In response to the proposed capital gains measures in Budget 2024, more than 750 Canadian technology leaders have already signed an open letter by the Council of Canadian Innovators (CCI) calling on Ottawa to claw back the changes.

The budget proposes lifting the inclusion rate businesses pay on capital gains from 50 percent to 66.7 percent, beginning on June 25, 2024. For individuals, the inclusion rate would increase to one-third of capital gains over $250,000 CAD.

The government projects the new measures would impact 0.13 percent of the population, or 40,000 people, and bring in $19.4 billion in revenue over five years, beginning this fiscal year.

“I think it would be a mistake if we make Canada even less competitive at such an incredibly important moment in time.”

Michael Katchen, Wealthsimple

Ben Bergen, president of CCI, said the federal government’s proposed changes will have “a chilling impact on the innovation ecosystem.”

“We’re already in a climate in Canada where raising capital is an issue,” Bergen said in an interview with BetaKit, underlining high interest rates and inflation as macroeconomic headwinds. “[This] potentially leads to some real risks about whether or not locals will continue to invest in companies.”

Bergen argued that the proposed tax hike could do “irreparable harm” to Canada’s innovation economy, pushing talent to “more competitive jurisdictions” such as the United States.

A broad swath of Canadian tech leaders appear to agree. The open letter’s signatories include entrepreneurs and venture capital investors from across the country, with representation from: AbCellera, Axonify, Bonsai, Borrowell, Clio, D2L, eSentire, Flinks, Float, Framework Venture Partners, FreshBooks, Graphite Ventures, Impression Ventures, Klue, League, Lightspeed Commerce, Magnet Forensics, N49P Ventures, Neo Financial, Nuvei, Q4 Inc, 7shifts, Symend, Tealbook, Thin Air Labs, Two Small Fish Ventures, Vidyard, and Well Health Technologies. Many others have pushed back against the changes elsewhere via social media.

In the budget, Finance Minister Chrystia Freeland also hiked the lifetime capital gains exemption from $1 million to $1.25 million, effective June 25, which will continue to be indexed to inflation. Entrepreneurs will be able to take advantage of the hike in combination with the newly proposed Canadian Entrepreneurs’ Incentive, a program that will reduce the inclusion rate to 33.3 percent on a lifetime maximum of $2 million in eligible capital gains (increasing by $200,000 each year, starting in 2025, until it reaches $2 million in 2034).

With the increased lifetime capital gains exemption, entrepreneurs will have a combined exemption of at least $3.25 million when selling all or part of a business, according to the budget. Certain businesses won’t be eligible for the proposed incentive, such as those in financial, insurance, real estate, food and accommodation, arts, recreation, consulting, and personal care services.

RELATED: What’s in #Budget2024 for Canadian tech?

Speaking on an INNOVATEwest panel moderated by BetaKit editor-in-chief Douglas Soltys Tuesday, hours before the previously reported tax changes were confirmed in the budget, Wealthsimple co-founder and CEO Michael Katchen noted he was “extremely nervous.”

“We talked about how Canada needs to be more competitive, and I worry that we might introduce new taxation, in particular, new forms of taxation, several forms of new taxation that make us even less competitive, and disincentivize investment,” Katchen said.

“I think it would be a mistake if we make Canada even less competitive at such an incredibly important moment in time for us to embrace competition and productivity.”

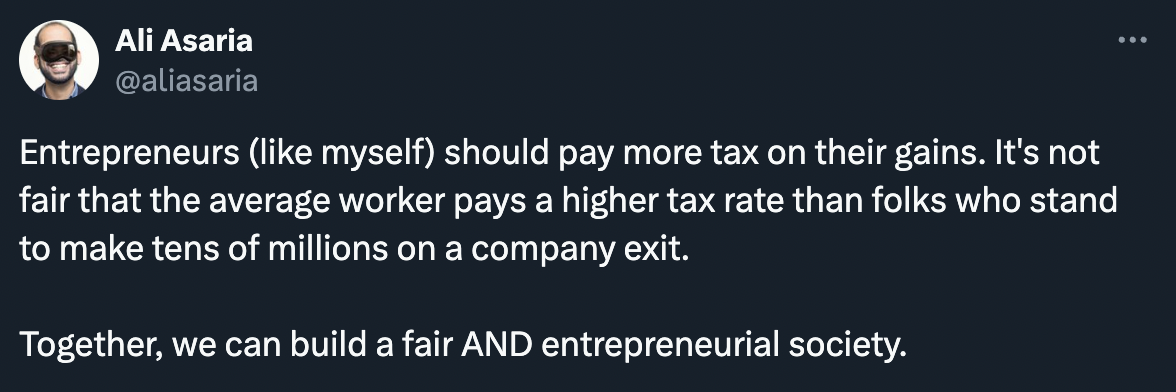

Ali Asaria, founder and chair of Tulip, said those arguing against the changes are “a tiny minority” of who will be impacted and that the criticism creates distraction and polarizes the conversation.

“I’m a bit afraid of speaking out on this issue just because I know that there are investors who are very mad that I said anything [on Twitter],” Asaria said in an interview. “I wouldn’t recommend an entrepreneur try to optimize for capital gains exemption when they’re starting a company—there’s so many more things to worry about.”

The Peak co-founder and CEO Brett Chang shared a different perspective, noting that “anyone critiquing the new capital gains tax rates should take a look at the lifetime capital gains exemption… Hysteria over a policy that will exclusively impact the 0.01% of richest Canadians.”

In a LinkedIn post, Canadian Venture Capital and Private Equity Association (CVCA) CEO Kim Furlong said that the organization is “baffled” by the federal government’s decision to hike the capital gains tax, proclaiming that CVCA “will work tirelessly to reverse this decision.”

“This measure, which effectively taxes innovation and risk-taking, will significantly dampen Canada’s entrepreneurial spirit, stifle economic growth in critical sectors of our economy, and impact job creation,” argued Furlong. “Such policy change undermines Canada’s position to attract the talent needed to grow and scale companies here.”

National Angel Capital Organization board chair Mary Long-Irwin anticipates that these changes will disproportionately impact smaller innovation ecosystems across Canada. “Small ecosystems will stay small with this policy, deterring investment in growth,” she said. “Entrepreneurs will face even greater challenges in building companies that grow large enough to make a national impact. This tax hike sets a ceiling on entrepreneurial ambition and encourages investors to invest elsewhere.”

Former Shopify vice-president of product and Ramen Ventures founding partner Adam McNamara noted that as written, this policy “punitively punishes high-growth startups in Canada.”

Clio co-founder and CEO Jack Newton argued that the move punishes tech founders and workers and makes Canada less competitive than the US, which he said taxes long-term capital gains at 20 percent alongside the qualified small business stock exemption, permitting entrepreneurs to avoid all capital gains in startups.

League founder and CEO Michael Serbinis offered a blunter assessment: “Time to start your next company in the US.”

Feature image courtesy Flickr.