Toronto-based startup Cinchy has closed a $10 million CAD Series A funding round as it looks to help financial and healthcare sectors manage and collect data amid COVID-19.

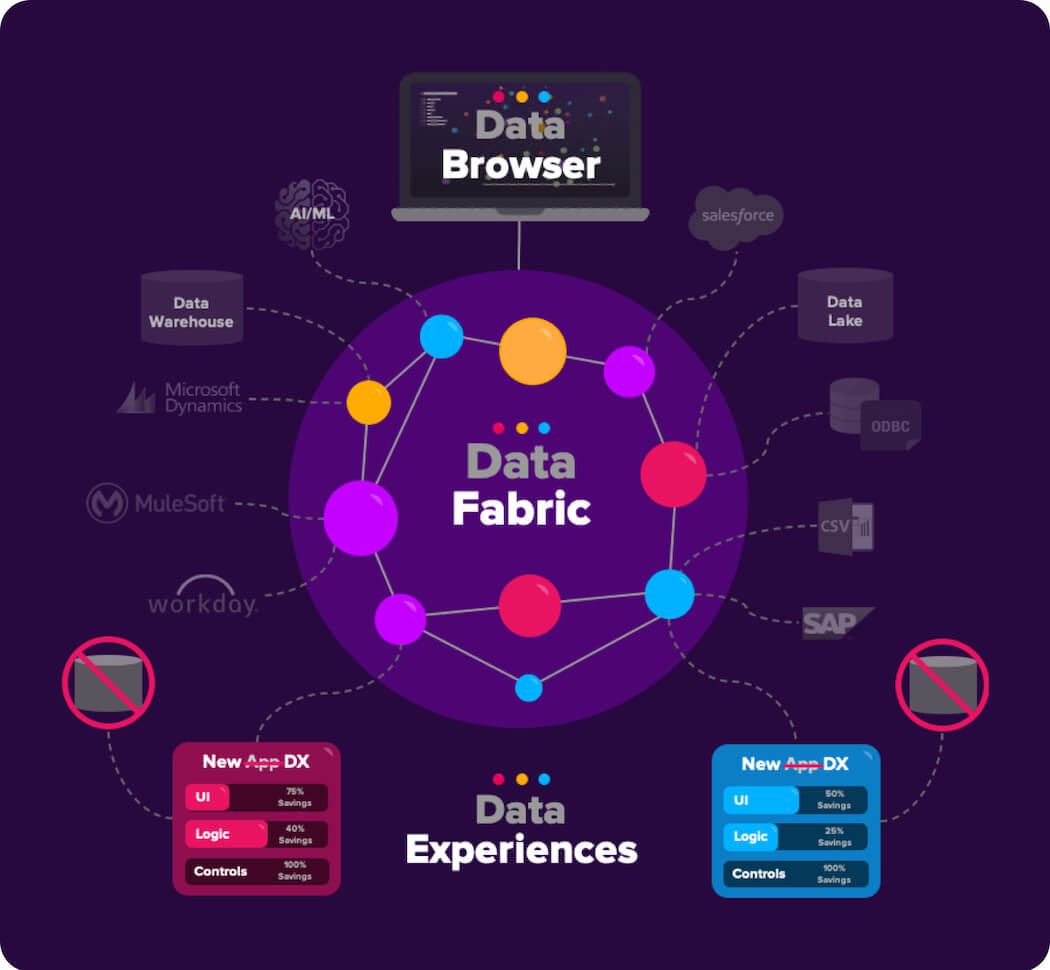

Cinchy touts itself as a data collaboration company that has developed “the world’s first autonomous data fabric [technology].” Cinchy’s platform is designed to help organizations connect unlimited data sources within one “networked architecture.”

“COVID is a good example where you could…literally improve patient outcomes and can help flatten curves.”

The $10 million funding round was led by Information Venture Partners with participation from new investor Manulife Investment Management, as well as return investors BDC Capital, ScaleUp Ventures, and Techstars.

The raise brings Cinchy’s total funding to date to $13 million following a $3 million round in late 2018.

“The driving force behind [Cinchy] is giving people control of their data,” Dan DeMers, Cinchy’s co-founder and CEO, told BetaKit. “The path to doing that is to enable big enterprise organizations to save hundreds of billions of dollars, by getting a handle on the data that they’re keeping as a custodian on your behalf. But ultimately, what it enables, for them and for you, is to get control over that data.”

Cinchy’s data fabric platform is built on the idea of making it easier and more secure to access data all in one location. Rather than organizations having to transfer or copy data in order to share it, Cinchy’s platform allows multiple users to access one common data source, while keeping that information secure.

“Cinchy is already a proven platform that is adopted by some of the largest financial institutions in the world to deliver complex enterprise projects while saving half the time and cost,” said David Unsworth, general partner at Information Venture Partners.

Amid COVID-19, healthcare agencies and governments have experienced a heightened need to easily, quickly, and securely share information, whether it’s to citizens or with other, third-party organizations.

As economies begin to open back up, contact tracing, the practice of tracking people who may have come in contact with an infected person, has been a growing topic of discussion. Tracing allows governments and healthcare agencies to track the virus and allows people to get tested and isolate if they have been in contact with another infected person. The Government of Canada is currently in talks with a number of different partners, including Apple and Google, on building out a contract tracing app for the country.

Cinchy has pitched its platform to the federal government and the Ontario government as a system that could help public health agencies use data from contact tracing solutions securely.

DeMers told BetaKit he sees this as an opportunity for Cinchy to be a “data collaboration command center.”

RELATED: Vector Institute repurposing AI infrastructure to support Ontario’s COVID-19 health data project

“That idea of a command center, had that been in place pre-pandemic [it], would have enabled rapid delivery of things like contact tracing and all these other capabilities,” he said. “Why our platform just makes sense in that COVID reality is you need to deliver things a lot faster … there’s a sudden need to do everything digitally.”

The “command centre”, according to Cinchy, could collect any information from contact tracing data to inventory at hospitals, and help build systems that could alert healthcare agencies to equipment shortages or a spike in COVID-19 cases.

DeMers told BetaKit that talks between Cinchy and government agencies are still ongoing, but he sees an opportunity for Cinchy to be more than just applicable to the healthcare system.

Cinchy’s expansion into the healthcare vertical is a new one. Founded in 2016, the startup previously focused on selling its platform to the financial services sector. DeMers’ background includes having spent over a decade at Citigroup, with Cinchy’s co-founder and CTO Karan Jaswal doing stints at both Citi and RBC Capital Markets. Because of this, Cinchy was designed specifically to handle the highly regulated, sensitive, and complex nature of financial systems.

“The control requirements are one of the reasons why organizations have challenges breaking into [financial services and healthcare],” Jaswal told BetaKit. “But that is actually what Cinchy does really, really well.”

Cinchy started by focusing on the financial sector but always had plans to expand, DeMers said, noting, “if it works for a bank it can work for a startup.” The CEO told BetaKit Cinchy had been working on a go-to-market strategy for its healthcare offering before COVID-19, and the pandemic simply helped to accelerate that move.

RELATED: DarwinAI, University of Waterloo develop neural network for COVID-19 detection

“COVID is a good example where you could see how faster delivery of technology can literally improve patient outcomes and can help flatten curves and have a major impact, hence the expansion,” he said. “This whole scenario is definitely opening new opportunities.”

Amid COVID-19, Cinchy worked with existing customer Concentra, a wholesale bank and trust company for Canadian credit unions, to develop a COVID-19 relief loan solution. Using Cinchy’s technology, Concentra was able to create a single platform that helped 35 credit unions distribute the Canada Emergency Business Account’s $40,000 small business loans.

Cinchy plans to use this latest funding round to meet what DeMers called “the growing demand for data fabric technology.” The startup, which currently sits at a team of 38, plans to grow its employee base across departments.

DeMers also has his sights on expanding Cinchy into other regions and sectors. “We’re scratching the surface in terms of the possibilities,” he said.

“The dramatic IT acceleration, data autonomy, and cost savings experienced by our customers and partners are proving that industry analysts were right,” said Jaswal. “Data Fabric technology is more than just the hottest trend, it is the beginning of a revolution.”

Images courtesy Cinchy