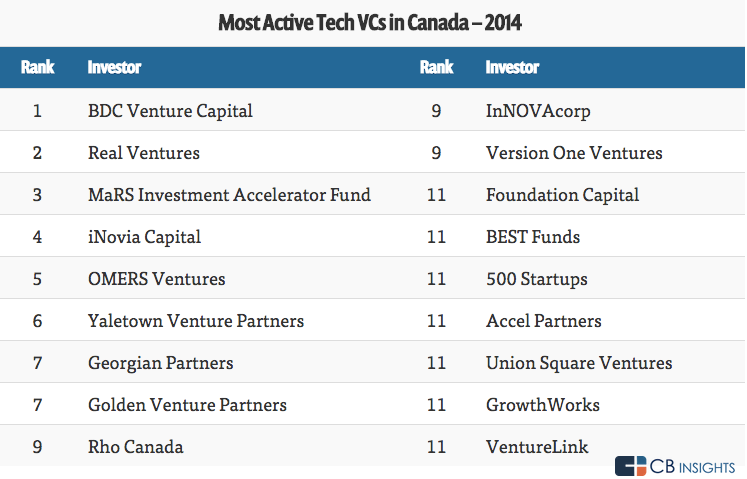

Venture capital analytics platform CB insights has published a blog post recounting the most active tech VCs in Canada for 2014. Unsurprisingly, BDC Capital is at the top of the list, with Real Ventures and MaRS IAF rounding out the top three. Familiar names like iNovia Capital, OMERS Ventures, and Golden Venture Partners help round out the top ten.

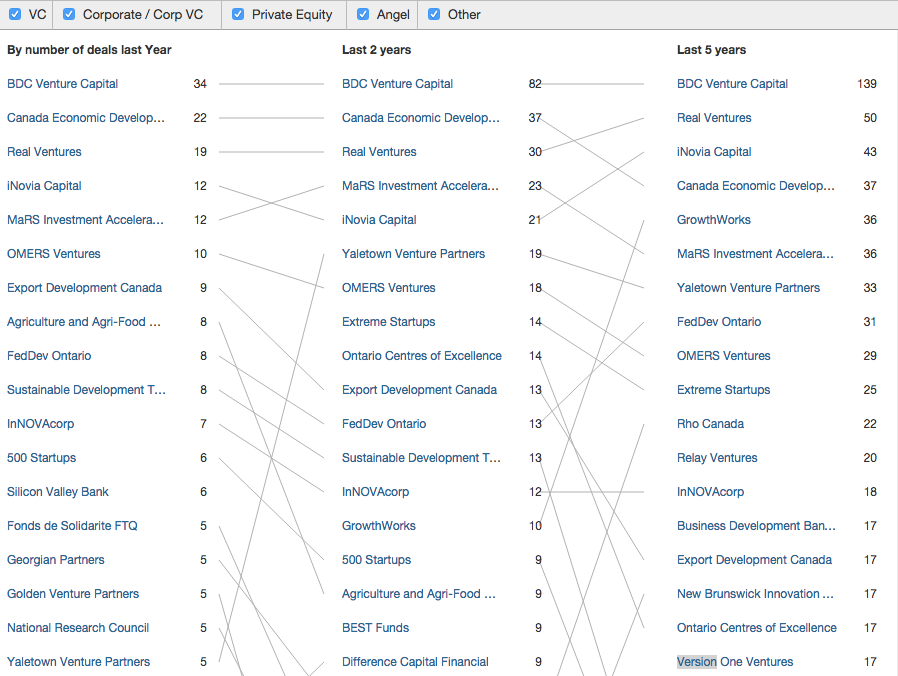

However, high-level reports such as this point to the difficulties in getting a complete scan of the Canadian investment map. For example, CB Insights’ blog post ranks investors by deals made in 2014, but does not include the number of deals. Using CB Insights’ real-time reporting tools, I was able to quickly recreate the list, but unable to get it to perfectly match the results provided in the blog post, no matter the combination of checkboxes.

The deal totals for VC firms included is also considerably lower than similar reports from the CVCA and Thompson Reuters. The latter two reports also include many VC firms conspicuously absent from CB’s dataset (according to CB Insights, Version One Ventures hasn’t closed a deal in the last two year).

Two important lessons are clear: reporting methodology is as important as the contents of a report; multiple sources are preferable when triangulating Canadian investment.