Welcome to a new BetaKit weekly series designed to help startups and entrepreneurs. Each week, investors Roger Chabra and Katherine Hague tackle the tough questions facing founders today. Have a question you would like answered? Tweet them with the #askaninvestor hashtag, or email them here.

Today on Ask An Investor, we’re going to do something a little different. Instead of answering a common question we often see as investors, we’re going to give feedback on one of the most important parts of the fundraising process: the pitch deck.

This week, we have a submitted pitch deck from Toronto startup CareGuide. For the purposes of evaluation, we are going to rewind the clock and focus on the company’s $1.5 million seed round, announced in July 2014. CareGuide is known for having the largest seed investor network in Canada, and to quote the original Betakit article, “the list of investors in CareGuide reads like an all-stars concert lineup. Ryan Holmes of Hootsuite, Brian Sharwood, President of HomeStars, Ameet Shah who sold Five Mobile to Zynga, Alex Black, Derek Szeto, who sold RedFlagDeals to Yellow Pages, Toronto’s own Daniel Debow, who sold Rypple to Salesforce, Mike Silagadze of Top Hat, Jevon MacDonald, Ben Yoskovitz and many more.”

So, how did a small company that was just getting started raise such an impressive round? CareGuide is led by John Philip Green. Having spoken to John and others associated with his company, in my opinion here are the reasons why CareGuide was so successful in raising their seed round:

Networked early and often

John is pretty well known in the Canadian and other startup ecosystems such as the Valley. This is a result of his experience working at startups in these communities. More than this, however, anyone who knows John knows that he goes above and beyond to meet people, help them out, and make them feel comfortable.

Putting this in the context of fundraising, John networked early and networked hard. But the point here is that he built relationships and nurtured them well ahead of proposing a business relationship (investment) with people. It’s hard to ask people for money and it’s much harder when you don’t know someone and, more importantly, they don’t know you.

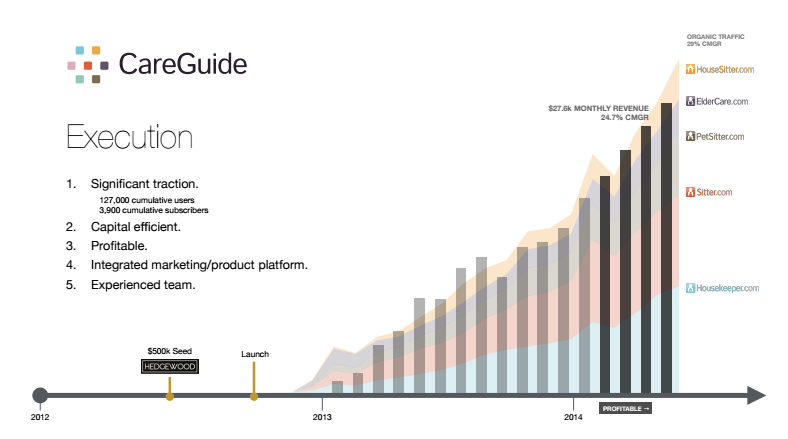

Good early traction

As you will see in the deck below, CareGuide achieved some impressive early traction on a very small amount of investment. Even at seed rounds, the more evidence of product-market fit you can demonstrate, the better your chances of raising a good amount of money on favorable terms. John timed his fundraise perfectly, to coincide with good (25%!) month-over-month revenue growth in the company. The fact he did all this on a small amount of investment and via organic means (meaning, not paid acquisition) further instills confidence in investors that their investment will be leveraged fully and go a long way to creating equity value in the company.

Easy to grasp business concept

Business concepts and business models in the tech sector can often be complicated and difficult to describe. CareGuide is a relatively simple business to understand (but not a simple business to execute on!) by tech folks and non-tech folks alike. There are a number of competitive sites out there that are easily recognizable to a broad audience. People understand this model.

Importantly, in addition, the company’s domain names immediately tell you what the company is doing. This is a luxury that very few companies today can command. Most tech companies have to spend considerable money and time building up their brand name (and URL) and having it identify with what the company is doing and selling. CareGuide has a built-in head start on this with both its customers and its potential investors. Everyone can identify with needing a babysitter or a petsitter and everyone can understand what CareGuide is doing just by seeing their URLs.

Social proof introductions

John ran his fundraising round brilliantly. Investors want to follow other investors and CareGuide did a great job bringing in some high profile angel investors early. From there, CareGuide networked to others who could provide a good collective investor group profile for the company. Instead of asking for introductions from people who weren’t actually investing, John asked the people who were actually cutting a cheque to make intros to others.

This changes the dynamic significantly. It’s much more powerful for an angel to write an email introduction with “hey, check out this company I am investing in, you should have a look also…” than “hey, check out this company, they are looking for money…” This is social proof at work. AngelList was built on this simple but powerful concept. Leverage it as much as you can when fundraising.

Concise and compelling deck

Finally, John did a great job distilling his fundraising deck down to just four (yes, just four!) slides. Investors don’t have time to read 20 page plus decks. It’s your job as a founder to get your message across simply and quickly. CareGuide’s example is an extreme one, most good decks that I see are in the 10-page range. However, combined with the factors mentioned above, his deck was a big part of getting his financing round done.

The main point here is that this deck was effective – boy was it ever. Big kudos to John and his team for that and also for being willing to share his deck and thoughts with the broader community here. Let’s take a closer look at the CareGuide seed round deck below and feature some commentary from me and John himself (indicated as JPG, ed.)

Slide One – “The Movie Poster”

This slide does a good job tying together the company’s properties and driving home what the company does quickly. As mentioned above, CareGuide is lucky to have domain names that are instantly identifiable with the company’s business. I think it is important for one slide to immediately communicate what your company does, but most companies will need more comprehensive schematics/graphics and more text to accomplish this.

One thing that isn’t immediately clear to me is the tagline – “we take care of the care economy.” It is a bit confusing as to whether they are powering other companies in the care economy or whether they are actually building care economy properties themselves.

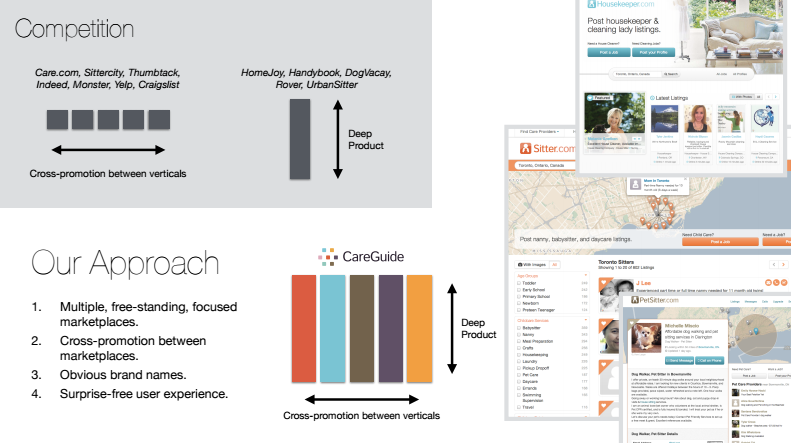

Slide Two – “Approach”

I like the approach to including well-known marketplace companies as a reference point. This immediately helps the reader understand what CareGuide’s business model is and sets up things cleverly for their differentiation. It is immediately clear that the company is building properties in a number of verticals and will leverage user bases between the properties to build scale.

The care economy and marketplace competitors here are well-known brands, but this may not be the case for a lot of tech companies in terms of their competitive set. In spaces which are more nascent and don’t have established competitors, it would be more effective to communicate the company’s business as more of a problem/solution statement. Clearly identify what the problem in your space is, how big of a problem it is dollar-wise, and how you are solving the problem.

Slide Three – “Execution”

Every slide deck needs at least one “greed-inducing” slide, and for CareGuide, this is the one.

Investors are in this for the returns and you need to leave them salivating with the possibility of getting many multiples on their invested capital. Here we see that the company is growing very rapidly and has done so on a very small amount of capital. Furthermore, we see that a lot of traffic is being driven organically. Again, this is amazing. An investor is left saying to themselves “this business is capital efficient and can you imagine what type of revenue they will be doing if we pump some money into marketing.” This is perfect positioning for an early stage consumer-facing business.

I do feel that the lack of projections is an issue. At this point, growth is good but the absolute user base and revenue are still tiny. Even though projections are always wrong it gives investors the ability to size the opportunity and determine if this specific deal fits their exit goals. Is the team going to go big or exit at a smaller number? Is this a big market opportunity or a smaller market opportunity?

Both are perfectly fine and can make you as a founder very rich. However, whatever your goals and opportunity size are, you need to match your investors to them. Otherwise, you will end up with misalignment and find it tough to manage your investors over time. Also, marketplace companies must include unit economics such as Cost-of-Acquisition (COA) and Lifetime-Value (LTV). These are not included here, and in my opinion, the revenue and traffic numbers are alone not sufficient.

Finally, the lack of team information would be an issue for most companies. As mentioned above, John is well-known and reached out to investors directly (and indirectly) that knew him well. Investors want to know who they are investing in and you need to hammer home the experiences and credibility of your team.

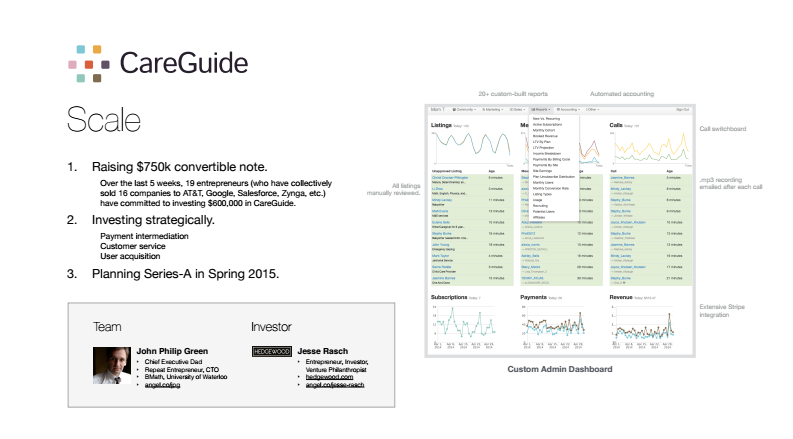

Slide Four – “Scale”

It’s essential to have an “Ask” slide and to articulate where you will spend the money and what it will get you to and when. This is done here in an efficient way. As mentioned above, the social proof piece is well highlighted and whets the appetite of the reader.

Speaking honestly, the proprietary technology piece doesn’t fit here. It feels like John put this in just to avoid having to add another slide. I actually feel like it isn’t necessary to be included in this deck at all. It’s somewhat important to the business but not essential to highlight in this short deck. In my opinion, the domain names are more proprietary and important than the dashboard or reporting. That coupled with the cross-vertical strategy, great team hires and a focus on customer service are what will set the company apart.

Got a question for the investors? Have a deck you want dissected? Email them here.