Welcome to BetaKit’s startup stories of the week! Here, you will find the week’s most important news, features, and editorials published on BetaKit. If you prefer this update hit your inbox every week, make sure to subscribe to the BetaKit Newsletter using the form at the bottom of this page.

Top Stories of the Week

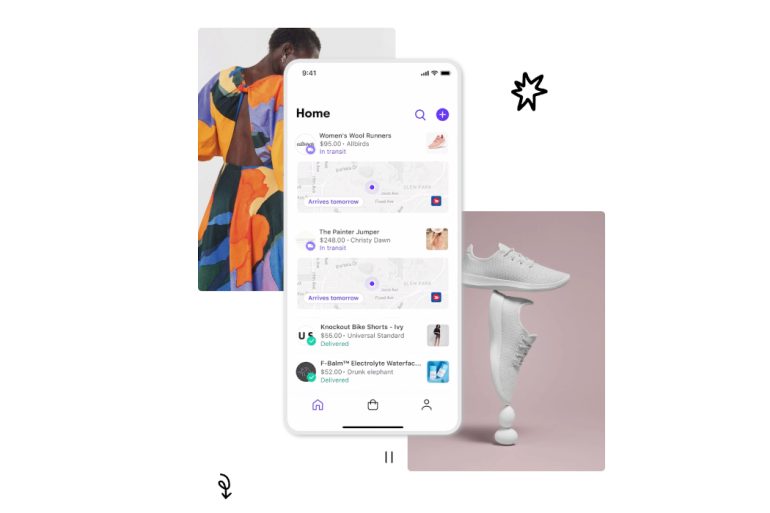

Shopify beta testing new rewards program, Shop Cash

The company has quietly rolled out a beta version of the rewards program, which is automatically added as a payment method for orders placed in the Shop app.

Canadian tech venture deal count continued to decline in Q1 2022, but total investment stayed high: CVCA

A new report from the CVCA states that in the first quarter of 2022, $1.4 billion CAD was invested in 212 private equity (PE) deals. That marks the second-highest number of deals for a single quarter on record; 215 deals were made in Q4, 2021.

Lightspeed sees path to profitability despite posting $146.1 million loss in fiscal Q4

Lightspeed CEO JP Chauvet told an earnings call that the company wasn’t nearly as concerned over inflation and the economy potentially plunging into a recession as it had been over the pandemic. “Any impact from a recession is nothing from what we’ve seen from COVID-19,” he said.

Value of Power Corp’s FinTech portfolio drops as Wealthsimple faces second May markdown

The total value of Power Corp’s investments in Wealthsimple has fallen by $400 million. As of March 31, the total value of Power Corp’s investments in Wealthsimple, across all Power-related entities, is $1.7 billion. This represents a 19 percent drop compared to the $2.1 billion value of Power Corp’s Wealthsimple stake following the latter’s May 2021 financing.

Round13 launches new venture fund with initial $70 million USD to back blockchain companies providing “the base” for Web3

To date, Round13 has made a name for itself backing mostly Canadian software companies, like Hubdoc and LifeSpeak. According to Round13 Founding Partner Bruce Croxon, the firm’s evergreen Digital Asset Fund hits Round13’s “sweet spot,” and comes as “a natural extension” to the software investments and sectors that it has previously played in.

ChargeLab secures $19.3 million CAD with aim to be Android for EV charging

The Toronto-based company has secured $19.3 million CAD ($15 million USD) in Series A capital towards its goal of becoming the operating system for EV chargers.

Latest Funding, Acquisitions, and Layoffs

-

SF – OMERS backs Canadian-led Imply’s $100M Series D (read more)

-

VAN – Tasktop to be acquired by Planview (read more)

-

TOR – Forma.ai – $57.8M (read more)

-

TOR – Fable – $13.4M (read more)

-

TOR – Converge to acquire Technology Integration Group (read more)

-

TOR – Haloo (formerly Heirlume) – $2.9M (read more)

-

FRE – PLATO Testing – $2M (read more)

-

HAL – Pressto – $1.5M (read more)

SHOULD POLITICIANS USE TWITTER + ONTARIO’S ELECTION BUDGET

“The unforeseen consequences of this stuff has ripples throughout society that in the most generous interpretation we didn’t see coming, but can no longer deny.”

Former OneEleven executive director Siri Agrell explains why she believes politicians shouldn’t use social media; CCI’s Alanna Sokic explains why the Ontario budget is not a budget.

OMERS VENTURES’ DAMIEN STEEL WANTS YOU TO STOP READING TECH HEADLINES

“That impact that’s being felt in the public markets will start to trickle down to the earlier rounds.”

Damien Steel, managing partner and head of ventures at OMERS Ventures, takes umbrage with how valuations – or more specifically, the sticker price placed on funding rounds – are paraded in the media.

Subscribe to B|K: The BetaKit Newsletter

Subscribe to B|K using the form below to ensure the best from BetaKit hits your inbox every week.