Never before in a panel have I seen so many dichotomies pop up.

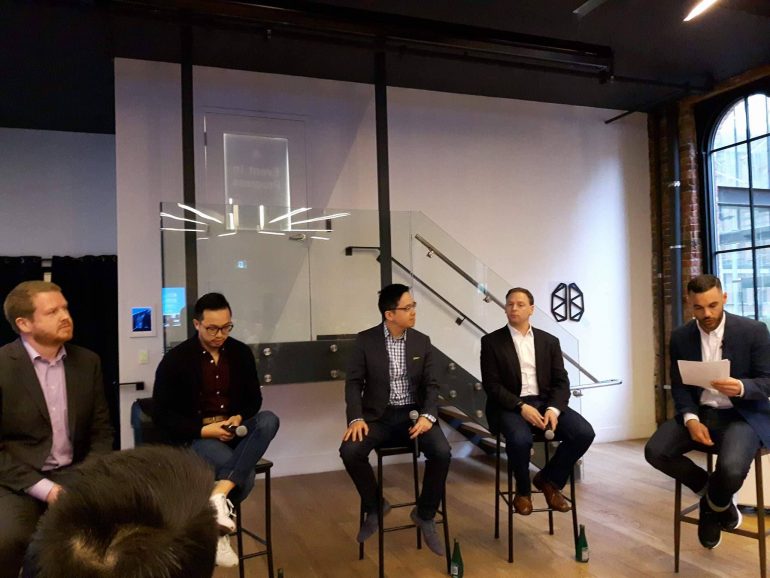

BrainStation hosted a panel in Toronto on FinTech featuring some very bright minds, including EQ Bank’s Dan Dickinson, President’s Choice Financial’s Phil Gene, BMO’s Peter Poon, and Scotiabank’s Kevin Stewart, and the stories were great but also filled with warnings, additional thoughts, and add-ons.

On one hand, banks are walled off oligopolies; on the other, they are massive data centres with troves of information that the public can benefit from. The panel touched on helping the customer succeed, but there were big concerns around the negative effects of automation on lower-level banking jobs. The banking system is notorious for its cushy-with-the-competition mentality, but at the same time there are genuine efforts being made to partner with new FinTech companies.

Within the conversation, some nuggets emerged that helped tell the story of FinTech, its goals, and some of the subtleties to watch for as you navigate the financial world of the future.

The history and tensions of FinTech

Dickinson kicked off the panel with his understanding of the origins of modern FinTech, noting that it goes back to the release of the iPhone in 2007, and the financial crisis of 2008. The iPhone solidified the mobile world, meaning that there was “huge demand for life to happen in your pocket,” he says.

This kick-started the world of app development and mobile-first development, but the financial crisis a year later created a new opportunity for would-be newcomers to the financial services industry.

Not only was the technology reaching a stage where it could be commercialized at scale, for the first time in modern history, banks had fundamentally shattered both trust with their consumers and the image of stability, two core pillars of their success since the beginning of financial services.

The tension between technology and financial services began almost immediately. Open source technology, made famous by Google Android and others, became the defining feature of the tech industry. The banking world, by contrast, was seen as a “walled garden” where only certain people were allowed in.

The openness factor played well for FinTech startups who could, now that consumer trust in big banks had been hurt, swoop in and acquire customer loyalty through more efficient customer experiences and user-centric service and support. Banks took note of this, but struggled to create brand new services while still ensuring that their current businesses don’t fail in the process.

This is where “open banking,” as described by Poon, comes into play.

Open banking is the idea that a bank, or any financial institution, cannot afford to lose consumer trust again the way they did in 2008. So instead of rampantly experimenting with consumer dollars, FIs can innovate on their customer experience to match those of nimble startups. With a focus on customer experience, big FIs start to play in the same mindset as FinTech startups and can achieve similar successes.

Asking the right questions for innovation

Another challenge for big FIs interacting with innovation, technology, and the startup ecosystem, is the question of whether to ‘buy or build.’

Dickinson and Gene, however, think that’s the wrong question to be asking.

A valid concern coming out of the FinTech world is emerging technologies and their effect on employment.

What big FIs should really be thinking of is, “what core competencies can we not afford to outsource?” says Gene. Once you’ve answered this, the options actually extend far beyond ‘buy versus build’ into buying, building, buying-then-customizing, investing, partnering, and incubating.

EQ Bank, for instance, is a small bank with limited budget, meaning that both “buy” and purely “build” are not really on the table, says Dickinson. However, what EQ does instead is build infrastructure that enables integrations with FinTech companies. Then they invest in companies building the technologies their customers need.

“We focus on an ‘execute what the customer wants’ mentality,” says Dickinson. “which means that investments and partnerships are good strategies for us.”

BMO feels the same way, says Gene, explaining that BMO has three FinTech incubators, including one in Toronto.

“Using our incubators, we can invest or incubate and provide mentorship, but partnership is always on the table if it makes our customer experience better,” said Gene.

The people behind it all

A valid concern coming out of the FinTech world is emerging technologies and their effect on employment. While the panel was happy to talk about automation and AI’s ability to “bring the bank to you, where you are,” says Stewart, the fear still remains that full automation could cost tens of thousands of jobs – not only at the banks themselves, but also in ancillary services like real estate, as branch networks shrink or close down entirely.

Granted, one cannot look to financial services to solve the challenges of every industry, but banks in Canada have a large part to play as the five major banks control the vast majority of assets and deposits in the country.

Coon and Stewart, the “big bank” folks on the panel, agreed that the concern is massive.

“We don’t want to tout the power of technology on the same day the news is running a story that we laid off thousands of branch workers,” said Stewart.

What they are doing instead is training people. Stewart says that Scotiabank offers retraining for their branch staff on technologies. Coon explained that BMO has a “we need people” policy towards its operations, meaning that the bank will first look to move their people to other areas and offer training or support before it looks to letting people go.

Continuing to the future of FinTech, the panel had one word: magic.

Payments would be done biometrically for a frictionless payment experience. Branches would no longer exist. Through AI and mobile banking, though, a “branch” could be ‘wherever you are, however you need.’ Customers can always talk to someone, using digital and video to connect with the right person for the question, which is sorted and assigned through machine learning.

It sounded utopian, but the technology is not far from existence if it’s not here already. The question remains, though: will this technology be used to make banking more human, or less?