PwC and CB Insights recently released the results of their MoneyTree report for Q3 2018, which pointed to a fall in Canadian venture capital activity for the second straight quarter.

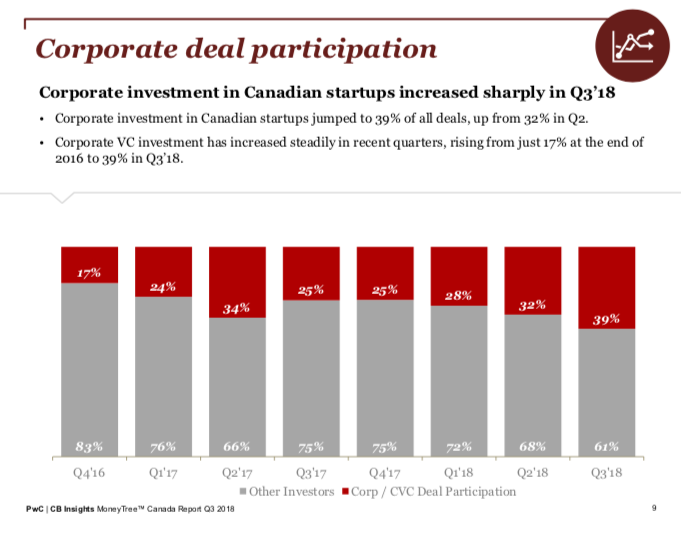

While there was an overall drop in VC activity, corporate participation was actually on the rise for the fourth straight quarter. BetaKit first started tracking the rise of corporate participation in Canadian venture deals last year, when PwC’s national technology sector leader Michael Dingle attributed the increase to corporates using investment as a way to engage with the tech sector.

“Corporates are finding that the risk-reward of investing in Canadian innovation and technology at earlier stages makes good business sense.”

In Q3 2018, corporate participation made up 39 percent of all Canadian deals; Dingle noted in a BetaKit interview that this number includes global corporates, not just Canadian firms. Sixty-one percent of corporate investors in the quarter were international, with twenty-three of 36 corporates making their first Canadian investment.

“I think that’s an astoundingly good sign for the Canadian innovation and technology sector,” Dingle said.

Dingle noted another important trend in the quarter: corporates are now becoming minority investors in rounds on an ongoing basis, rather than with one-off strategic investments. Traditionally, he said, corporates have been focused on mergers and acquisitions rather than investing in a venture that doesn’t provide them complete control. However, increasing corporate participation could indicate that these enterprises are now seeing value in letting startups grow independently, providing support more as clients or distributors.

“[Corporates are] sometimes investing alongside competitors, which I think is healthy for the innovation and tech ecosystem, and provides for opportunities for these younger-stage businesses to actually have the corporates [act as] a strategic,” said Dingle. “We’re seeing a maturation in the corporate investing space, which provides for the realization that some assets, some target investees are best if they aren’t controlled by an entity, [but] are best if they have access to a market writ large, and that includes doing deals with several corporates that occupy the same space.”

While the attitudes of corporates may be maturing, their target investment is actually getting younger; Dingle noted that 17 of 36 deals with corporate participation were at the seed and early stage. However, he also notes that seven of the 10 largest deals in the quarter had corporate venture participation, indicating strong activity in the later stage.

“Corporates are finding that the risk-reward of investing in Canadian innovation and technology at earlier stages makes good business sense,” he said. “These entities are challenging the traditional distribution inside of the market and are providing these corporates with something they don’t otherwise have. Traditionally, it will be access directly to a consumer or to an end user, and the underlying data in respect of how they interact with the business or the asset,” Dingle said.

“Just giving startups money and investing in them, whether it’s taking a minority or majority stake is not enough.”

– Mohammed Ghalayini, Maple Leaf Angels

Mohammed Ghalayini, an angel investor with Maple Leaf Angels, shared the challenges of realizing the full benefits of a startup-corporate investment and partnership. The serial entrepreneur has participated in at least two co-creation partnerships, most recently in 2017. In a LinkedIn post, Ghalayini explained that while startup-corporate partnerships are important to fostering innovation, startups also risk a disadvantage in bargaining power. For example, the CEO of the startup isn’t often directly negotiating with the CEO or a decision-maker in the enterprise, and startups often have to do more work to prove they’re worth the partnership.

“Going into that partnership, startups have way more to lose than the companies, so that immediately puts them at a disadvantage when it comes to negotiating terms and fees, and you’ll often see startups giving them way too many discounts and offering free work…so there’s that imbalance,” Ghalayini said in an interview with BetaKit. “And even when a partnership gets underway, usually the priorities are not there.”

Ghalayini generally felt positive about the increase in corporate participation but hoped that their support would move beyond investment. “Just giving startups money and investing in them, whether it’s taking a minority or majority stake is not enough,” he said. “I think partnering in a way that big companies are actually giving access to resources to the startups, that’s where interesting things will happen.”

The need for corporate partners and investors to provide more than just capital is a sentiment that Dingle agrees with.

“We know that there are both economic and strategic investors available to these companies in terms of funding, and corporates often represent being strategic, but in order to be strategic they have to produce something other than economic investment,” he said.

Read the full report here.

BetaKit is a PwC MoneyTree Canada media partner. Feature photo via Unsplash.