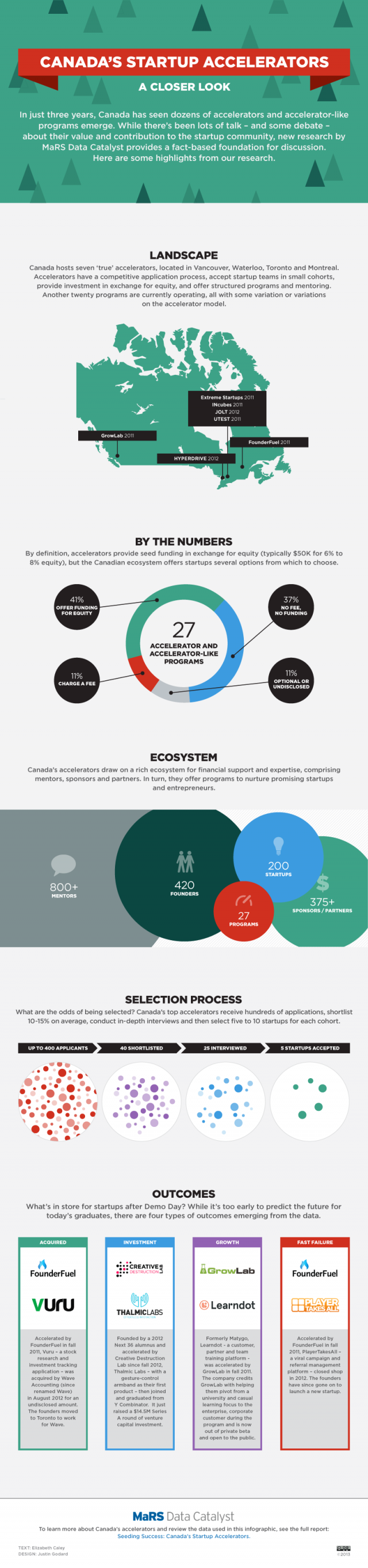

Since 2010 there has been over 30 accelerators, or accelerator-like programs, launch in Canada. Some say that this influx of startups and entrepreneurs might lead to an “accelerator bubble,” but the bottom line is that this enthusiasm is breeding a much needed pool of innovation.

MaRS Data Catalyst, along with the Henley Business School, have released a report called ‘Seeding Success’ that sheds light into the Canadian startup accelerator space. The term accelerator was defined as being: An open, highly competitive application process; Pre-seed investment, usually in exchange for equity; A focus on small teams, not individual founders; Time-limited support comprising programmed events and intensive mentoring; and Startups supported in cohorts rather than individual companies.

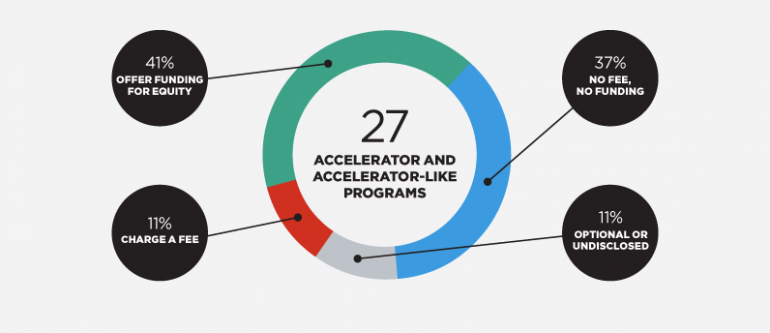

The findings were calculated from interviewing 18 directors and founders of various Canadian accelerated companies between March and May 2013. The results showed that of the 37 accelerator programs reviewed, seven met the formal definition of accelerator. Canadian accelerator programs have 3 or less partners and operate between 3-8-months. The upfront seed investment into a accelerator is between $20,000 to $50,000 for 5% to 10% of the business, plus each has an average 60 mentors in their ecosystem. Mentors come from the investment community; the most active firms represented include iNovia, OMERS Ventures, Real Ventures, Rho Canada Ventures and the Business Development Bank of Canada (BDC), plus also from notable Canadian tech companies such as The Working Group, Wave, Jet Cooper, OpenText and BlackBerry.

As expected, Ontario is where most of the accelerator programs are based, mainly MaRS in Toronto and Communitech in Waterloo. However, newer programs have surfaced in Vancouver and Montreal. Below is an infographic of deeper, prettier, stats. You can also check out the full report here at MaRS.