Last month, PwC partnered with CB Insights to release the first-ever Canadian edition of its MoneyTree report. A survey of the venture capital landscape, the report puts Canadian deal activity in context with global trends, and more specifically allows for direct US-Canada data comparisons.

Speaking with BetaKit about the report, PwC director of corporate finance Shivalika Handa noted the impact of government-backed investment firms in Canada. BDC was the most active venture capital fund in the country in 2016 with 30 investments that year, followed by Halifax-based Innovacorp, which made 17 investments. In a list of the top eleven venture funds, five were government-backed.

Per MoneyTree, in a list of the top eleven venture funds for 2016, five were government-backed.

“I think [government-backed funds] are something that we really have to pay attention to, as we see reports in the media about what’s happening south of the border, and how entrepreneurs are being forced out of the US because of its immigration law. So there’s that, combined with the fact that the top two investors in Canada are government-backed VCs,” Handa said.

Government-backed firms also lead the pack when it came to investments by stage, with BDC dominating most of them (Expansion, Early, Later). Innovacorp took the top spot for Seed stage investing, followed by BDC (Anges Quebec took fifth place). Two different Canadian firms (RBC, Georgian Partners) shared pole-position in the Later stage with BDC, along with two US firms (General Atlantic and Volition Capital).

“There’s been a call to action for a VCAP part two in the industry, so it’s important because these funds — while they are government-backed — are still seeking return; it’s not a charity. It shows that the program is working,” Handa said.

As of now, though, it’s unclear whether there will be another VCAP, as Bill Morneau’s financial advisory committee omitted any recommendation to renew the government’s $400 million VCAP program.

“Some of these government-backed funds have been around for a while. So we’re not talking about an injection of recent capital that’s driving this trend; I think given what we’re hearing about in the market, the call to action from the community is not only for more programs like VCAP, but also to fund startups.”

The prevalence of US firms at the top stage of Canadian investments begs for an in-depth comparison of US and Canadian VC activity. Additional MoneyTree data provided by PwC tells the tale of a less-robust Canadian ecosystem compared to its US counterpart.

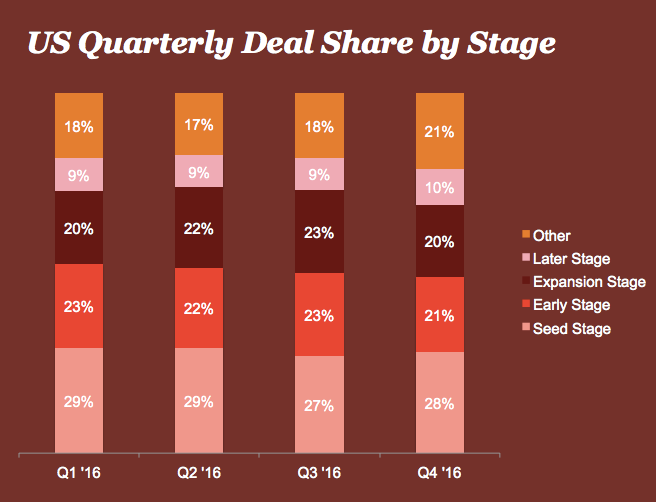

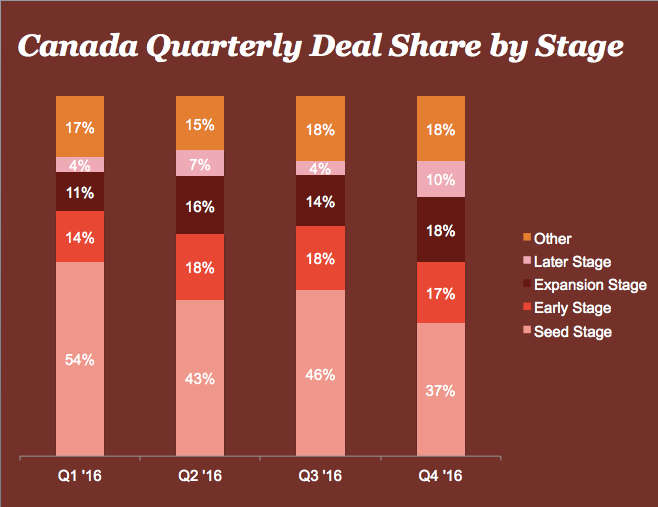

Comparing quarterly deal share by stage in 2016, it is clear that a significantly larger percentage of Canadian VC deals are in the Seed stage compared to the US. In Q1 2016, 54 percent of Canadian VC funding was dedicated to Early stage startups; by Q4 2016, that number dropped to 37 percent. In comparison, Seed stage funding in the US never surpassed 29 percent.

“It’s very easy to get seed stage in Canada, and even really early stage money. There a lot of people willing to write you anywhere from a few hundred thousand up to $5 million in cheques if you’ve got good tech,” Handa told BetaKit.

However, the numbers drop significantly in the middle stages of funding in Canada; Early stage funding and Expansion stage never surpassed 18 percent in Canada, while in the US, it stayed fairly consistent hovering around 20 to 22 percent.

Later stage funding in Canada was the smallest percentage and the most volatile, vacillating between four to 10 percent. US numbers, in comparison never surpassed ten percent, but remained steady throughout the year.

“It gets harder when you get from $5 million to $15 million,” Handa said. “I think there’s more participation with the handful of funds that’ll do $20 million or $30 million dollar cheques, but it’s that middle zone that is difficult in Canada for sure.”

However, Handa indicated Canada’s bottom-heavy investment approach could change as Canada’s business environment becomes more attractive to investors, and Canadians become more keen to build here than abroad.

“Canadians have traditionally or historically been very conservative compared to the US, but as the ecosystem in Canada continues to build, and companies have this desire to stay in Canada, the middle segment of investment curve is stronger,” she said. “I think the level of acceptance on valuation trends and taking bigger risks in Canada from an investment standpoint will start to increase, so it’ll feed on its own.”

Overall, Seed stage funding in Canada took 56 percent of venture dollars, while Early and Expansion stage companies took up 22 and 16 percent of funding respectively. Later stage funding represented six percent of deals.

In the US, percentages were more consistent, with 28 percent going to Seed funding, 21 percent to Early stage funding, 20 percent to Expansion stage funding, and 10 percent to Later stage funding.

“PwC gets an opportunity to talk to people that are starting new funds, and in the last month, I’ve had at least three conversations about new funds. So I think a growth in the number of private funds that get started is another thing we’re going to see this year,” said Handa.

On the heels of major exits like BlueCat’s $400 million sale to US-based Madison Dearborn, and Tio Networks’ $304 million sale to PayPal, Handa said to continue looking out for Canadian exits in 2017. For entrepreneurs ready to exit, Handa had encouraging words.

“If you’re going to exit and you’re ready to exit, the market is still great for that. We haven’t seen any so-called bubbles burst. There’s still room for more IPOs, it hasn’t been saturated; in fact, we’re sort of lacking IPOs and the markets are on fire,” Handa said. “There’s tons of cash and available capital to be spent by larger companies looking to swoop up interesting technology from a buy versus build strength, and so I think there’s a long road ahead for exits.”

Canadian VC firms: make sure to update your data at editor.cbinsights.com to be included in the next PwC Canada & CB Insights MoneyTree Report being released in April 2017.

BetaKit is a PwC MoneyTree Canada media partner.