” he jokes.

Chan stresses that the company is more than a marketplace, as it uses data to match firms with the types of agents that they want to work with. “Our enterprise platform leverages data to identify and develop talent necessary to improve organizational strength. So, while firms focus on today’s business goals, they can rely on us to provide visibility into their producers’ transition needs and offer them tools to support future growth.”

The company already counts HUB Financial, PPI Solutions, and IFB as clients. The company plans to use the funding to invest in sales and marketing, product development, and to expand in the US. It’s currently in negotiations with US carriers, and used its experience at the Des Moines, Iowa-based Global Insurance Accelerator to research whether they were solving an actual problem.”

“The GIA itself, whose fund is 100 percent comprised of 13 US based insurance carriers, did a follow on investment in our company,” said Chan. “We’ve already deployed an experienced, enterprise insurtech sales team on the ground in the US. Lack of perpetuation in the financial services industry isn’t limited to North America either. This is a global problem.”

“There is a large market for transition assistance in many personal services industries,” said Dave

Wingert, Grinnell Mutual executive vice president, chief operating officer, and acting president. “Because of an impending generational shift of wealth coming — the largest ever — providing business and transition advice and networking opportunities to those personal service businesses will fill a critical need and help them stay viable. Grinnell Mutual is excited to have the chance to support that kind of initiative in a rapidly expanding market.”