Québec City-based automotive software provider LeddarTech has reached an agreement to merge with Prospector, a publicly-traded special purpose acquisition company (SPAC) led by former Qualcomm executives.

LeddarTech builds systems that help autonomous vehicles understand their surroundings. This SPAC deal, which is expected to close by the fourth quarter, gives LeddarTech a $348-million USD pro-forma equity valuation. Once it is complete, LeddarTech expects to become listed on the Nasdaq under the symbol LDTC. UPDATE: The business combination was completed December 21, and LeddarTech will commence trading on the Nasdaq December 22.

LeddarTech CEO Charles Boulanger said this SPAC deal will provide LeddarTech with the capital and resources “to take the company to the next level.”

With the agreement, which comes about 16 months after LeddarTech closed $140 million in equity Series D funding and debt, LeddarTech is set to secure fresh capital and go public via SPAC at a time when the private fundraising and conventional initial public offering (IPO) markets have frozen over.

LeddarTech CEO Charles Boulanger said in a statement that this deal will provide LeddarTech with the capital and resources “to take the company to the next level.”

LeddarTech anticipates that the transaction will deliver up to $66 million in gross proceeds, including as much as $23 million from the Prospector trust account, and $43 million in convertible private-placement financing from a group that includes FS Investors and Investissement Québec. With funding obtained through this deal, LeddarTech plans to commercialize its first embedded software solutions and expand its product offerings.

In a statement, Boulanger hailed the agreement as an “important milestone” for LeddarTech, and claimed it will make the company “one of the rare public companies in the pure-play [advanced driver-assistance systems/autonomous driving] software space.”

Prior to this deal, LeddarTech explored private financing and an IPO before determining that a SPAC was a more “structured” and “predictable” route, Boulanger told Bloomberg.

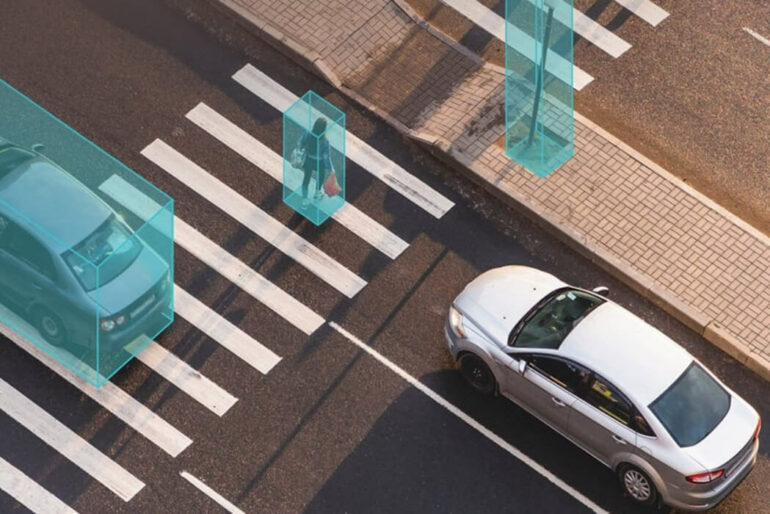

Founded in 2007, LeddarTech develops environmental-sensing solutions for autonomous vehicles and advanced driver-assistance systems. Within this space, LeddarTech claims it has “a strong early-mover advantage.”

RELATED: LeddarTech scores $140 million USD in Series D funding and debt

Over the past seven years, LeddarTech claims it has worked on low-level sensor fusion and perception, filing 150 patents and securing 80, covering “foundational technologies” like signal acquisition, perception, and sensor fusion.

“During my tenure at Qualcomm, I experienced the tremendous value that can be created when innovative companies with foundational technologies disrupt industries,” Prospector CEO and former Qualcomm president Derek Aberle said in a statement. “We believe LeddarTech has the potential to do just that.”

Aberle is expected to become chair of LeddarTech’s board. Boulanger, who has led LeddarTech since 2013, intends to retire as CEO once the SPAC transaction is complete, remaining with the firm as a special advisor and a member of its board of directors. Frantz Saintellemy—LeddarTech’s president and COO—is expected to succeed Boulanger as CEO.

The SPAC deal remains subject to customary closing conditions and approval from shareholders and the Superior Court of Justice of Québec.

Feature image courtesy LeddarTech.