Canadian venture capitalists and private equity firms scored big marks in a recent Deloitte-NVCA survey that revealed global investor confidence has risen in Canada.

Kirk Falconer at PEHub reported the story this morning.

The 2014 Global Venture Capital Confidence Survey polled more than 300 venture capital, private equity and growth equity investors in the Americas, Europe, Asia and Africa, and Canada scored high. Other countries examined included the US, the UK and Israel.

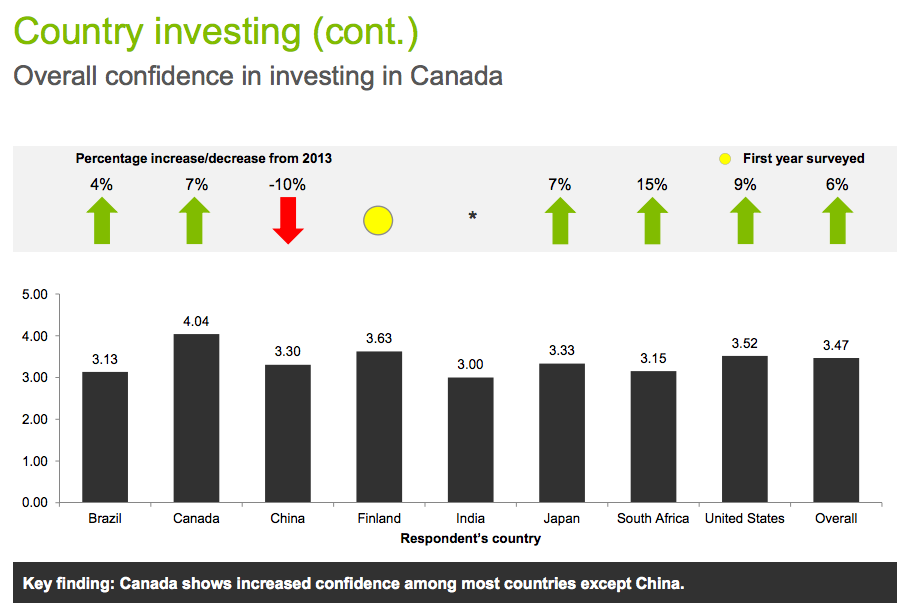

Brazil, China and India all showed declining investor confidence.

The survey was conducted in May and June and assessed investor confidence on the global venture capital environment, market factors shaping industries, and investments in specific geographies and industry sectors. A score of 5 represented the highest level of confidence.

Coming in at number one, the US scored 4.03. Israel took second spot with a score of 3.71, followed by Canada with 3.48. Germany, the United Kingdom and Sinapore scored 3.38, 3.36 and 3.36, respectively.

Interestingly, only Chinese investors were found to be rating Canada lower in 2014 as compared to 2013.

The survey also looked at how investors are feeling about developments in their home markets, and Canadian investors gave low marks to the local industry’s ability to secure new funding.

Another interesting finding related to global investor perspectives on the hottest technology sectors. Survey results showed that in 2014, most votes were being cast for cloud computing, mobile and healthcare IT and services.