Despite experiencing a dip in venture funding and deal volume, Alberta’s tech sector stayed busy in the second quarter of 2023, and remains on course to beat out its 2022 funding record this year.

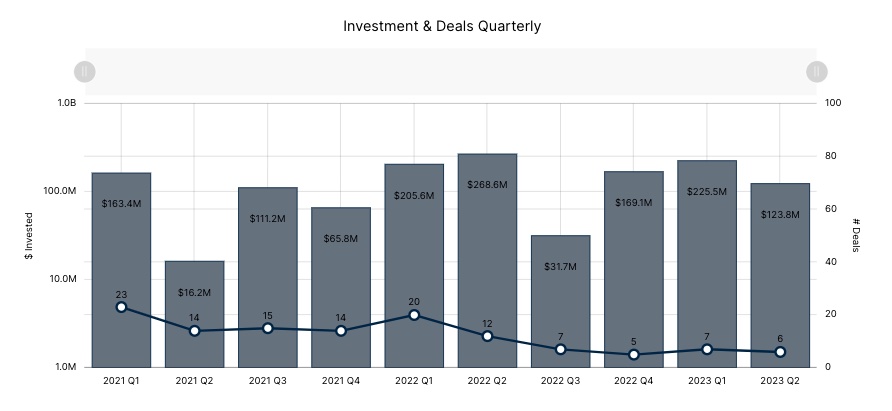

According to briefed.in’s latest report, Alberta tech companies raised $123.8 million through six deals in the second quarter of 2023, according to briefed.in. Investment decreased by 45 percent quarter-over-quarter and 54 percent year-over-year. Deal volume also decreased in Alberta in Q2 2023, falling by 14 percent since the first quarter of 2023 and 50 percent since the second quarter of 2022.

“You could say that there has never been a better time to be in tech in Alberta than right now.”

– Catherine Warren, Edmonton Unlimited

In the last few quarters, when venture funding in most other Canadian tech ecosystems fell amid a more challenging macroeconomic and fundraising environment, Alberta has maintained a consistent upward trend. Alberta’s tech sector has also set a new venture funding record every year since at least 2019, when briefed.in first began tracking the province.

Last year proved to be a particularly triumphant one for Alberta, which saw $675 million in total investment, almost double what was raised in 2021. As of the end of Q2 2023, Alberta’s tech companies have already raised more than half (52 percent) of the investment raised in 2022.

Briefed.in’s data for Alberta in Q2 2023 might indicate a cooling of the local venture capital ecosystem. However, Catherine Warren, CEO of Edmonton Unlimited, a city-supported innovation organization, said there were several uncaptured deals that point to a much more active ecosystem in Alberta. Warren specifically cited data from a Venture Capital Association of Alberta (VCAA) newsletter, which reported 18 investments in Alberta in Q2 2023, four of which were undisclosed.

“I’d say the ecosystem is hopping,” Warren said. “From our vantage, we are seeing a highly diversified province with investable companies.”

Briefed.in’s data may not be consistent with the VCAA’s since briefed.in collects its data from founders who submit their deal information directly, or from online, public sources, and not all companies or investors publicly disclose deals. briefed.in also tracks investment according to when deals are announced or submitted, and since there can be a delay between a deal closing and an announcement, briefed.in may not capture all deals that closed in a given quarter.

The emergence of megadeals, or deals valued over $100 million, has been a key contributing factor to Alberta’s winning streak in recent quarters. Some of these deals include Jobber’s $100-million USD Series D funding round in Q1 2023 and Neo Financial’s $185-million Series C funding round in Q2 2022. Given that Alberta’s tech sector is much smaller and younger than that of Toronto or British Columbia, local investors have taken the presence of these large deals as a sign of the ecosystem’s maturity.

While there were no megadeals in Alberta in Q2 2023, briefed.in tracked a few significant late-stage rounds during the quarter, such as Eavor’s $80-million Series B funding round, GeologAI’s $20-million Series A funding round, and OneVest’s $17-million Series A funding round.

Warren said she believes Alberta’s tech ecosystem has managed to buck the Canadian tech downturn due to a few local factors. The first, she said, is that young skilled talent are more likely to “take a risk” in cities like Edmonton and Calgary, given their affordability compared to other major Canadian cities.

The Alberta Enterprise Corporation (AEC), a provincial fund of funds, also plays a role in keeping dollars flowing into local companies, Warren noted. “Every dollar invested by AEC results in more than $5.50 of investment back into Alberta companies, so you have that virtuous circle.”

“We’re also part of a low-tax regime, which means investors can keep more money in their pockets, they can take a chance, they can take risks, and they can focus on helping these companies build a dream, while at the same time mitigating risks,” Warren added. “All of this is contributing to a super-climate of investable companies.”

Briefed.in tracked only two early-stage deals in Q2 2023. These include Highwood Emissions Management’s $3-million seed round, and Kibbi Technologies’ $1.1-million pre-seed round.

Per briefed.in’s data, both pre-seed and seed deal volume has trended downward since 2021. Only two early-stage deals in Q2 2023 may seem like a concerning drop in activity, however, it is possible there were more early-stage deals that were not disclosed, since many early-stage founders choose not to announce early rounds.

Warren added that early-stage funding is universally the most challenging stage for companies to raise money. Still, she remains optimistic about Alberta’s prospects, and pointed to several local factors that signal brighter skies for local early-stage ventures.

In 2021, Alberta Innovates launched the Scale GAP program, which has helped to deliver five programs: the Alberta Accelerator by 500, Plug and Play Alberta, Telus Community Safety, and Wellness Accelerator powered by Alchemist, Thrive Canada Accelerator, and Alberta Catalyzer. This week, it was revealed that these programs have contributed $147 million to startups and created 118 new jobs.

Warren added that Edmonton Unlimited recently opened the doors to a new 18,000-square-foot innovation hub and noted the city is also considering a $100-million innovation fund.

“There’s a lot going on at street level for very early-stage startups,” she added.

Another notable development in Alberta in the second quarter was the provincial election in May, which saw the United Conservative Party (UCP) once again form the government. The UCP has pledged various commitments aimed at attracting and retaining talent in Alberta, while also fostering increased tech investment to diversify the province’s economy beyond energy. However, the precise impact of these policies on venture funding for the remainder of 2023 remains uncertain.

Warren, for her part, is hopeful about Alberta’s venture funding performance in the coming quarters.

“As a relative newcomer to Alberta from BC, I would say that Alberta is doing what it takes to build capacity, and we’re starting to see this pay off,” she said.

“We’re also seeing more tech companies operating in our province than ever before,” Warren added. “In the last few years, the number of tech companies in the province has more-than-doubled from 1,200 to 2,800, so you could say that there has never been a better time to be in tech in Alberta than right now.”

briefed.in is owned and operated by Communitech. BetaKit receives data from briefed.in as part of a media partnership with Communitech and retains full editorial control of all articles that reference the data produced by briefed.in/Communitech.