CoPower, a clean energy investing startup, is set to be acquired by Vancity Community Investment Bank (VCIB), a Toronto-based chartered bank and subsidiary of the Vancouver-based Vancity credit union.

VCIB noted that the acquisition is a way for the bank to grow and scale its impact finance business, as well as unlock new funding sources. The deal will see the two organizations working together for financing clean energy and social purpose real estate.

“Climate change and housing affordability are two of the most critical challenges facing our communities.”

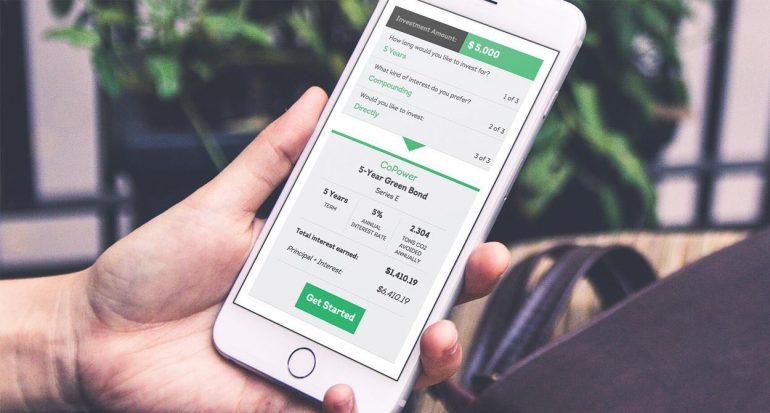

CoPower, founded in 2013, offers an online platform that “simplifies” clean energy investing. The startup looks to help Canadians invest in energy efficiency and renewable energy projects through Green Bonds. To date, CoPower has reportedly raised more than $30 million for clean energy and energy efficiency projects. According to a statement from VCIB, this has helped avoid more than 12,000 tonnes of C02 emission, equivalent to 2,548 fewer cars on the road for one year.

Through the acquisition, Montreal-based CoPower will become a subsidiary of VCIB, with the startup’s team of sustainable finance experts moving in-house to VCIB.

“We’re thrilled to be joining VCIB,” said David Berliner, managing director and co-founder of CoPower. “Our mission has always been to move money for the clean energy transition. As a subsidiary of VCIB, we’ll be able to better serve the needs of clean energy developers while delivering a powerful range of investment products for investors looking to earn a strong return, and supporting projects that are green, inclusive, and affordable.”

VCIB touts itself as Canada’s first values-driven bank, focuses on lending for social purpose real estate, such as affordable housing, co-op housing, co-working spaces, green and heritage buildings. It also works with not-for-profit organizations, foundations, and endowments. The bank noted that this deal brings together “two leaders” in impact financing, as it looks to grow and lean into digital technologies to improve its banking experience.

“VCIB exists because we need a different kind of bank to enable a future that serves all Canadians,” said Jake Stacey, VP of impact banking at VCIB. “Joining forces with CoPower is not just about looking to where the market is heading, but about shaping a financial system that puts communities first.”

The bank added that adding CoPower’s clean energy investing expertise will allow it to accelerate investment in affordable and sustainable communities.

“Climate change and housing affordability are two of the most critical challenges facing our communities, and we believe the financial industry can and should play a key role in enabling and shaping ambitious solutions,” said Jay-Ann Gilfoy, CEO of VCIB.

Prior to the acquisition, CoPower had raised more than $2 million in equity financing, with backing from Montreal-based pension fund Fondaction CSN and Royal Bank of Canada, which invested $125,000 for an equity stake in 2015.

Terms of the deal were not disclosed. The deal is expected to close later this month, but is still subject to closing conditions.

Image source CoPower